Comprehensive 2024 Guide to Accounting and Bookkeeping for Startups: Everything You Need to Know

Introduction: What Startup Businesses Need to Know

Starting a new business is an exciting journey, but it comes with its fair share of challenges. One of the most critical aspects of running a successful startup is maintaining accurate bookkeeping and accounting practices. Proper bookkeeping helps startups track their financial records, manage cash flow, and prepare financial statements. Meanwhile, accounting takes these records to analyze financial performance, ensure regulatory compliance, and inform strategic decisions.

In this comprehensive guide, you will learn the essentials of bookkeeping and accounting for startups, including practical tips for managing financial records, choosing the right software, and ensuring compliance with tax laws. Whether you are a new entrepreneur or looking to improve your current practices, this guide will provide valuable insights to help your startup thrive.

What is the Difference Between Bookkeeping and Accounting?

Understanding the distinction between bookkeeping and accounting is crucial for managing your business’s finances effectively.

Bookkeeping

Bookkeeping is the process of recording daily transactions and maintaining accurate financial records. This involves documenting every financial transaction your business makes, such as sales, purchases, receipts, and payments. Bookkeepers ensure that these records are organized, up-to-date, and easily accessible. The primary goal of bookkeeping is to keep a systematic track of all financial activities, providing a solid foundation for further financial analysis.

Accounting

Accounting, on the other hand, takes the information compiled through bookkeeping and uses it to prepare comprehensive financial statements, such as balance sheets, income statements, and cash flow statements. Accountants analyze these statements to evaluate the business’s financial performance, identify trends, and make strategic recommendations. They also handle more complex tasks such as budgeting, forecasting, tax preparation, and financial planning. In essence, accounting transforms raw financial data into actionable insights, guiding business decisions and ensuring regulatory compliance.

Bookkeeping Options for Your Startup

When it comes to managing your startup’s finances, choosing the right bookkeeping method is crucial. Here are the primary options to consider:

- Manual Bookkeeping:

- Cost-effective for very small startups.

- Can become cumbersome and error-prone as the business grows.

- Using Spreadsheets:

- Suitable for startups with minimal transactions.

- Offers more flexibility than manual bookkeeping.

- Can be time-consuming and complex with increased volume.

- Hiring an In-House Bookkeeper:

- Provides more control and immediate access to financial expertise.

- Can be expensive, especially for startups with limited budgets.

- Ideal for startups that require frequent and detailed financial analysis.

- Outsourcing to a Professional Bookkeeping Service:

- Offers expert knowledge and time savings.

- Often includes access to advanced software tools.

- Popular choice for many startups due to its efficiency and reliability.

Consider your startup’s size, budget, and specific needs when choosing the best bookkeeping option.

Why Bookkeeping is Important for Startups

Tracking Financial Records

Accurate bookkeeping allows startups to maintain detailed financial records. This is crucial for understanding the financial position of the business, identifying trends, and making informed decisions. By tracking every financial transaction, startups can ensure they have a complete and accurate record of their income and expenses.

Preparing Financial Statements

Financial statements, such as the balance sheet, income statement, and cash flow statement, are vital for assessing the financial health of a startup. These statements provide insights into the company’s profitability, liquidity, and overall financial stability. Accurate bookkeeping ensures that these statements are reliable and can be used for strategic planning and attracting investors.

Managing Cash Flow

Cash flow management is critical for startups, as it ensures that the business has enough cash to meet its obligations. Bookkeeping helps startups monitor their cash flow by tracking incoming and outgoing funds. By maintaining accurate records, startups can identify potential cash flow issues early and take corrective action.

Ensuring Accurate Financial Health

Regular bookkeeping allows startups to assess their financial health and make necessary adjustments. By reviewing financial records periodically, startups can identify areas where they can cut costs, increase revenue, or improve efficiency. This proactive approach helps startups stay financially healthy and avoid potential pitfalls.

Pro Tip: Regularly review your financial reports to spot trends early and make proactive adjustments to your business strategy.

Facilitating Tax Return Preparation

Accurate bookkeeping simplifies the process of preparing tax returns. By maintaining organized financial records, startups can ensure they comply with tax regulations and avoid penalties. Additionally, having detailed records makes it easier to claim deductions and credits, potentially reducing the overall tax liability.

Basics of Bookkeeping 2024: Essential Guide for Small Business Owners

In 2024, understanding the basics of bookkeeping is more crucial than ever for small business owners. Effective bookkeeping involves recording all financial transactions accurately and systematically. This practice helps businesses maintain a clear picture of their financial health, ensuring they can make informed decisions, comply with tax regulations, and identify areas for growth. Key components of bookkeeping include tracking income and expenses, managing invoices, reconciling bank statements, and preparing financial reports. By mastering these basics, small business owners can lay a solid foundation for financial stability and long-term success in a competitive market. Embracing modern bookkeeping software and tools can streamline these processes, making it easier to stay organized and efficient.

Choosing the Right Bookkeeping Software for Startups

Selecting the right bookkeeping software is a critical step for any startup. The right software can streamline your bookkeeping tasks, reduce errors, and save time. Here are some key features to look for in bookkeeping software for startups:

- User-friendly interface: The software should be easy to navigate, even for those without a background in accounting.

- Scalability: Choose software that can grow with your business, accommodating more transactions and users as your startup expands.

- Integration capabilities: The software should integrate seamlessly with other tools you use, such as CRM systems, payment processors, and payroll services.

- Automation features: Look for features that automate repetitive tasks like invoicing, expense tracking, and bank reconciliation.

- Reporting and analytics: The software should provide detailed financial reports and analytics to help you make informed decisions.

Popular Bookkeeping Software Options for Startups

We recommend and exclusively use QuickBooks Online for its robust features and ease of use. QuickBooks Online offers comprehensive tools for invoicing, expense tracking, payroll, and financial reporting, making it an ideal choice for startups.

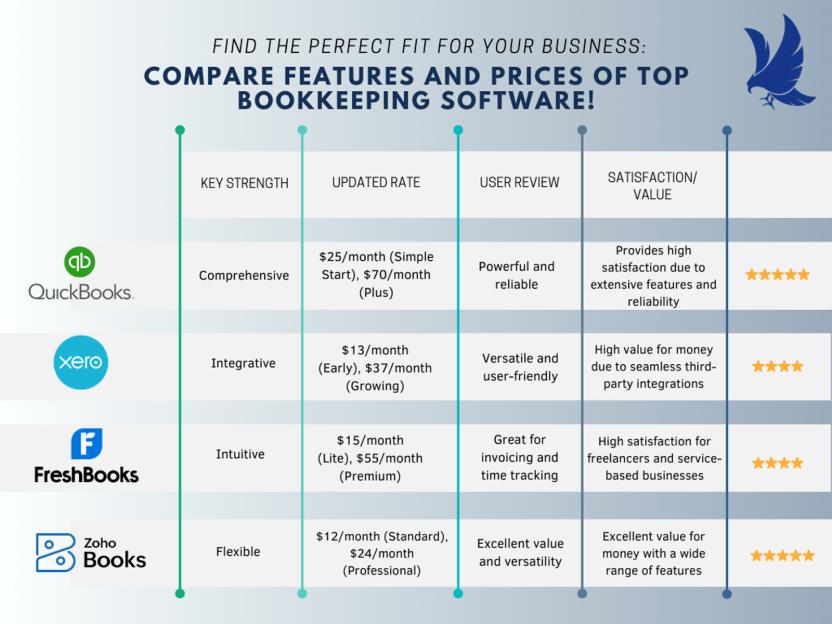

- QuickBooks: Known for its robust features and ease of use, QuickBooks is a popular choice among startups. It offers comprehensive tools for invoicing, expense tracking, payroll, and financial reporting.

- Xero: Xero is another excellent option, particularly for startups that need strong integration capabilities. It offers features such as bank reconciliation, invoicing, and expense management.

- FreshBooks: FreshBooks is ideal for startups that need a simple yet effective solution for invoicing and expense tracking. It also offers time-tracking and project management features.

- Zoho Books: Zoho Books is a versatile option that provides robust accounting features, including invoicing, expense tracking, inventory management, and strong integration capabilities with other Zoho applications.

By carefully considering these options and selecting the one that best fits your startup’s needs, you can ensure a smoother financial management process and focus on growing your business.

Startup Bookkeeping: Essential Practices for Success

Recording Financial Transactions

Recording financial transactions accurately is the foundation of good bookkeeping. Startups should use accounting software to automate this process and reduce the risk of errors. Each transaction should be recorded promptly, including details such as the date, amount, and description. This practice ensures that financial records are up-to-date and reliable.

Reconciling Bank Statements

Bank reconciliation involves comparing the startup’s financial records with bank statements to ensure consistency. This process helps identify discrepancies, such as missing transactions or errors, and ensures that the financial records are accurate. Startups should reconcile their bank statements regularly, ideally at the end of each month.

Managing Accounts Receivable and Accounts Payable

Accounts receivable represent money owed to the startup by customers, while accounts payable represent money the startup owes to suppliers. Managing these accounts effectively is crucial for maintaining healthy cash flow. Startups should implement a system for tracking and collecting receivables promptly and ensuring timely payment of payables to avoid late fees and maintain good relationships with suppliers.

Tracking Expenses and Income

Tracking expenses and income is essential for understanding the startup’s financial performance. Startups should categorize expenses and income to identify trends and make informed decisions. Using accounting software can simplify this process and provide valuable insights into the startup’s financial health.

Preparing and Analyzing Financial Statements

Preparing financial statements is a key aspect of bookkeeping for startups. The balance sheet, income statement, and cash flow statement provide a comprehensive view of the startup’s financial position. Analyzing these statements helps startups identify strengths and weaknesses, set financial goals, and make strategic decisions.

Common Challenges of Bookkeeping for Startups and How to Overcome Them

Cash Flow Management

Managing cash flow is a common challenge for startups. To overcome this, startups should create a cash flow forecast, monitor cash flow regularly, and implement strategies to improve cash flow, such as offering discounts for early payments and negotiating favorable payment terms with suppliers.

Handling Tax Returns

Tax compliance can be daunting for startups. To simplify the process, startups should keep detailed financial records, stay informed about tax regulations, and consider working with a CPA or tax accountant. They can provide expert advice, help prepare tax returns, and ensure compliance with tax laws.

Maintaining Accurate Financial Records

Accurate financial records are essential for making informed decisions and ensuring compliance. Startups should implement a robust accounting system, use bookkeeping software, and conduct regular audits to maintain accurate records. Additionally, startups should educate themselves on common bookkeeping mistakes and take steps to avoid them.

Dealing with Unexpected Expenses

Unexpected expenses can strain a startup’s finances. To mitigate this risk, startups should create an emergency fund, review their budget regularly, and identify areas where they can cut costs. By being proactive, startups can better manage unexpected expenses and maintain financial stability.

Hiring a CPA or Accountant

Hiring a CPA or accountant can provide valuable benefits, such as expert financial advice, tax planning, and compliance assistance. Startups should consider hiring a CPA or accountant when they need help with complex financial matters, such as preparing financial statements, handling tax returns, or seeking investment. When choosing a CPA or accountant, startups should look for someone with experience working with startups and a deep understanding of the industry.

DIY Bookkeeping vs. Professional Bookkeeping Services

Startups can choose between DIY bookkeeping and professional bookkeeping services. DIY bookkeeping allows startups to save money and maintain control over their finances. However, it requires time and effort to ensure accuracy. Professional bookkeeping services, on the other hand, offer expertise and can save time, but they come at a cost. Startups should weigh the pros and cons of each option and choose the one that best suits their needs.

Tips for Successful Bookkeeping for Startups

- Regularly update your financial records: Keeping records up-to-date ensures accuracy and helps identify potential issues early.

- Use technology to streamline bookkeeping tasks: Accounting software can automate tasks and reduce the risk of errors.

- Stay organized and keep all financial documents in one place: Organization is key to maintaining accurate records.

- Continuously educate yourself on bookkeeping best practices: Staying informed about best practices and industry trends can help improve your bookkeeping processes.

Why Accounting for Startups is Essential

Ensuring Financial Compliance

Accounting for startups ensures compliance with financial regulations and tax laws. By keeping accurate records and preparing necessary financial documents, startups can avoid legal issues and penalties. Proper accounting practices also help in filing timely and accurate tax returns, which is essential for maintaining a good standing with tax authorities.

Analyzing Financial Performance

Accounting for startups provides a comprehensive analysis of financial performance. Through detailed financial reports such as income statements, balance sheets, and cash flow statements, startups can assess their profitability, liquidity, and overall financial health. This analysis is crucial for making informed decisions and identifying areas for improvement.

Supporting Strategic Planning

Effective accounting for startups supports strategic planning by providing insights into the financial implications of business decisions. Whether it’s expanding into new markets, launching a new product, or adjusting pricing strategies, accounting data helps startups evaluate the potential risks and benefits. This ensures that strategic plans are grounded in financial reality.

Attracting Investors

Accurate and transparent accounting for startups is essential for attracting investors. Potential investors require detailed financial information to assess the viability and profitability of a startup. Well-maintained financial records and comprehensive financial statements build investor confidence and demonstrate the startup’s commitment to financial integrity.

Managing Payroll and Issuing Invoices for Startups: Steps to Ensure Accuracy, Compliance, and Timely Payments

Managing Payroll

Managing payroll is a critical accounting function for startups. It involves calculating employee wages, withholding taxes, and ensuring timely payment. Accurate payroll management ensures compliance with tax regulations and boosts employee satisfaction.

Steps to Manage Payroll Effectively:

- Choose Payroll Software: Select reliable payroll software that automates calculations and tax withholdings.

- Understand Tax Regulations: Stay updated on tax laws and ensure correct deductions.

- Maintain Accurate Records: Keep detailed records of employee hours, wages, and benefits.

- Set a Payroll Schedule: Establish a consistent payroll schedule to ensure timely payments.

- Review Regularly: Periodically review payroll processes to identify and correct any discrepancies.

Issuing Invoices

Invoicing is an essential aspect of accounting that involves issuing bills to clients for services rendered or products sold. Proper invoicing ensures timely payments, maintains cash flow, and provides a clear record of transactions for financial reporting.

Advice for Effective Invoicing:

- Use Professional Templates: Use standardized, professional invoice templates for consistency.

- Detail the Services or Products: Clearly describe the services or products provided, including quantities and rates.

- Set Payment Terms: Clearly state payment terms and due dates on the invoice.

- Automate Invoicing: Use accounting software to automate invoicing and send reminders.

- Track Payments: Monitor outstanding invoices and follow up promptly on late payments.

Benefits of Effective Startup Accounting

Effective accounting practices are essential for the success and growth of any startup. Here are the key benefits:

- Financial Clarity:

- Provides a clear picture of your startup’s financial health.

- Helps in understanding income, expenses, and profitability.

- Informed Decision-Making:

- Enables data-driven decisions for business growth.

- Assists in evaluating the financial impact of different strategies.

- Regulatory Compliance:

- Ensures compliance with tax laws and financial regulations.

- Minimizes the risk of legal issues and penalties.

- Efficient Cash Flow Management:

- Helps in tracking and managing cash flow effectively.

- Prevents cash shortages and ensures smooth operations.

- Attracting Investors:

- Demonstrates financial responsibility and transparency.

- Increases the likelihood of securing funding from investors.

- Strategic Planning:

- Provides accurate financial data for creating realistic budgets.

- Assists in setting achievable financial goals and planning for the future.

Implementing effective accounting practices in your startup will help you maintain financial stability, make informed decisions, and achieve long-term success.

What are the Best Accounting Methods for Startups?

Cash Accounting

Cash accounting records revenues and expenses when they are actually received or paid. This method is straightforward and provides a clear view of cash flow, making it suitable for small startups with simple financial transactions. It helps in managing day-to-day finances effectively.

Accrual Accounting

Accrual accounting records revenues and expenses when they are incurred, regardless of when cash is exchanged. This method provides a more accurate picture of a startup’s financial health by matching income and related expenses in the same period. It is beneficial for understanding long-term financial trends and planning for future growth.

Hybrid Method

The hybrid method combines elements of both cash and accrual accounting. Startups can use cash accounting for certain transactions and accrual accounting for others, depending on their needs. This method offers flexibility and can be tailored to suit the unique financial structure of a startup.

Choosing the Right Method

Selecting the appropriate accounting method depends on various factors, including the complexity of financial transactions, regulatory requirements, and the startup’s growth stage. Consulting with an accounting professional can help startups choose the method that best supports their financial management and reporting needs.

Creating a Chart of Accounts

A chart of accounts is a systematic listing of all the accounts used by a business to record financial transactions. It categorizes all the financial data into different accounts, making it easier to track and manage. Here are the common categories in a chart of accounts for startups:

- Assets: Cash, accounts receivable, inventory, equipment

- Liabilities: Accounts payable, loans, credit card balances

- Equity: Owner’s equity, retained earnings

- Revenue: Sales, service income, interest income

- Expenses: Rent, utilities, salaries, marketing, office supplies

Steps to Create a Chart of Accounts:

- Identify the main categories: Start with the broad categories such as assets, liabilities, equity, revenue, and expenses.

- Subdivide each category: Break down each main category into more specific subcategories. For example, under assets, you might have cash, accounts receivable, and inventory.

- Assign account numbers: Assign a unique number to each account to make it easier to track and reference.

- Customize for your business: Tailor the chart of accounts to fit the specific needs of your startup. You might need additional categories based on your industry or business model.

Cash Basis vs. Accrual Basis Accounting

When setting up your startup’s accounting system, you’ll need to choose between cash basis accounting and accrual basis accounting. Each method has its advantages and disadvantages, and the right choice depends on your business needs.

Cash Basis Accounting

- Definition: Records transactions when cash is received or paid.

- Pros: Simple to implement, provides a clear picture of cash flow, and is easier to manage for small businesses.

- Cons: Does not provide a complete picture of financial health, as it doesn’t account for receivables and payables.

Accrual Basis Accounting

- Definition: Records transactions when they are earned or incurred, regardless of when cash changes hands.

- Pros: Provides a more accurate representation of financial performance, better for long-term planning and financial analysis.

- Cons: More complex to implement, requires more detailed record-keeping, and may not reflect immediate cash flow.

Choosing the Best Method

- Consider your business model: If your startup deals with a lot of credit transactions, accrual basis accounting might be more suitable.

- Regulatory requirements: Some jurisdictions and industries require the use of accrual basis accounting.

- Future growth: If you plan to scale your business quickly, accrual basis accounting can provide a more comprehensive view of your financial health.

By carefully selecting the right bookkeeping software, creating a detailed chart of accounts, and choosing the appropriate accounting method, you can set up a robust bookkeeping system that supports your startup’s growth and success.

Conclusion: Accounting and Bookkeeping – Essential Startup Needs

Accounting and bookkeeping are critical aspects of running a successful startup. By maintaining accurate financial records, preparing financial statements, and managing cash flow, startups can ensure their financial health and make informed decisions. Proper accounting practices also help startups comply with financial regulations, attract investors, and support strategic planning. Implementing the tips and strategies discussed in this guide will help startups maintain good bookkeeping and accounting practices, laying a strong foundation for long-term success.

Frequently Asked Questions (FAQs)

What is the best bookkeeping software for startups?

Some popular options include QuickBooks, Xero, FreshBooks, and Zoho Books. These platforms offer features such as invoice management, expense tracking, and financial reporting, making them ideal for startups.

How often should I update my financial records?

It’s best to update financial records regularly, ideally daily or weekly, to ensure accuracy and stay on top of your startup’s financial health.

What are the most common bookkeeping mistakes startups make?

Common mistakes include failing to keep receipts, not reconciling bank statements, mixing personal and business finances, and not keeping records up-to-date.

How can I improve my startup’s cash flow?

To improve cash flow, create a cash flow forecast, monitor cash flow regularly, offer discounts for early payments, and negotiate favorable payment terms with suppliers.

When should I hire a professional bookkeeper or CPA?

Consider hiring a professional when you need help with complex financial matters, such as preparing financial statements, handling tax returns, or seeking investment.

This comprehensive guide provides valuable insights and practical tips to help startups maintain accurate financial records and achieve financial health. By implementing these strategies, startup founders and business owners can ensure their startups thrive in the competitive business landscape.

2 Comments