Benefits of Incorporating Your Small Business in 2025: Tax Advantages, Liability Protection, and Expert Insights

As we approach 2025, the landscape for small businesses continues to evolve rapidly. One crucial decision that many entrepreneurs face is whether to incorporate their business. This comprehensive guide will explore the numerous benefits of incorporating your small business, helping you make an informed decision as we enter a new era of business operations.

Understanding Business Structures

Before diving into the benefits of incorporation, it’s essential to understand the various business structures available to entrepreneurs. Each structure has its own set of advantages and disadvantages, and the choice you make can significantly impact your business’s future.

Sole Proprietorship

A sole proprietorship is the simplest and most common form of business structure. In this arrangement, there is no legal distinction between the business and its owner. While it’s easy to set up and offers complete control, it also means that the owner is personally liable for all business debts and obligations.

Key characteristics of a sole proprietorship:

- Easy to establish and maintain

- Owner has complete control

- Profits are taxed as personal income

- Unlimited personal liability for business debts

Partnership

A partnership is a business structure where two or more individuals share ownership. Like sole proprietorships, partnerships are relatively easy to form but come with shared liability among partners.

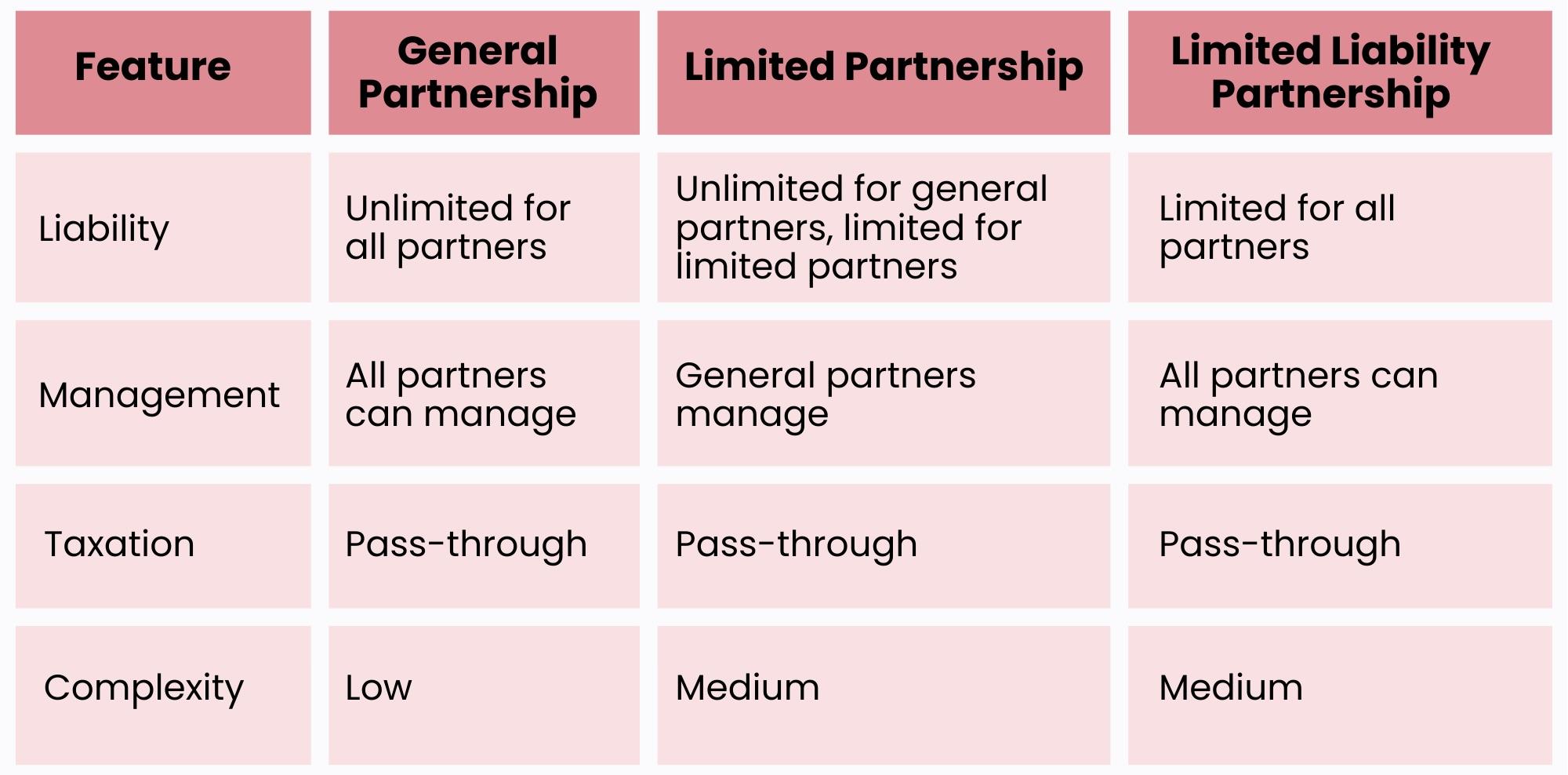

Types of partnerships:

- General Partnership: All partners share equal responsibility and liability.

- Limited Partnership: One general partner has unlimited liability, while limited partners have liability only up to their investment.

- Limited Liability Partnership (LLP): All partners have some degree of limited liability.

Limited Liability Company (LLC)

An LLC is a hybrid structure that combines elements of corporations and partnerships. It provides personal asset protection for owners (called members) while offering tax and flexibility benefits of a partnership.

Benefits of an LLC:

- Limited liability protection for members

- Pass-through taxation (in most cases)

- Flexibility in management structure

- Less paperwork compared to corporations

Corporation (S Corporation and C Corporation)

Corporations are more complex business structures that exist as separate legal entities from their owners. They offer the strongest protection from personal liability but are subject to more regulations and tax rules.

Types of corporations:

- C Corporation: Standard corporation, taxed separately from owners.

- S Corporation: Offers pass-through taxation for small businesses.

For a more detailed comparison of business structures, you can visit the U.S. Small Business Administration’s guide.

As we move into 2025, understanding these structures is crucial for making an informed decision about incorporating your small business. In the next section, we’ll delve into the key benefits of incorporation and how they can impact your business in the coming years.

Key Benefits of Incorporating Your Small Business

As we approach 2025, the advantages of incorporating your small business have become increasingly significant. Let’s explore these benefits in detail, considering the evolving business landscape and economic trends.

Limited Liability Protection

One of the most compelling reasons to incorporate your small business is the limited liability protection it offers. This benefit has become even more crucial in today’s litigious society and uncertain economic climate.

How limited liability works:

- Separates personal assets from business debts

- Protects against lawsuits targeting the business

- Shields personal wealth from business creditors

According to a recent study by the U.S. Chamber Institute for Legal Reform, the cost of the U.S. tort system reached $443 billion in 2023, highlighting the importance of liability protection for businesses of all sizes.

Case Study: Tech Startup Shielded from Lawsuit In 2024, a Silicon Valley tech startup faced a patent infringement lawsuit. Thanks to their corporate structure, the founders’ personal assets remained protected while the company navigated the legal challenge. This case underscores the importance of liability protection in high-risk industries.

Financial Benefits

Incorporation can offer significant financial advantages, particularly in terms of taxation and capital raising.

Tax Advantages

The tax landscape for corporations has evolved since the Tax Cuts and Jobs Act of 2017, with further adjustments expected in the coming years.

Key tax benefits for incorporated businesses:

- Lower corporate tax rates (currently 21% for C Corporations)

- Potential for additional deductions and credits

- Ability to defer personal income taxes

It’s worth noting that tax laws can change, and it’s essential to consult with a tax professional for the most up-to-date advice. For current tax information, you can refer to the IRS website.

Easier Capital Raising

Incorporated businesses often find it easier to raise capital, which can be crucial for growth and expansion.

Methods of raising capital for corporations:

- Selling shares of stock

- Attracting venture capital

- Issuing corporate bonds

According to PitchBook Data, venture capital funding in the U.S. reached $238.3 billion in 2023, demonstrating the significant opportunities available for incorporated businesses seeking investment.

Credibility and Professional Image

In an increasingly competitive business environment, the credibility that comes with incorporation can be a significant advantage.

Ways incorporation enhances credibility:

- Demonstrates commitment and longevity

- Increases trust with customers and partners

- Attracts more serious consideration from stakeholders

A survey by the National Small Business Association found that 73% of small business owners believe incorporation improved their company’s professional image.

Perpetual Existence and Succession Planning

Incorporation provides a framework for business continuity that extends beyond the original owner’s involvement.

Benefits for long-term planning:

- Business can continue operating regardless of ownership changes

- Simplifies the process of transferring ownership

- Facilitates estate planning and generational wealth transfer

As we look towards 2025 and beyond, these benefits of incorporation become increasingly important for small businesses aiming for long-term success and stability. In the next section, we’ll explore potential drawbacks to consider when deciding whether to incorporate your small business.

Advantages of Incorporating Your Business

Understanding the advantages of incorporating your small business is crucial for making an informed decision about your company’s future. Here are the primary benefits of incorporation to consider:

1. Limited Liability Protection: A Major Advantage of Incorporation

One of the most significant advantages of incorporating your small business is the personal asset protection it provides:

- Shields personal assets from business debts and liabilities

- Protects against lawsuits targeting the business

- Reduces personal financial risk for business owners

2. Tax Benefits: A Key Advantage for Incorporated Businesses

Tax advantages are often a primary reason for incorporating:

- Potential for lower corporate tax rates

- Ability to deduct business expenses

- Option for S Corporation status to avoid double taxation

- Opportunity for income splitting in some cases

3. Credibility and Professionalism: An Important Advantage in the Market

Incorporation can significantly enhance your business’s image:

- Adds credibility with customers and partners

- Often viewed more favorably by potential investors

- Can lead to better business opportunities and contracts

4. Perpetual Existence: A Long-term Advantage of Corporate Structure

The concept of perpetual existence is a unique advantage of incorporation:

- Business can continue regardless of ownership changes

- Simplifies succession planning and business transfer

- Provides stability for long-term business planning

5. Easier Access to Capital: A Crucial Advantage for Growth

Incorporated businesses often find it easier to raise capital:

- Ability to sell stock to investors

- Generally more attractive to venture capitalists

- Can issue corporate bonds for debt financing

- Often viewed as less risky by lenders

6. Flexibility in Management Structure: An Organizational Advantage

Incorporation offers flexibility in how the business is managed:

- Can establish a board of directors for strategic guidance

- Allows for clear separation of ownership and management

- Provides structure for bringing in professional management

7. Enhanced Business Continuity: A Stability Advantage

Incorporation provides a framework for business continuity:

- Ownership can be transferred through stock sales

- Facilitates creation of succession plans

- Business can outlive its founders or current owners

8. Potential for Better Benefits: An Employee Advantage

Incorporated businesses can often offer better benefits:

- More options for retirement plans like 401(k)s

- Ability to offer stock options or equity compensation

- Potential tax advantages for certain benefit programs

9. Anonymity: A Privacy Advantage in Some Jurisdictions

In some states, incorporation can provide a level of privacy:

- Owners’ names may not be public record

- Can use a registered agent for official communications

10. International Expansion: A Global Business Advantage

For businesses looking to expand globally, incorporation offers advantages:

- Easier to establish international subsidiaries

- More recognizable structure for foreign partners and customers

- Potential for favorable treatment under international trade agreements

By understanding these advantages of incorporating your small business, you can better assess whether incorporation aligns with your business goals and strategies for 2025 and beyond. Remember to weigh these benefits against the potential disadvantages to make the best decision for your unique business situation.

Potential Disadvantages of Incorporating Your Business

While incorporation offers numerous benefits, it’s crucial to consider the potential drawbacks as well. As we approach 2025, some of these challenges have evolved, and new considerations have emerged.

Increased Costs

One of the primary concerns for small business owners considering incorporation is the associated costs.

Initial incorporation expenses:

- Filing fees (vary by state, ranging from $50 to $725 as of 2024)

- Legal fees (if using an attorney, typically $500 to $5,000)

- Accounting fees for initial setup

Ongoing costs:

- Annual report filing fees

- Franchise taxes in some states

- Higher accounting and legal fees for compliance

According to a recent survey by the National Association of Small Businesses, the average cost of incorporation for small businesses in 2024 was $1,500, with ongoing annual costs averaging $800.

Administrative Burden

Incorporation comes with increased paperwork and record-keeping requirements, which can be time-consuming for small business owners.

Key administrative tasks:

- Maintaining detailed corporate records

- Holding regular board meetings and keeping minutes

- Filing annual reports and other required documents

A study by the Small Business Administration found that small business owners spend an average of 20 hours per month on administrative tasks related to regulatory compliance.

Complexity in Management

Incorporated businesses often have more complex management structures, which can be challenging for small business owners accustomed to sole proprietorship.

Management complexities:

- Board of directors oversight

- Shareholder considerations

- Stricter decision-making processes

Limitations on Using Business Losses

While corporations can offer tax advantages, they also come with limitations on how business losses can be used.

Loss limitations:

- Corporate losses can’t be deducted on personal tax returns

- Stricter rules on carrying forward or back business losses

The Tax Cuts and Jobs Act of 2017 introduced new limitations on business loss deductions, which are set to continue through 2025 unless further legislative changes occur.

Potential for Higher Taxes in Certain Scenarios

In some cases, incorporation can lead to higher overall taxes, particularly for small businesses with lower profits.

Tax considerations:

- Double taxation for C Corporations (corporate and dividend taxes)

- Self-employment tax savings may be offset by higher overall tax rates

- Loss of certain personal tax deductions

It’s important to note that tax implications can vary significantly based on individual circumstances. For the most current tax information, always consult the IRS website or a qualified tax professional.

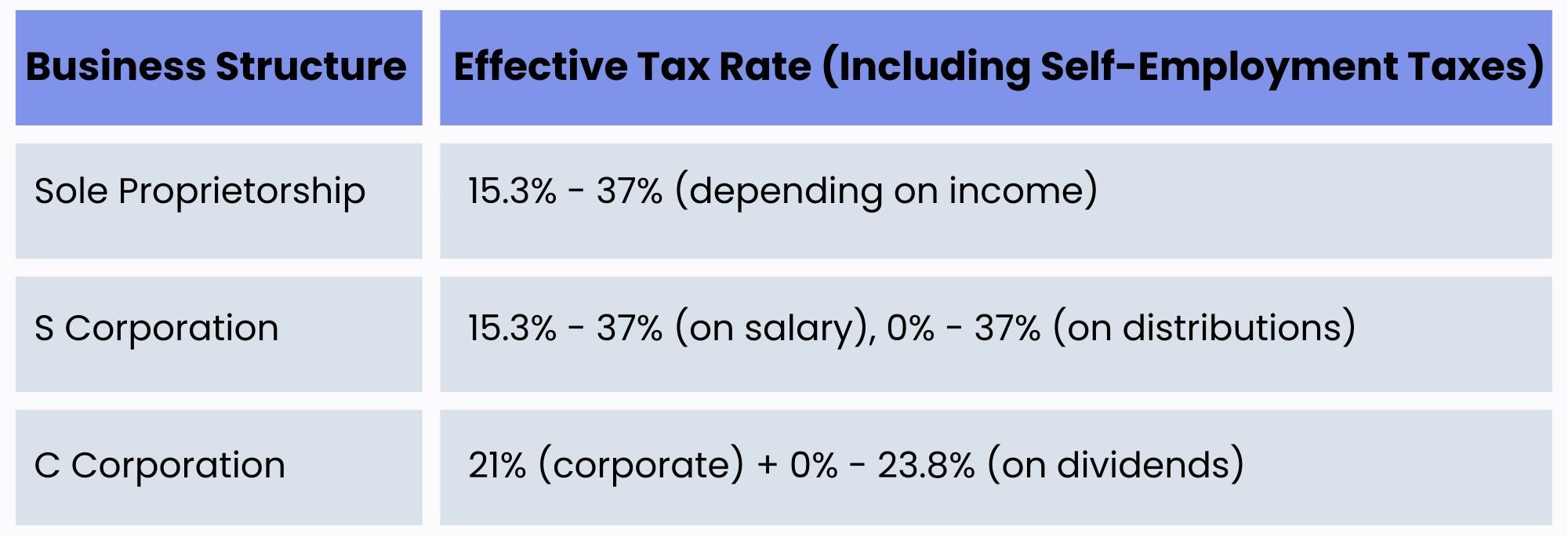

Table: Comparison of Tax Rates (2024 estimates) This table provides a simplified overview and actual rates may vary based on specific circumstances and state taxes.

This table provides a simplified overview and actual rates may vary based on specific circumstances and state taxes.

Understanding these potential drawbacks is crucial for making an informed decision about incorporation. In the next section, we’ll explore when you should consider incorporating your small business, taking into account various factors and scenarios.

When Should You Consider Incorporating Your Small Business?

As we approach 2025, the decision to incorporate your small business should be based on a careful evaluation of your specific circumstances, goals, and industry trends. Let’s explore the key factors and scenarios that might indicate it’s time to consider incorporation.

Signs Your Business is Ready for Incorporation

- Rapid Growth: If your business is experiencing significant growth, incorporation can provide the structure needed to manage this expansion effectively.

- Increasing Profits: When your business starts generating substantial profits, incorporation can offer tax advantages and help in reinvesting earnings.

- Expanding Team: As you hire more employees, incorporation can provide a more formal structure and potentially offer better benefits options.

- Seeking Investment: If you’re looking to attract outside investors or venture capital, incorporation is often necessary.

- Diversifying Products or Services: Expanding your offerings may increase liability risks, making incorporation more appealing.

Factors to Consider Before Incorporating

- Business Maturity: Is your business model proven and stable?

- Financial Stability: Can you afford the costs associated with incorporation?

- Long-term Goals: Does incorporation align with your vision for the business?

- Industry Risks: Does your industry have high liability risks?

- Competitive Landscape: Will incorporation give you a competitive edge?

Scenarios Favoring Incorporation

1. Concerned About Liability

If your business operates in a high-risk industry or you’re worried about potential lawsuits, incorporation can provide crucial protection for your personal assets.

Example Industries with High Liability Risks:

- Healthcare

- Construction

- Food Services

- Professional Services (e.g., law, accounting)

According to a report by the U.S. Chamber Institute for Legal Reform, small businesses bore 53% of business tort liability costs in 2023, emphasizing the importance of liability protection.

2. Building a Business to Sell

If your long-term plan involves selling your business, incorporation can make the process smoother and potentially more lucrative.

Benefits of Incorporation for Business Sale:

- Easier valuation process

- More attractive to potential buyers

- Tax advantages on capital gains

A study by BizBuySell found that incorporated businesses sold for an average of 20% more than unincorporated businesses in 2024.

3. Business Earns More Cash Than Needed Personally

When your business generates more income than you need for personal expenses, incorporation can offer tax deferral benefits.

Tax Deferral Strategy:

- Retain earnings in the corporation

- Pay lower corporate tax rates on retained earnings

- Reinvest profits for business growth

This strategy can be particularly effective for businesses in growth phases. However, it’s crucial to consult with a tax professional to ensure compliance with IRS regulations on retained earnings.

Scenarios Where Incorporation May Not Be Beneficial

1. You Are Your Business (Owner-Operated)

For sole proprietors who are the primary service providers (e.g., freelancers, consultants), the benefits of incorporation may be limited.

Considerations for Owner-Operated Businesses:

- Limited liability protection may not extend to professional negligence

- Additional administrative burden may outweigh benefits

- Pass-through taxation of sole proprietorship may be more advantageous

2. Expecting Initial Losses

If your business is in its early stages and expecting losses, operating as a sole proprietorship or partnership might allow for more favorable tax treatment of these losses.

Tax Treatment of Business Losses:

- Sole Proprietorship: Losses can offset other personal income

- Corporation: Losses generally can’t be deducted on personal tax returns

3. Real Estate Rental Businesses

For real estate investors, the decision to incorporate requires careful consideration due to specific tax implications and liability concerns.

Factors to Consider for Real Estate Businesses:

- Mortgage transfer issues when incorporating existing properties

- Potential loss of personal tax deductions

- Alternative structures like LLCs may be more beneficial

For more information on real estate business structures, you can refer to the National Association of Realtors’ guide.

As we move closer to 2025, the decision to incorporate your small business should be based on a thorough analysis of these factors and scenarios. In the next section, we’ll explore the process of incorporating your small business.

The Process of Incorporating Your Small Business

As we look towards 2025, the process of incorporating a small business has become more streamlined, thanks to digital tools and online resources. However, it still requires careful planning and attention to detail. Let’s break down the steps involved in incorporating your small business.

Choosing the Right Business Structure

The first step in incorporation is deciding which corporate structure best suits your business needs. The most common options are:

- C Corporation

- S Corporation

- Limited Liability Company (LLC)

Comparison Table: Corporate Structures For a more detailed comparison, you can visit the IRS website’s business structures page.

For a more detailed comparison, you can visit the IRS website’s business structures page.

Selecting a Business Name

Choosing a unique and appropriate name for your corporation is crucial. Here are some guidelines:

- Ensure the name is not already in use in your state

- Include a corporate designator (e.g., “Inc.”, “Corp.”, “LLC”)

- Avoid names that could be misleading about your business activities

Pro Tip: Conduct a thorough search using your state’s business name database and the U.S. Patent and Trademark Office’s trademark database to avoid potential legal issues.

Filing Articles of Incorporation

This is the formal process of creating your corporation. The requirements vary by state but generally include:

- Business name and address

- Purpose of the corporation

- Names and addresses of initial directors

- Number and type of authorized shares

- Name and address of the registered agent

As of 2024, the average filing fee for articles of incorporation across the U.S. is approximately $135, but this can range from $50 to $725 depending on the state.

Creating Corporate Bylaws

Bylaws are the internal rules governing your corporation. While not always required to be filed with the state, they are crucial for proper corporate governance. Key elements include:

- Procedures for electing directors and officers

- Rules for shareholder and board meetings

- Conflict resolution processes

- Procedures for amending bylaws

Important: Well-crafted bylaws can help prevent disputes and ensure smooth operations. Consider consulting with a corporate attorney to draft comprehensive bylaws.

Obtaining Necessary Licenses and Permits

Depending on your industry and location, you may need various licenses and permits to operate legally. Common requirements include:

- General Business License

- Professional Licenses

- Health Permits (for food-related businesses)

- Zoning Permits

The SBA’s Business License & Permits page provides a good starting point for understanding your requirements.

Issuing Stock

For corporations, issuing stock is a crucial step. This involves:

- Determining the number of shares to issue

- Setting the par value of shares

- Deciding on different classes of stock (if applicable)

- Creating stock certificates

Note: As of 2024, many states allow for electronic stock certificates, simplifying this process.

Holding the First Board Meeting

The initial board meeting is where you’ll:

- Adopt the bylaws

- Elect officers

- Authorize the issuance of stock

- Decide on the fiscal year

- Adopt an official stock certificate form

- Authorize opening a corporate bank account

Best Practice: Keep detailed minutes of this meeting, as they may be required for legal and tax purposes.

Setting Up Corporate Records

Maintaining proper corporate records is crucial for preserving your limited liability protection. Essential records include:

- Articles of Incorporation

- Bylaws

- Minutes of board meetings

- Stock ledger

- Annual reports

- Financial statements

Consider using digital record-keeping solutions to streamline this process. Many cloud-based services offer secure storage and easy access to corporate documents.

Obtaining an EIN

An Employer Identification Number (EIN) is necessary for tax purposes and opening a business bank account. You can obtain an EIN for free from the IRS website.

Key Points about EIN:

- It’s free to apply

- You can apply online and receive your EIN immediately

- It’s required for hiring employees and opening business bank accounts

Opening a Corporate Bank Account

Once you have your EIN, you can open a corporate bank account. This is crucial for maintaining the separation between personal and business finances.

Documents typically required:

- EIN

- Articles of Incorporation

- Corporate bylaws

- Initial resolution to open a bank account (from board meeting minutes)

Tip: Shop around for business banking services. As of 2024, many banks offer specialized services for small businesses, including low-fee accounts and integrated accounting software.

Maintaining Your Incorporated Status

Incorporating your business is just the beginning. To maintain your corporate status and the benefits it provides, you need to follow certain ongoing requirements.

Annual Reports and Filings

Most states require corporations to file annual reports. These reports typically include:

- Current business address

- Names and addresses of directors and officers

- Brief description of business activities

- Number of shares issued

State-Specific Requirements: Check with your state’s Secretary of State office for specific deadlines and fees. As of 2024, the average annual report fee is around $150, but this varies widely by state.

Maintaining Corporate Records

Keeping detailed and accurate corporate records is crucial for maintaining your corporate status and limited liability protection.

Essential corporate records include:

- Minutes of board meetings and shareholder meetings

- Stock ledger

- Financial statements

- Tax returns

- Important contracts and agreements

Best Practice: Implement a digital record-keeping system with regular backups to ensure easy access and security of your corporate documents.

Separating Personal and Business Finances

One of the most critical aspects of maintaining your corporate status is keeping your personal and business finances separate.

Key practices:

- Use separate bank accounts for business and personal transactions

- Avoid using corporate funds for personal expenses

- Keep detailed records of all business transactions

- Issue formal loans if transferring money between personal and business accounts

Warning: Failing to maintain this separation (known as “piercing the corporate veil”) can result in the loss of limited liability protection.

Holding Regular Board Meetings

Regular board meetings are essential for corporate governance and decision-making. For small corporations, these meetings should be held at least annually, but more frequent meetings may be beneficial.

Topics typically covered in board meetings:

- Review of financial performance

- Major business decisions

- Election of officers

- Declaration of dividends (if applicable)

- Approval of significant contracts or loans

Tip: Use a board meeting agenda template to ensure all necessary topics are covered. Many corporate governance software solutions offer such templates and can help streamline the process.

Compliance with Tax Obligations

Corporations have specific tax obligations that must be met to maintain good standing.

Key tax considerations:

- Filing annual corporate tax returns

- Paying estimated taxes quarterly

- Handling payroll taxes if you have employees

- Managing sales tax collection and remittance (if applicable)

As tax laws can be complex and change frequently, it’s advisable to work with a qualified tax professional to ensure compliance.

By following these maintenance requirements, you can ensure that your corporation remains in good standing and continues to provide the benefits of limited liability protection and other advantages of incorporation.

In the next section, we’ll explore the tax implications of incorporating your small business in more detail, as this is often a key factor in the decision to incorporate.

Tax Implications of Incorporating Your Small Business

As we approach 2025, understanding the tax implications of incorporation remains crucial for small business owners. The tax landscape continues to evolve, and staying informed can help you make the most of your corporate structure.

Corporate Tax Rates vs. Personal Tax Rates

One of the primary considerations when incorporating is how it will affect your tax liability. As of 2024, the corporate tax rate for C Corporations remains at a flat 21%, established by the Tax Cuts and Jobs Act of 2017. However, this rate is subject to potential changes as new tax legislation is debated.

Comparison of Tax Rates (2024 estimates): Note: Personal tax rates include self-employment taxes for sole proprietors. Corporate rates do not include potential dividend taxes for shareholders.

Note: Personal tax rates include self-employment taxes for sole proprietors. Corporate rates do not include potential dividend taxes for shareholders.

For the most up-to-date tax brackets and rates, always refer to the IRS website.

Pass-Through Taxation vs. Corporate Taxation

S Corporations and LLCs (by default) use pass-through taxation, where business income is reported on the owners’ personal tax returns. C Corporations, on the other hand, are subject to corporate taxation.

Pros of Pass-Through Taxation:

- Avoids double taxation

- Can lead to lower overall tax burden for small businesses

- Allows business losses to offset personal income

Pros of Corporate Taxation:

- Potential for lower tax rates on retained earnings

- More options for fringe benefits

- Easier to accumulate capital for growth

Self-Employment Taxes

Incorporation can affect how self-employment taxes are handled. In a sole proprietorship or partnership, owners pay self-employment tax (15.3% as of 2024) on all business profits. In an S Corporation or C Corporation, only salary is subject to these taxes.

Example: A business with $100,000 in profits:

- Sole Proprietor: Pays self-employment tax on $100,000

- S Corporation: If $60,000 is taken as salary and $40,000 as distributions, self-employment tax is only paid on the $60,000 salary

Caution: The IRS requires that S Corporation owners pay themselves a “reasonable salary” to prevent abuse of this tax strategy.

Deductions and Credits Available to Corporations

Corporations often have access to more tax deductions and credits than sole proprietorships. Some key deductions include:

- Health Insurance Premiums: Corporations can deduct 100% of health insurance premiums for employees, including owner-employees.

- Retirement Plans: Corporations have more options for retirement plans, including 401(k)s, which can lead to higher contribution limits.

- Business Expenses: While all business structures can deduct legitimate business expenses, corporations may have more flexibility in how these are categorized and reported.

- Charitable Contributions: C Corporations can deduct charitable contributions up to 10% of taxable income.

- Carry Forward of Losses: Corporations can carry forward net operating losses to offset future profits, potentially reducing tax liability in profitable years.

Research and Development Tax Credit: For innovative small businesses, the R&D tax credit can be particularly valuable. As of 2024, eligible startups can use this credit to offset up to $250,000 in payroll taxes.

State Tax Considerations

While we’ve focused primarily on federal taxes, state taxes can significantly impact the benefits of incorporation. Some states have more favorable tax environments for corporations than others.

Factors to consider:

- State corporate income tax rates

- Franchise taxes

- Sales and use taxes

- Employment taxes

Example: As of 2024, Nevada, South Dakota, and Wyoming do not impose a corporate or personal income tax, making them potentially attractive states for incorporation.

For state-specific tax information, consult your state’s Department of Revenue website or a local tax professional.

Tax Planning Strategies for Incorporated Businesses

Incorporating your business opens up new tax planning opportunities. Here are some strategies to consider:

- Income Splitting: For C Corporations, strategically timing salary payments and dividend distributions can help minimize overall tax liability.

- Accumulating Earnings: C Corporations can retain earnings at the corporate tax rate, potentially allowing for more capital to reinvest in the business.

- Fringe Benefits: Corporations can often deduct a wider range of fringe benefits, such as health insurance, life insurance, and disability insurance.

- Fiscal Year Selection: Unlike sole proprietorships, corporations can choose a fiscal year different from the calendar year, which can be advantageous for tax planning.

- Stock Options: Corporations can use stock options as a form of compensation, which can have tax advantages for both the company and employees.

Case Study: Tech Startup Tax Strategy A Silicon Valley tech startup incorporated as a C Corporation in 2023. By carefully structuring their compensation packages with a mix of salary and stock options, they were able to attract top talent while managing their tax liability. Additionally, they took advantage of the R&D tax credit to offset payroll taxes, freeing up cash for further innovation.

Potential Tax Pitfalls to Avoid

While incorporation can offer tax benefits, there are potential pitfalls to be aware of:

- Double Taxation: C Corporations face the risk of double taxation on distributed profits. Careful planning is needed to mitigate this issue.

- Accumulated Earnings Tax: C Corporations that retain too much earnings without a clear business purpose may face an additional tax.

- Personal Holding Company Tax: Closely held C Corporations with mostly passive income may be subject to this additional tax.

- Unreasonable Compensation: S Corporations must ensure that owner-employee salaries are “reasonable” to avoid IRS scrutiny.

- Losing QBI Deduction: The Qualified Business Income (QBI) deduction, available to some pass-through entities, is not available to C Corporations.

Important: Always consult with a tax professional to navigate these complex issues and ensure compliance with current tax laws.

Future Tax Considerations

As we look towards 2025 and beyond, several factors could impact the tax landscape for incorporated businesses:

- Potential changes to corporate tax rates

- Evolving regulations around international taxation and profit shifting

- Increased focus on environmental taxes and incentives

- Possible adjustments to capital gains tax rates

Tip: Stay informed about proposed tax legislation and how it might affect your business. The U.S. Chamber of Commerce often provides updates on tax policy that could impact small businesses.

Legal Considerations When Incorporating

While tax implications are crucial, legal considerations are equally important when incorporating your small business. Let’s explore some key legal aspects to keep in mind.

The Role of a Registered Agent

A registered agent is a person or company designated to receive legal documents and official correspondence on behalf of your corporation.

Key points about registered agents:

- Must have a physical address in the state of incorporation

- Available during business hours to receive documents

- Can be an individual, a company officer, or a professional registered agent service

Many small business owners choose to use a professional registered agent service to ensure compliance and maintain privacy. As of 2024, these services typically cost between $100 and $300 annually.

Compliance with State and Federal Laws

Incorporation comes with additional compliance requirements at both the state and federal levels.

State-level compliance:

- Annual report filings

- Maintaining good standing

- State-specific corporate governance laws

Federal-level compliance:

- SEC regulations (if publicly traded)

- Industry-specific regulations (e.g., FDA for food businesses)

- Employment laws

Tip: Consider using compliance management software to keep track of deadlines and requirements. Many of these platforms offer automated reminders and document preparation assistance.

The Importance of Corporate Bylaws

Corporate bylaws are the internal rules that govern how your corporation operates. While not always required to be filed with the state, they are crucial for proper corporate governance.

Key elements of corporate bylaws:

- Procedures for electing directors and officers

- Rules for shareholder and board meetings

- Voting rights

- Procedures for issuing and transferring stock

- Conflict resolution processes

- Amendment procedures for the bylaws themselves

Best Practice: Review and update your bylaws regularly to ensure they remain relevant and compliant with current laws. Many legal tech platforms now offer AI-assisted bylaw drafting and review services, which can be a cost-effective option for small businesses.

Maintaining Corporate Formalities

To preserve the limited liability protection offered by incorporation, it’s crucial to maintain corporate formalities. This includes:

- Holding regular board meetings and keeping minutes

- Maintaining separate bank accounts for business and personal finances

- Using the corporate name on all business documents

- Issuing stock certificates to shareholders

- Filing all required reports and paying necessary fees on time

Warning: Failure to maintain these formalities can lead to “piercing the corporate veil,” where courts may hold shareholders personally liable for corporate debts or legal issues.

Intellectual Property Protection

Incorporation can play a role in protecting your business’s intellectual property (IP). As a separate legal entity, a corporation can own trademarks, copyrights, and patents.

Benefits of corporate IP ownership:

- Continuity of ownership even if founders leave

- Potential tax advantages for IP licensing

- Clearer valuation of IP assets for investment purposes

For more information on IP protection, visit the U.S. Patent and Trademark Office website.

Employment Law Considerations

As an incorporated business, you’ll need to be aware of various employment laws and regulations:

- Fair Labor Standards Act (FLSA): Governs minimum wage, overtime pay, and child labor standards

- Equal Employment Opportunity (EEO) laws: Prohibit discrimination in the workplace

- Occupational Safety and Health Act (OSHA): Sets and enforces workplace safety standards

- Family and Medical Leave Act (FMLA): Provides certain employees with up to 12 weeks of unpaid, job-protected leave per year

Tip: Consider working with an HR consultant or using HR management software to ensure compliance with these complex regulations.

Contracts and Agreements

As a corporation, you’ll likely enter into various contracts and agreements. It’s crucial to ensure these are properly drafted and executed.

Common corporate contracts:

- Employee agreements

- Vendor contracts

- Lease agreements

- Non-disclosure agreements (NDAs)

- Shareholder agreements

Best Practice: Have a qualified business attorney review important contracts before signing. Many legal tech platforms now offer AI-assisted contract review services, which can be a cost-effective option for routine agreements.

Dispute Resolution

Incorporating your business provides a framework for resolving disputes, both internal (among shareholders or directors) and external (with third parties).

Common dispute resolution methods:

- Mediation

- Arbitration

- Litigation

Tip: Include dispute resolution clauses in your bylaws and important contracts to specify how disagreements will be handled.

International Considerations

If your business operates internationally or plans to expand globally, incorporation can have additional legal implications:

- Compliance with foreign business registration requirements

- International tax treaties and regulations

- Export/import laws and regulations

- Data privacy laws (e.g., GDPR for businesses dealing with EU customers)

Resource: The U.S. Commercial Service offers resources and assistance for U.S. companies looking to expand internationally.

Ongoing Legal Compliance

Maintaining legal compliance is an ongoing process. Consider implementing a compliance calendar or using legal compliance software to stay on top of requirements.

Key areas for ongoing compliance:

- Annual report filings

- License and permit renewals

- Tax filings and payments

- Industry-specific regulatory compliance

By carefully considering these legal aspects and maintaining proper compliance, you can ensure that your incorporated business enjoys the full benefits of its corporate status while minimizing legal risks.

In the next section, we’ll explore alternatives to incorporation, helping you understand all your options as you make this important decision for your small business.

Alternatives to Incorporation

While incorporation offers many benefits, it’s not the only option for structuring your small business. As we approach 2025, it’s important to consider all available alternatives to ensure you choose the structure that best fits your business needs and goals.

Limited Liability Company (LLC)

An LLC is a popular alternative to incorporation, offering a blend of liability protection and tax flexibility.

Key features of LLCs:

- Limited liability protection for members

- Pass-through taxation (by default)

- Flexible management structure

- Less formal requirements than corporations

Pros:

- Simpler to set up and maintain than corporations

- Avoid double taxation

- Can choose to be taxed as a corporation if beneficial

Cons:

- May be more difficult to raise capital

- Some states impose additional taxes or fees on LLCs

According to the National Association of Small Business’s 2024 survey, 35% of small businesses are structured as LLCs, making it the most popular choice after sole proprietorships.

For more information on LLCs, visit the SBA’s guide to LLCs.

Partnership Structures

Partnerships can be a good option for businesses with multiple owners who want to maintain a simpler structure than a corporation.

Types of partnerships:

- General Partnership (GP)

- Limited Partnership (LP)

- Limited Liability Partnership (LLP)

Comparison Table: Partnership Structures Pros of partnerships:

Pros of partnerships:

- Easy to form and operate

- Pass-through taxation

- Flexibility in management structure

Cons of partnerships:

- Unlimited liability for general partners (in GPs and LPs)

- Potential for disputes between partners

- May be less attractive to outside investors

Sole Proprietorship

For single-owner businesses, remaining a sole proprietorship is the simplest option.

Key features of sole proprietorships:

- No separation between owner and business

- Pass-through taxation

- Complete control for the owner

Pros:

- Easiest and least expensive to set up

- No formal business filings required

- Complete control over business decisions

Cons:

- Unlimited personal liability

- Difficulty raising capital

- Limited life of the business (tied to the owner)

As of 2024, approximately 23 million businesses in the U.S. operate as sole proprietorships, according to IRS data.

S Corporation Election

While technically a type of corporation, an S Corporation election can be seen as an alternative to traditional C Corporation status.

Key features of S Corporations:

- Pass-through taxation

- Limited liability protection

- Restrictions on number and type of shareholders

Pros:

- Avoid double taxation

- Potential tax savings on self-employment taxes

- Limited liability protection

Cons:

- More complex than LLCs or partnerships

- Restrictions on ownership (max 100 shareholders, must be U.S. citizens/residents)

- More scrutiny from IRS on reasonable compensation

Benefit Corporations and B Corps

For businesses focused on social and environmental impact alongside profits, Benefit Corporations and B Corps offer alternative structures.

Benefit Corporations:

- Legally required to consider impact on all stakeholders, not just shareholders

- Must report on social and environmental performance

- Available in 37 states as of 2024

B Corps:

- Certified by the nonprofit B Lab for meeting rigorous social and environmental standards

- Can be any business structure (corporation, LLC, etc.)

- Over 4,000 certified B Corps worldwide as of 2024

For more information on these socially responsible business structures, visit B Lab’s website.

Choosing the Right Alternative

When considering alternatives to incorporation, ask yourself:

- How much personal liability protection do I need?

- What are my tax preferences?

- How complex of a management structure do I want?

- What are my plans for growth and capital raising?

- How important is flexibility in ownership and profit distribution?

- Are there industry-specific considerations that favor one structure over another?

Decision-Making Tool: Many online platforms now offer AI-powered business structure recommendation tools. These tools consider various factors like your industry, growth plans, and risk tolerance to suggest the most suitable structure for your business.

Case Studies: Small Businesses That Benefited from Incorporation

To better understand the real-world impact of incorporation, let’s examine three case studies of small businesses that successfully incorporated and reaped significant benefits.

Case Study 1: Tech Startup – InnovateTech Inc.

Background: InnovateTech, a software development startup founded in 2022, initially operated as an LLC.

Decision to Incorporate: In 2024, the founders decided to incorporate as a C Corporation to attract venture capital funding and offer stock options to employees.

Benefits Realized:

- Raised $5 million in Series A funding within 6 months of incorporation

- Attracted top talent with competitive stock option packages

- Utilized the R&D tax credit to offset $200,000 in payroll taxes

- Enhanced credibility with enterprise clients, leading to 150% revenue growth

Key Takeaway: Incorporation enabled InnovateTech to access capital markets and talent pools that were previously out of reach, fueling rapid growth.

Case Study 2: Family-Owned Retail Store – Smith’s Emporium Inc.

Background: Smith’s Emporium, a third-generation family-owned retail store, operated as a sole proprietorship for over 50 years.

Decision to Incorporate: In 2023, facing expansion plans and increased liability concerns, the Smith family decided to incorporate as an S Corporation.

Benefits Realized:

- Protected personal assets as the business expanded to three new locations

- Saved approximately $15,000 annually in self-employment taxes through optimized salary structures

- Implemented a formal succession plan, ensuring smooth transition to the fourth generation

- Secured a $500,000 business loan for expansion, which was previously unattainable as a sole proprietorship

Key Takeaway: Incorporation provided Smith’s Emporium with the liability protection and financial structure needed to support significant expansion while preserving family ownership.

Case Study 3: Professional Services Firm – Elite Consulting Group Inc.

Background: Elite Consulting, a management consulting firm, started as a partnership between three experienced consultants in 2021.

Decision to Incorporate: In 2024, as the firm grew to 15 employees and faced increasing liability risks, the partners decided to incorporate as a C Corporation.

Benefits Realized:

- Limited personal liability, crucial for high-stakes consulting projects

- Implemented a comprehensive benefits package, including health insurance and a 401(k) plan, improving employee retention

- Established credibility with Fortune 500 clients, leading to a 200% increase in high-value contracts

- Utilized corporate tax strategies to reinvest profits into the business, funding a new AI-driven consulting tool

Key Takeaway: Incorporation allowed Elite Consulting to professionalize its operations, manage risks, and compete more effectively in the high-end consulting market.

Analysis of Case Studies:

These case studies highlight several key benefits of incorporation:

- Access to Capital: Incorporation opened doors to venture capital, loans, and other funding sources.

- Talent Attraction and Retention: The ability to offer stock options and comprehensive benefits packages helped attract and retain top talent.

- Liability Protection: All three businesses benefited from the personal asset protection offered by incorporation.

- Tax Advantages: Each company was able to implement tax strategies that supported their growth and profitability.

- Enhanced Credibility: Incorporation led to increased credibility with clients, partners, and financial institutions.

- Succession Planning: For family businesses like Smith’s Emporium, incorporation facilitated long-term succession planning.

Lessons for Small Business Owners:

- Consider your long-term growth plans when deciding on business structure.

- Evaluate the potential for liability in your industry.

- Assess the impact of different business structures on your ability to attract talent and funding.

- Consider the tax implications of different business structures in the context of your specific financial situation and goals.

- Don’t underestimate the impact of enhanced credibility that comes with incorporation, especially when dealing with larger clients or partners.

- Think about succession planning early, even if it seems far off.

Expert Advice: When to Seek Professional Help

While this guide provides comprehensive information on incorporating your small business, there are times when seeking professional help is not just beneficial, but necessary. Let’s explore when and how to engage experts in your incorporation journey.

Consulting with a Tax Professional

When to consult a tax professional:

- When deciding between different business structures

- If your business has complex income streams or international operations

- When planning significant changes in business operations or ownership

- If you’re unsure about tax deductions and credits available to your business

Benefits of working with a tax professional:

- Optimize your tax strategy

- Ensure compliance with tax laws

- Plan for future tax implications of business decisions

- Stay updated on changes in tax legislation

Tip: Look for a Certified Public Accountant (CPA) with experience in small business taxation. Many now offer virtual consultations, making expert advice more accessible than ever.

Working with a Business Attorney

When to consult a business attorney:

- During the incorporation process, especially if you have complex ownership structures

- When drafting or reviewing important contracts

- If facing potential legal disputes or litigation

- When considering mergers, acquisitions, or significant business changes

Benefits of working with a business attorney:

- Ensure legal compliance in all aspects of your business

- Protect your intellectual property

- Navigate complex regulatory environments

- Mitigate legal risks

Resource: The American Bar Association offers a lawyer referral service to help you find qualified attorneys in your area.

The Role of Accountants in Incorporation Decisions

Accountants can play a crucial role beyond just tax considerations:

How accountants can help:

- Financial projections to inform structure decisions

- Setting up accounting systems for the new corporation

- Advising on financial implications of different corporate structures

- Assisting with budgeting and cash flow management for the newly incorporated business

Tip: Look for accountants with specific experience in small business incorporations. Many offer initial consultations at reduced rates to discuss your needs.

Leveraging Technology and Online Resources

While professional help is invaluable, there are many technology solutions and online resources that can complement expert advice:

- Incorporation Services: Platforms like LegalZoom, Incorporate.com, and ZenBusiness offer streamlined incorporation services at competitive prices.

- Legal Document Generators: Services like Rocket Lawyer and LawDepot provide customizable legal document templates.

- Compliance Management Software: Tools like Corpnet and Harbor Compliance help track and manage ongoing compliance requirements.

- Financial Modeling Tools: Platforms like LivePlan and Futrli can help with financial projections and scenario planning.

- Government Resources: The SBA website and state-specific business portals offer free, reliable information on incorporation and business management.

Caution: While these tools are helpful, they should not completely replace professional advice, especially for complex situations.

Creating a Professional Advisory Team

As your business grows, consider building a team of advisors to support your incorporation and ongoing business needs:

- Tax Professional: For tax planning and compliance

- Business Attorney: For legal advice and document preparation

- Accountant: For financial management and reporting

- Financial Advisor: For investment and growth strategies

- Insurance Agent: For risk management and appropriate coverage

Best Practice: Hold regular meetings with your advisory team to ensure all aspects of your business are aligned and optimized.

When DIY Incorporation Might Be Appropriate

While professional help is often advisable, there are situations where a DIY approach to incorporation might be suitable:

- Your business has a simple structure with a single owner

- You have a good understanding of business and tax laws

- Your industry has minimal regulatory complexity

- You’re comfortable with research and paperwork

If choosing the DIY route:

- Use reputable online incorporation services

- Thoroughly research your state’s specific requirements

- Double-check all paperwork before submission

- Consider having a professional review your work before finalizing

Warning: Even if you choose to incorporate on your own, it’s wise to have a professional review your work to ensure everything is in order and you haven’t missed any crucial steps.

Conclusion: Making the Right Choice for Your Small Business

As we’ve explored throughout this comprehensive guide, incorporating your small business can offer numerous benefits, from liability protection to tax advantages and enhanced credibility. However, it’s not a one-size-fits-all solution, and the decision to incorporate should be made carefully, considering your specific business needs, goals, and circumstances.

Key Takeaways:

- Understand the Options: We’ve covered various business structures, including C Corporations, S Corporations, LLCs, and partnerships. Each has its own set of advantages and potential drawbacks.

- Consider the Benefits: Incorporation can provide limited liability protection, potential tax advantages, easier access to capital, and increased credibility.

- Weigh the Responsibilities: Remember that incorporation comes with additional administrative duties, compliance requirements, and potential costs.

- Think Long-term: Your choice of business structure should align with your long-term business goals, including plans for growth, funding, and potential exit strategies.

- Seek Professional Advice: While this guide provides a solid foundation, consulting with tax professionals, attorneys, and accountants can provide invaluable insights tailored to your specific situation.

- Stay Informed: Business and tax laws are subject to change. Stay updated on relevant legislation that might affect your incorporated business.

Next Steps:

If you’re considering incorporation for your small business, here are some actionable steps to take:

- Assess Your Business: Evaluate your current business model, financial situation, and future goals.

- Research Further: Dive deeper into the specific requirements for incorporation in your state.

- Consult Professionals: Schedule consultations with a tax professional and a business attorney to discuss your specific case.

- Create a Plan: Develop a detailed plan for incorporation, including timelines, costs, and necessary changes to your business operations.

- Prepare Documentation: Begin gathering the necessary documents for incorporation, such as articles of incorporation and corporate bylaws.

- Consider Timing: Determine the best time to incorporate, considering factors like your fiscal year and business cycles.

Remember, the decision to incorporate is a significant step in your business journey. While it comes with responsibilities, it can also open doors to new opportunities for growth and success.

Final Thoughts:

As we look towards 2025 and beyond, the business landscape continues to evolve rapidly. Incorporation can provide a solid foundation for navigating these changes, offering flexibility, protection, and opportunities for growth. However, it’s crucial to approach this decision thoughtfully, armed with knowledge and expert advice.

Whether you choose to incorporate or opt for an alternative business structure, the key is to make an informed decision that aligns with your vision for your business. With the right structure in place, you’ll be well-positioned to face the challenges and seize the opportunities that lie ahead in the dynamic world of small business.

Thank you for exploring this comprehensive guide on the benefits of incorporating your small business. We hope it serves as a valuable resource as you make this important decision for your business’s future.

FAQs About Incorporating Your Small Business

To wrap up our comprehensive guide, let’s address some of the most frequently asked questions about incorporating a small business. These questions and answers will help clarify any remaining doubts and provide additional insights into the incorporation process.

1. What’s the difference between an S Corporation and a C Corporation?

Answer: The main differences lie in taxation and ownership structure:

- C Corporation:

- Taxed as a separate entity (potential for double taxation)

- No restrictions on number or type of shareholders

- Can issue multiple classes of stock

- S Corporation:

- Pass-through taxation (avoiding double taxation)

- Limited to 100 shareholders, who must be U.S. citizens or residents

- Can only issue one class of stock

Both offer limited liability protection, but S Corporations have more restrictions in exchange for potentially favorable tax treatment.

2. How much does it cost to incorporate a small business?

Answer: Costs vary depending on the state and method of incorporation:

- State Filing Fees: Range from $50 to $725 (as of 2024)

- Professional Services: If using a lawyer, costs can range from $500 to $5,000+

- Online Incorporation Services: Typically $100 to $500

Additional costs may include:

- Registered agent fees ($100-$300 annually)

- Annual report filing fees

- Ongoing compliance costs

Tip: Check your state’s Secretary of State website for the most up-to-date filing fees.

3. Can I incorporate my business myself, or do I need a lawyer?

Answer: You can incorporate your business yourself, especially if it’s a simple structure. However, a lawyer can be beneficial for:

- Complex ownership structures

- Businesses with significant assets or liabilities

- Industries with specific regulatory requirements

- Ensuring all legal requirements are met

If you choose to incorporate yourself, consider using reputable online incorporation services for guidance.

4. Will incorporating my business affect my personal credit score?

Answer: Incorporating itself doesn’t directly impact your personal credit score. However:

- Your business will develop its own credit profile

- Personal guarantees on business loans can still affect your personal credit

- Maintaining the corporate veil (separating personal and business finances) is crucial

Note: Some lenders may still consider personal credit for new corporations until the business establishes its own credit history.

5. How long does the incorporation process take?

Answer: The timeline varies by state and method:

- Expedited Filing: Some states offer 24-48 hour processing for an additional fee

- Standard Filing: Typically 1-3 weeks

- Online Services: Often faster, sometimes as quick as 5-10 business days

Remember to factor in time for preparation of documents and obtaining necessary licenses.

6. Can I change my business structure after incorporating?

Answer: Yes, you can change your business structure, but it involves legal and tax implications:

- C Corp to S Corp: Relatively straightforward, requires filing IRS Form 2553

- LLC to Corporation: More complex, may involve dissolving the LLC and forming a new corporation

- Sole Proprietorship to Corporation: Requires forming a new legal entity

Always consult with legal and tax professionals before changing your business structure.

7. How does incorporation impact my ability to secure business loans?

Answer: Incorporation can positively impact loan eligibility:

- Establishes a separate business credit profile

- May increase credibility with lenders

- Allows for various funding options (e.g., selling shares, corporate bonds)

However, new corporations may still need personal guarantees from owners for loans.

8. What are the tax filing requirements for incorporated businesses?

Answer: Tax filing requirements depend on the type of corporation:

- C Corporations: File Form 1120 annually

- S Corporations: File Form 1120S annually, plus Schedule K-1 for each shareholder

- Estimated Tax Payments: Typically required quarterly

Additional state and local tax filings may also be necessary.

9. Can I incorporate my business in a different state or country?

Answer: Yes, you can incorporate in any state or even abroad. Popular states for incorporation include Delaware, Nevada, and Wyoming due to business-friendly laws.

Consider:

- Tax implications of incorporating in different jurisdictions

- Compliance requirements for “foreign” corporations operating in your home state

- Additional costs of maintaining a registered agent in the state of incorporation

For international incorporation, be aware of:

- Complex tax regulations

- Potential for double taxation without proper planning

- Compliance with both U.S. and foreign laws

Tip: Consult with an international business attorney if considering offshore incorporation.

10. How does incorporation impact my ability to hire employees?

Answer: Incorporation can facilitate hiring employees in several ways:

- Provides a more formal structure for employment

- Allows for offering stock options or equity compensation

- May enhance the company’s credibility, attracting better talent

However, it also comes with additional responsibilities:

- Compliance with employment laws and regulations

- Proper payroll tax management

- Potential need for workers’ compensation insurance

11. What ongoing maintenance is required after incorporation?

Answer: Ongoing maintenance for corporations typically includes:

- Annual report filings with the state

- Regular board meetings and maintaining minutes

- Keeping accurate financial records

- Maintaining separation between personal and business finances

- Timely tax filings and payments

- Renewing necessary licenses and permits

Best Practice: Create a compliance calendar to track all ongoing requirements.

12. Can I run multiple businesses under one corporation?

Answer: Yes, you can operate multiple businesses under one corporation, often through the use of DBAs (Doing Business As) or by creating subsidiaries. Consider:

- Pros:

- Simplified administration and tax filing

- Shared resources and overhead

- Cons:

- Increased liability risk across all businesses

- Potential confusion in branding and marketing

Alternatively, you might create separate corporations or LLCs for each business for enhanced liability protection.

13. How does incorporation affect my business’s intellectual property?

Answer: Incorporation can benefit intellectual property (IP) management:

- The corporation can own and manage IP assets

- Easier to transfer or license IP

- Can enhance the value of IP for potential investors or buyers

Ensure all IP is properly assigned to the corporation after incorporation.

14. What’s the difference between an LLC and a corporation?

Answer: Key differences include:

- Management Structure: LLCs are more flexible; corporations have a formal structure with directors and officers

- Taxation: LLCs have pass-through taxation by default; corporations are taxed as separate entities (unless S Corp election is made)

- Ownership: LLCs have more flexibility in ownership structure; corporations have shareholders

- Compliance: Corporations generally have more formal compliance requirements

15. How does incorporation impact my personal taxes?

Answer: The impact on personal taxes depends on the type of corporation:

- C Corporation: Salary is taxed as personal income; dividends are taxed separately (potential for double taxation)

- S Corporation: Business income passes through to personal tax return; potential for tax savings on self-employment taxes

- General Impact: Clearer separation of personal and business income

Always consult a tax professional for personalized advice.

16. Can I dissolve my corporation if I change my mind?

Answer: Yes, you can dissolve a corporation, but the process involves several steps:

- Board approval for dissolution

- Filing dissolution documents with the state

- Notifying creditors and settling debts

- Distributing remaining assets to shareholders

- Filing final tax returns

The process can be complex, so legal assistance is often recommended.

17. How does incorporation affect my business’s ability to expand internationally?

Answer: Incorporation can facilitate international expansion by:

- Providing a more recognizable business structure for foreign partners

- Allowing for the creation of foreign subsidiaries

- Potentially offering tax benefits for international operations

However, it also requires careful consideration of international tax laws and regulations.

18. What are the main risks of incorporating my business?

Answer: While incorporation offers many benefits, potential risks include:

- Increased administrative burden and costs

- Potential for double taxation (for C Corporations)

- Greater regulatory scrutiny

- Complexity in decision-making processes

- Potential personal liability if corporate formalities are not maintained

Proper planning and ongoing compliance can mitigate many of these risks.

19. How does incorporation affect my ability to sell my business in the future?

Answer: Incorporation can make selling your business easier and potentially more lucrative:

- Clearer valuation of business assets

- Easier transfer of ownership through stock sales

- Potentially more attractive to buyers due to established legal structure

- May offer tax advantages for both seller and buyer

However, ensure proper record-keeping and compliance throughout the life of the corporation to facilitate a smooth sale process.

20. Can I convert my existing business to a corporation?

Answer: Yes, you can convert most business structures to a corporation:

- Sole Proprietorship to Corporation: Involves creating a new legal entity and transferring assets

- Partnership to Corporation: Similar process to sole proprietorship conversion

- LLC to Corporation: Can be done through statutory conversion in many states

Each conversion type has specific tax and legal implications, so professional guidance is recommended.

21. How does incorporation impact my business’s ability to raise capital?

Answer: Incorporation generally enhances a business’s ability to raise capital:

- Allows for the issuance of stock to investors

- Can make the business more attractive to venture capitalists

- Enables various funding options like corporate bonds or preferred stock

- May increase credibility with banks for business loans

The formal structure of a corporation often provides more confidence to potential investors.

22. What are the privacy implications of incorporating my business?

Answer: Incorporation can have both positive and negative impacts on privacy:

- Public Records: Corporate filings are typically public record

- Personal Privacy: Can provide a layer of separation between personal and business affairs

- Anonymous Ownership: Some states allow for more privacy in ownership details

Consider using a registered agent service to maintain some level of privacy for personal contact information.

23. How does incorporation affect my business’s brand and marketing?

Answer: Incorporation can positively impact your business’s brand and marketing efforts:

- Added Credibility: The “Inc.” or “Corp.” suffix can lend authority to your brand

- Permanence: Suggests a more established and stable business

- Brand Protection: Easier to trademark and protect your brand name

- Marketing Opportunities: Can open doors to partnerships or contracts with larger companies

Ensure your marketing materials and website are updated to reflect your new corporate status.

24. What are the implications of incorporating for home-based businesses?

Answer: Home-based businesses can benefit from incorporation, but should consider:

- Zoning Laws: Ensure compliance with local regulations for operating a corporation from home

- Tax Implications: Potential for home office deductions, but with stricter requirements

- Liability Protection: Helps separate personal and business assets

- Professional Image: May need to consider a virtual office or mail forwarding service for a business address

Maintaining clear boundaries between home and business operations becomes even more critical.

25. How does incorporation impact my retirement planning as a business owner?

Answer: Incorporation can offer advantages for retirement planning:

- Access to More Retirement Plan Options: Such as 401(k)s with higher contribution limits

- Potential Tax Advantages: Certain retirement contributions may be deductible business expenses

- Succession Planning: Easier to structure the business for eventual sale or transfer

- Separation of Personal and Business Assets: Can help in diversifying retirement investments

Consult with a financial advisor to align your corporate structure with your long-term retirement goals.

This comprehensive FAQ section addresses a wide range of concerns and questions that small business owners often have when considering incorporation. While it provides valuable insights, remember that every business situation is unique. For specific advice tailored to your circumstances, it’s always best to consult with legal, tax, and financial professionals who can provide guidance based on your individual business needs and goals.

1 Comment