Are Tax Preparation Fees Deductible? A Comprehensive Guide (2025)

Introduction

Tax season can be a daunting time for many, with forms to fill out and numbers to crunch. One question that often arises is whether tax preparation fees are deductible. Understanding this aspect can potentially save you money and simplify your filing process. In this guide, we’ll delve into what tax preparation fees are, whether they can be deducted, and how to claim these deductions if applicable. This information is crucial for anyone looking to optimize their tax filing process and ensure compliance with IRS regulations.

Tax preparation fees refer to the costs incurred for preparing and filing your tax returns. These can include payments made to professional tax preparers, as well as expenses for tax preparation software. With changes in tax laws over recent years, understanding the deductibility of these fees has become more important than ever. Let’s explore this topic in detail.

What Are Tax Preparation Fees?

Tax preparation fees encompass a range of costs associated with filing your taxes. These can include:

- Professional Services: Fees paid to accountants or tax professionals who prepare your tax return.

- Software Costs: Expenses for purchasing or subscribing to tax preparation software.

- Filing Fees: Charges for electronic filing of tax returns.

Many people mistakenly believe that any cost associated with tax filing is automatically deductible. However, this is not always the case. Understanding what qualifies as a tax preparation fee is the first step in determining deductibility.

Historically, taxpayers could deduct these fees as part of their miscellaneous deductions. However, recent changes in tax legislation have affected this ability. It’s important to stay informed about these changes to ensure you’re not missing out on potential savings.

For more detailed information about tax preparation fees, you can visit the IRS website.

Can You Deduct Tax Preparation Fees?

The question o  f whether tax preparation fees are deductible has become more complex due to recent changes in tax laws. Under the Tax Cuts and Jobs Act of 2017, many miscellaneous itemized deductions, including tax preparation fees, were suspended for tax years 2018 through 2025. This means that, for most taxpayers, these fees are no longer deductible on their federal tax returns.

f whether tax preparation fees are deductible has become more complex due to recent changes in tax laws. Under the Tax Cuts and Jobs Act of 2017, many miscellaneous itemized deductions, including tax preparation fees, were suspended for tax years 2018 through 2025. This means that, for most taxpayers, these fees are no longer deductible on their federal tax returns.

For business owners, tax preparation fees can be deductible as a business expense. These fees fall under “miscellaneous deductions” on your Schedule C. This means you can deduct the cost of preparing the business portion of your taxes.

Here’s what you can deduct:

- Software Costs: If you use tax prep software specifically for your business taxes, these costs are deductible.

- Professional Services: Fees paid to accountants or tax professionals for business tax preparation are deductible.

- Legal Publications: Costs for legal publications that help you understand tax laws related to your business are also deductible.

IRS Guidelines and Publications

According to the IRS, tax preparation fees were previously deductible as a miscellaneous itemized deduction on Schedule A. However, with the suspension of these deductions, taxpayers can no longer claim them unless they are self-employed. Self-employed individuals can still deduct the cost of preparing their business taxes as a business expense on Schedule C.

Key Points:

- Suspension of Miscellaneous Deductions: Most taxpayers cannot deduct tax preparation fees from 2018 to 2025.

- Self-Employed Exception: Self-employed individuals can deduct tax prep fees as a business expense.

For more detailed IRS guidelines, refer to IRS Publication 529.

Impact of Changes on Miscellaneous Deductions

The suspension of miscellaneous deductions has significantly impacted taxpayers who previously relied on these deductions to lower their taxable income. It’s crucial to stay updated on these changes and understand how they affect your tax situation. Consulting with a tax professional can provide clarity and help you navigate these changes effectively.

How to Claim Tax Preparation Fees as a Deduction

For those who are self-employed, deducting tax preparation fees remains a viable option. Here’s a step-by-step guide to help you claim these deductions:

Step-by-Step Guide

- Gather documentation: Collect all receipts and records of payments made for tax preparation services. This includes invoices from tax professionals or receipts for tax software purchases.

- Determine eligibility: Ensure that you qualify for deducting these fees. If you’re self-employed, you can deduct the portion of the fees related to your business taxes.

- Fill out schedule C: On Schedule C, include the tax preparation fees under “Other Expenses.” This form is used to report income or loss from a business you operated or a profession you practiced as a sole proprietor.

- Keep accurate records: Maintain detailed records of your tax preparation fees and any other deductions claimed. This is crucial in case of an IRS audit.

Necessary Documentation and Records

- Invoices and receipts: Keep copies of all invoices and receipts related to tax preparation.

- Bank statements: These can serve as additional proof of payment.

- Tax forms: Ensure that all relevant tax forms are completed accurately.

Common mistakes to avoid:

- Mixing personal and business expenses: Ensure that only the portion of tax prep fees related to business is deducted.

- Inaccurate record-keeping: Keep thorough and accurate records to support your deduction claims.

For more information on filling out Schedule C, visit the IRS Schedule C Instructions.

Legal Considerations for Tax Preparation Fees Deductible

When considering whether tax preparation fees are deductible, it’s important to be aware of the legal implications. Understanding these can help you avoid potential pitfalls and ensure compliance with IRS regulations.

Legal Implications of Claiming Deductions

- IRS Audits: Claiming deductions incorrectly can increase the likelihood of an IRS audit. It’s essential to ensure that your deductions are legitimate and well-documented.

- Consulting a Tax Professional: If you’re unsure about the deductibility of your tax preparation fees, consulting a tax professional is advisable. They can provide personalized advice and help you navigate complex tax laws.

- State vs. Federal Deductions: While federal deductions for tax preparation fees are limited, some states may still allow these deductions. Check your state’s tax laws to see if you can claim them on your state return.

What to do if audited

- Be prepared: Have all documentation ready to support your deduction claims.

- Respond promptly: If the IRS contacts you, respond promptly and provide the requested information.

- Seek legal advice: If necessary, seek legal advice from a tax attorney or accountant to guide you through the audit process.

For more legal guidance on tax deductions, consider visiting Nolo’s Tax Deduction Guide.

Software vs. Professional Tax Prep: Which Is Better for Deductions?

When it comes to preparing your taxes, deciding between using tax software or hiring a professional can impact your ability to claim deductions. Both options have their advantages, and the choice often depends on your specific needs and circumstances.

Pros and Cons of Using Tax Software

Pros:

- Cost-Effective: Tax software is generally cheaper than hiring a professional.

- Convenience: You can prepare your taxes at your own pace and from the comfort of your home.

- Guidance: Many software programs offer step-by-step instructions and checklists.

Cons:

- Limited personalization: Software may not account for unique tax situations.

- Technical issues: Users may encounter software glitches or errors.

Benefits of Hiring a Professional Tax Preparer

Pros:

- Expertise: Professionals offer personalized advice and can handle complex tax situations.

- Accuracy: They are less likely to make errors that could lead to audits.

- Time-Saving: A professional can save you time and stress, especially if your tax situation is complicated.

Cons:

- Higher costs: Hiring a professional can be more expensive than using software.

- Finding the right fit: It can take time to find a trustworthy and competent tax preparer.

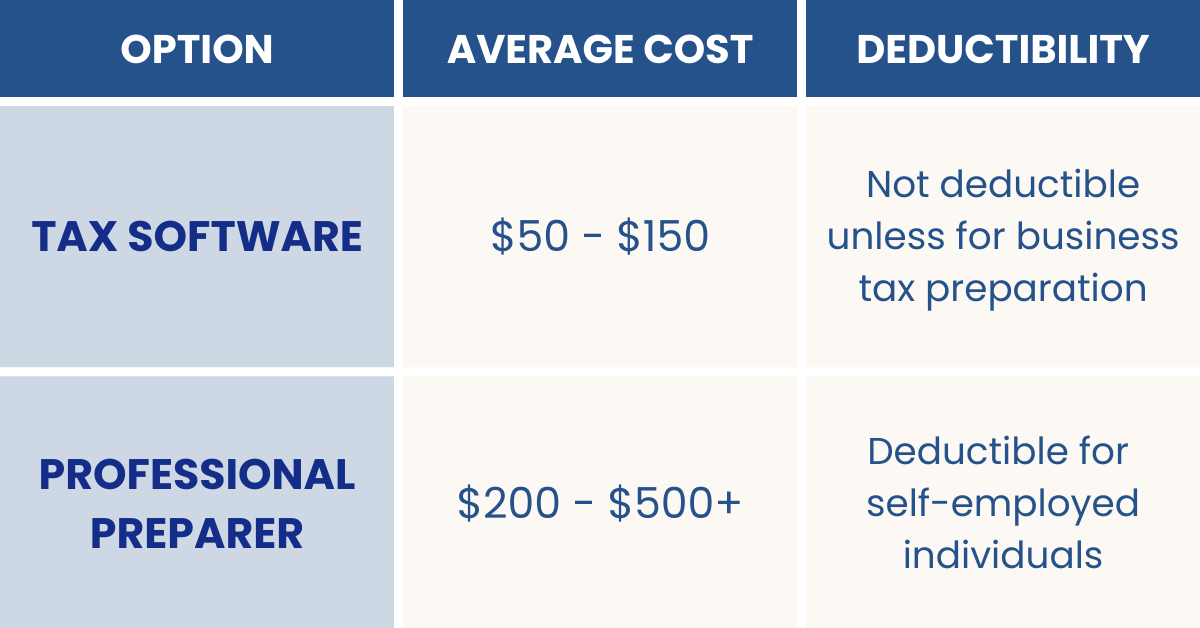

Cost Comparison and Potential Deductions

Choosing between tax software and a professional preparer depends on your budget, tax complexity, and preference for convenience versus personalized service.

For more insights on choosing the right tax preparation method, check out Investopedia’s Guide to Tax Preparation.

Other Miscellaneous Deductions to Consider

While the ability to deduct tax preparation fees has been limited, there are still other miscellaneous deductions that taxpayers can consider. These deductions can help reduce taxable income and potentially lower your tax bill.

Overview of Other Deductible Expenses

- Medical expenses: You can deduct unreimbursed medical expenses that exceed 7.5% of your adjusted gross income (AGI).

- Charitable contributions: Donations to qualified charitable organizations are deductible. Be sure to keep records of your contributions.

- Educator expenses: Teachers can deduct up to $250 of unreimbursed expenses for classroom supplies.

- Investment interest: Interest paid on money borrowed to purchase taxable investments can be deductible.

How to Categorize and Claim These Deductions

- Organize receipts: Keep all receipts and documentation related to deductible expenses.

- Use Schedule A: Most miscellaneous deductions are claimed on Schedule A. Ensure you meet the criteria for itemizing deductions.

- Consult IRS Publications: For detailed guidance, refer to IRS publications that cover specific deductions.

Examples of Common Miscellaneous Deductions

- Job Search Expenses: Costs related to searching for a new job in your current occupation.

- Tax Preparation Fees for Business: As previously mentioned, self-employed individuals can deduct tax prep fees related to their business.

Common Miscellaneous Deductions

For more information on miscellaneous deductions, visit the IRS Miscellaneous Deductions Guide.

Frequently Asked Questions About Tax Preparation Fees

Understanding the nuances of tax preparation fees can be challenging. Here are some frequently asked questions to provide further clarity:

Can I still deduct tax prep fees if I use free software?

No, if you use free tax software, there are no fees to deduct. However, if you pay for additional features or services within the software, those costs may be deductible if you are self-employed and the expenses relate to business taxes.

Are fees for filing state taxes deductible?

Previously, fees for filing both federal and state taxes could be deducted as miscellaneous itemized deductions. However, under the current tax law, these are no longer standard deductions for most taxpayers unless they are related to business expenses for self-employed individuals.

What if I paid for tax advice separately?

If you paid for tax advice separately and it pertains to your business, you might be able to deduct these fees as a business expense. For personal tax advice, these fees are not deductible under the current tax laws.

Additional Considerations

- Impact of state laws: Some states may have different rules regarding the deductibility of tax preparation fees. It’s important to check with your state’s tax authority.

- Record-keeping: Always keep detailed records of any fees paid for tax preparation and advice, as they may be relevant for future tax years or audits.

Navigating the intricacies of tax deductions, especially when it comes to tax preparation fees deductible, can be complex. With the suspension of many miscellaneous deductions under the Tax Cuts and Jobs Act, it’s crucial to stay informed about what you can and cannot deduct. While most taxpayers can no longer deduct tax preparation fees, self-employed individuals still have the opportunity to claim these costs as business expenses.

Key Takeaways

- Understand current laws: Be aware of the current tax laws and how they affect the deductibility of tax preparation fees.

- Self-employed benefits: If you’re self-employed, you can still deduct tax prep fees related to your business.

- Stay informed: Regularly consult IRS publications and trusted tax resources to stay updated on any changes in tax legislation.

Remember, consulting with a tax professional can provide personalized advice tailored to your specific situation. They can help you maximize your deductions and ensure compliance with all tax regulations.

For additional resources and guidance, consider exploring the following:

- [PDF] FREE Hidden Tax Deductions in 2025 Checklist

- IRS Tax Topics

- NerdWallet’s Guide to Tax Deductions

By staying informed and proactive, you can make the most of your tax situation and potentially save money in the process.