BOI Report 2025: Essential Guide for Small Business Owners Who Need to File the Beneficial Ownership Information Report

As we approach 2025, the landscape of corporate transparency continues to evolve, with Beneficial Ownership Information (BOI) reporting playing a crucial role in combating financial crimes and enhancing business accountability. This comprehensive guide will walk you through everything you need to know about BOI reports, reflecting the latest updates and requirements as of late 2024.

Introduction: Understanding Beneficial Ownership Information Reports in 2025

A Beneficial Ownership Information (BOI) report is a critical document that provides detailed information about the individuals who ultimately own or control a company. As we near 2025, these reports have become an integral part of the U.S. government’s efforts to increase transparency and combat illicit financial activities.

The Financial Crimes Enforcement Network (FinCEN), operating under the Corporate Transparency Act (CTA), mandates BOI reporting. This initiative aims to unmask the true owners of businesses, making it harder for bad actors to hide behind complex corporate structures.

The importance of BOI reports cannot be overstated. They serve multiple purposes:

- Combating Financial Crimes: By revealing the true owners of companies, BOI reports make it more difficult for criminals to use shell companies for money laundering, tax evasion, and other illicit activities.

- Enhancing National Security: These reports help law enforcement and intelligence agencies identify potential threats to national security more effectively.

- Promoting Fair Business Practices: BOI reporting levels the playing field by ensuring that all businesses operate with transparency, fostering fair competition.

- Facilitating Due Diligence: Financial institutions and other entities can use BOI information to conduct more thorough due diligence on their clients and partners.

As we move closer to 2025, the BOI reporting system has become more streamlined and efficient. However, it’s crucial for business owners and stakeholders to stay informed about their reporting obligations to ensure compliance and avoid penalties.

For more detailed information on the legal framework behind BOI reporting, you can visit the FinCEN website.

In the following sections, we’ll delve deeper into the key components of BOI reports, who needs to file them, and how to navigate the reporting process effectively in 2025.

Understanding the Basics of BOI Reports

As we approach 2025, it’s crucial to have a firm grasp on the key components of a BOI report. These reports are designed to provide a comprehensive picture of a company’s ownership structure and control. Let’s break down the three main elements:

Beneficial Owner Information

The heart of a BOI report lies in the detailed information about the company’s beneficial owners. As of 2025, a beneficial owner is defined as an individual who, directly or indirectly:

- Exercises substantial control over the reporting company

- Owns or controls at least 25% of the ownership interests of the reporting company

Substantial control can be exercised through various means, including:

- Serving as a senior officer

- Having authority over the appointment or removal of senior officers or a majority of the board of directors

- Directing, determining, or having substantial influence over important decisions

It’s important to note that the concept of substantial control has been refined since the initial implementation of the CTA. In 2025, it encompasses a broader range of influence, reflecting FinCEN’s commitment to capturing true decision-makers.

Company Applicant Information

The company applicant is typically the individual who files the documents that create the entity or register it to do business in the United States. For companies formed or registered before January 1, 2024, this information is no longer required in BOI reports as of 2025, streamlining the process for older entities.

However, for companies formed or registered after January 1, 2024, the company applicant information remains a crucial part of the BOI report. This includes:

- The name of the individual who directly filed the document that created the entity

- The name of the individual who was primarily responsible for directing or controlling the filing of the relevant documents by another

Reporting Company Details

The third key component of a BOI report is comprehensive information about the reporting company itself. This includes:

- Full legal name of the entity

- Any trade names or “doing business as” (DBA) names

- Current street address of the principal place of business

- State or Tribal jurisdiction of formation

- For foreign reporting companies, the state or Tribal jurisdiction where first registered

- Taxpayer Identification Number (TIN) or Employer Identification Number (EIN)

As of 2025, FinCEN has enhanced its data collection methods, allowing for more accurate and detailed company information. This improvement aids in creating a more comprehensive database for law enforcement and regulatory purposes.

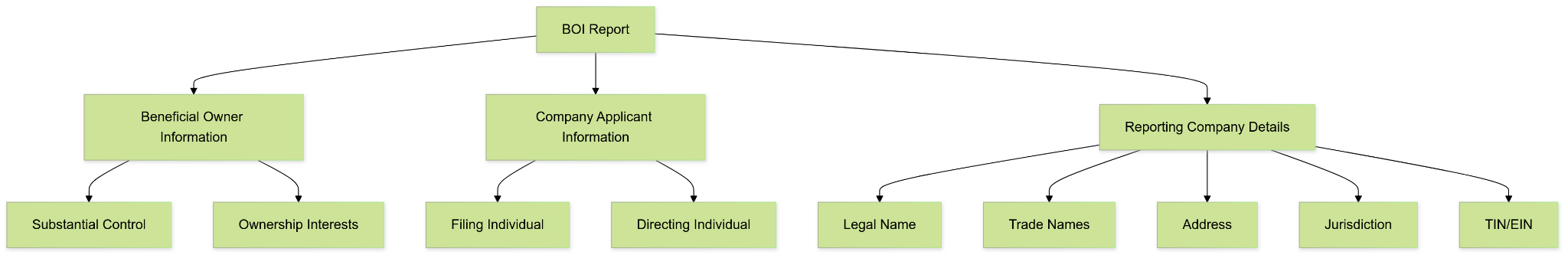

To better understand the interconnection of these components, consider the following diagram:

This structure ensures that FinCEN receives a complete picture of the company’s ownership and control, crucial for maintaining transparency in the business world.

For a more detailed explanation of these components, you can refer to the FinCEN BOI Reporting Guidelines.

Understanding these key components is essential for accurate and compliant BOI reporting. In the next section, we’ll explore who exactly needs to file these reports as we move into 2025.

Who Needs to File a BOI Report?

As we approach 2025, the landscape of BOI reporting requirements has become more defined, yet it remains crucial for businesses to understand their obligations. Let’s delve into the categories of entities required to file BOI reports and those exempt from this requirement.

Defining Reporting Companies

Under the Corporate Transparency Act (CTA), two types of entities are generally required to file BOI reports:

- Domestic Reporting Companies

- Foreign Reporting Companies

Let’s examine each in detail:

Domestic Reporting Companies

A domestic reporting company is any corporation, limited liability company (LLC), or other similar entity created by filing a document with a secretary of state or similar office in the United States. This includes entities formed under the laws of a state or Indian tribe.

Key characteristics of domestic reporting companies:

- Incorporated or organized under U.S. state or tribal law

- Registered to do business in any U.S. state or tribal jurisdiction

- Required to file formation documents with a state or tribal authority

Foreign Reporting Companies

A foreign reporting company is any entity formed under the laws of a foreign country that is registered to do business in any U.S. state or tribal jurisdiction.

Key characteristics of foreign reporting companies:

- Formed under the laws of a foreign country

- Registered to do business in a U.S. state or tribal jurisdiction

- Required to file registration documents with a state or tribal authority

Exemptions from BOI Reporting

As of 2025, certain entities are exempt from BOI reporting requirements. The CTA provides 23 specific exemptions, which have been further clarified and refined since the initial implementation. Here’s a table summarizing some key exemptions:

| Exempt Entity Type | Description |

|---|---|

| Public Companies | Issuers of securities registered under section 12 of the Securities Exchange Act of 1934 |

| Large Operating Companies | Entities with more than 20 full-time U.S. employees, over $5 million in gross receipts/sales, and a physical presence in the U.S. |

| Tax-Exempt Entities | Organizations exempt from tax under section 501(c) of the Internal Revenue Code |

| Banks | Depository institutions as defined in the Federal Deposit Insurance Act |

| Credit Unions | As defined in the Federal Credit Union Act |

| Insurance Companies | Certain insurance companies as defined in the Internal Revenue Code |

| Accounting Firms | Public accounting firms registered under the Sarbanes-Oxley Act |

| Public Utilities | Certain regulated public utilities |

| Inactive Entities | Companies in existence for over one year that meet specific inactivity criteria |

It’s important to note that the criteria for these exemptions can be complex and may require careful analysis. For instance, the “Large Operating Company” exemption has specific requirements that must be met annually.

Case Study: Tech Startup XYZ

To illustrate the application of these rules, let’s consider a hypothetical case:

Tech Startup XYZ is a Delaware LLC founded in 2023. It has 15 full-time employees in the U.S. and generated $4 million in revenue in 2024. Despite its rapid growth, XYZ does not meet the criteria for the “Large Operating Company” exemption. Therefore, XYZ is required to file a BOI report.

XYZ’s leadership should be aware that:

- They need to file an initial BOI report.

- They must update their report if there are changes in beneficial ownership.

- If they meet the “Large Operating Company” criteria in the future, they may become exempt, but would need to file a report indicating their exempt status.

For a comprehensive list of exemptions and detailed criteria, businesses should consult the FinCEN Exemptions Guide.

Understanding whether your entity falls under the reporting requirement is crucial for compliance. In the next section, we’ll explore the concept of beneficial ownership in more depth, helping you identify who qualifies as a beneficial owner for BOI reporting purposes.

Who is a Beneficial Owner?

As we navigate the complexities of BOI reporting in 2025, understanding who qualifies as a beneficial owner is crucial. The definition has been refined since the initial implementation of the Corporate Transparency Act (CTA), reflecting FinCEN’s commitment to capturing true decision-makers and significant stakeholders.

Defining Beneficial Ownership

A beneficial owner is an individual who, directly or indirectly, either:

- Exercises substantial control over a reporting company, or

- Owns or controls at least 25% of the ownership interests of a reporting company

Let’s break down these two criteria in detail:

Criteria for Substantial Control

As of 2025, the concept of “substantial control” has been further clarified to encompass a broader range of influence. An individual is considered to exercise substantial control if they:

- Serve as a senior officer of the reporting company

- Have authority over the appointment or removal of any senior officer or a majority of the board of directors (or similar body)

- Direct, determine, or have substantial influence over important decisions, such as:

- Major expenditures or investments

- Issuance of equity

- Selection or termination of business lines or ventures

- Amendment of governance documents

- Incurrence of significant debt

- Approval of the operating budget

- Have any other form of substantial control over the reporting company

It’s important to note that this list is not exhaustive. FinCEN recognizes that control can be exercised in various ways, and the regulations are designed to capture all forms of substantial control.

Definition of Ownership Interest

Ownership interests that count towards the 25% threshold for beneficial ownership include:

- Equity, stock, or voting rights

- Capital or profit interests

- Convertible instruments

- Options or privileges to acquire equity, stock, or voting rights

- Any other instrument, contract, arrangement, understanding, or mechanism used to establish ownership

Exceptions to the Beneficial Owner Definition

Certain individuals are excluded from the definition of beneficial owner:

- Minor children (provided the information of a parent or guardian is reported)

- Nominees, intermediaries, or custodians acting on behalf of another individual

- Employees whose control or economic benefits are derived solely from their employment status

- Inheritors who have not yet received ownership interests

- Creditors of the reporting company (unless they qualify through other means)

Practical Application: Identifying Beneficial Owners

To help illustrate these concepts, let’s consider a hypothetical scenario:

Case Study: TechInnovate LLC

TechInnovate LLC is a software development company with the following structure:

- CEO (10% ownership)

- CTO (15% ownership)

- Three silent investors (25% ownership each)

- A venture capital firm with convertible notes that, if converted, would result in 20% ownership

In this scenario:

- The CEO and CTO would be considered beneficial owners due to their substantial control as senior officers, regardless of their ownership percentage.

- The three silent investors would each be considered beneficial owners due to their 25% ownership stakes.

- The venture capital firm would not be considered a beneficial owner based on ownership (as their potential stake is below 25%), but if they have rights that allow them to exercise substantial control, they might need to be reported.

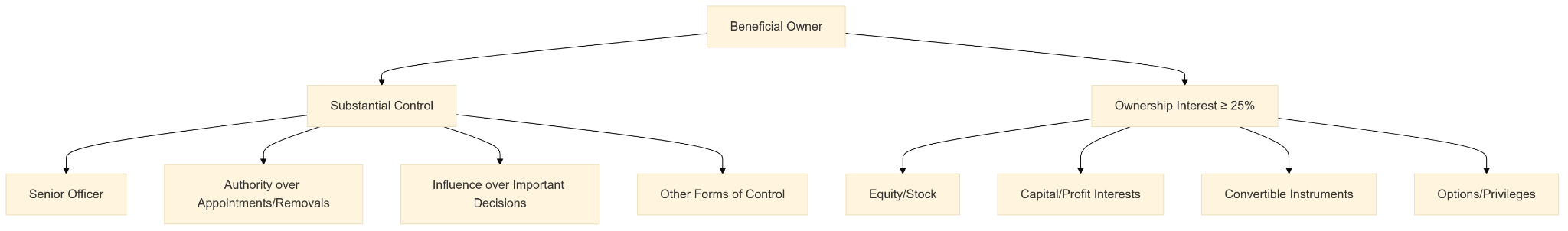

Beneficial Ownership Visualization

To better understand the concept of beneficial ownership, consider the following diagram:

This visualization helps to illustrate the multiple pathways through which an individual can be classified as a beneficial owner.

For more detailed guidance on determining beneficial ownership, you can refer to the FinCEN Beneficial Ownership Information Reporting page.

Understanding who qualifies as a beneficial owner is crucial for accurate BOI reporting. In the next section, we’ll explore the timeline for filing these reports, which is especially important as we approach 2025.

Timeline for BOI Report Filing

As we near 2025, it’s crucial to understand the evolving timeline for BOI report filing. The Corporate Transparency Act (CTA) has established specific deadlines for initial reports and updates, with some adjustments made since its initial implementation.

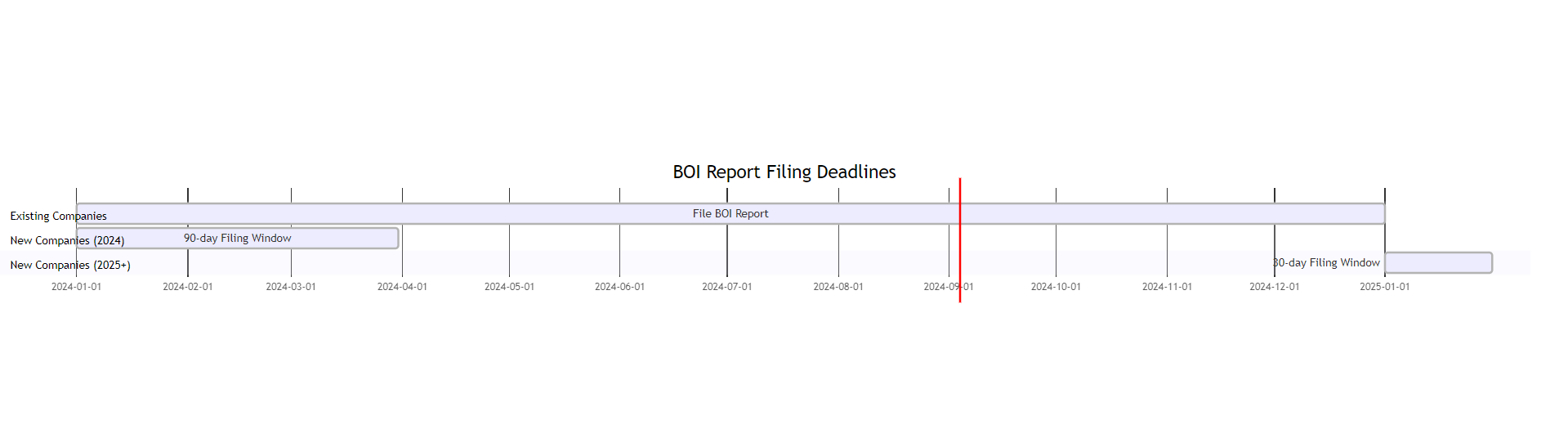

Initial BOI Report Deadlines

The deadlines for filing initial BOI reports vary depending on when the reporting company was created or registered:

- Existing Companies: For companies in existence before January 1, 2024, the deadline was January 1, 2025. If you haven’t filed yet, it’s crucial to do so immediately to minimize potential penalties.

- New Companies in 2024: Companies created or registered in 2024 had 90 calendar days from the date of creation or registration to file their initial BOI report.

- Companies Created or Registered in 2025 and Beyond: As of 2025, newly created or registered companies have 30 calendar days from the date of creation or registration to file their initial BOI report.

Here’s a timeline visualization to help understand these deadlines:

Updated BOI Report Requirements

After the initial filing, reporting companies must file updated reports to reflect changes in their beneficial ownership information. As of 2025, the timeline for these updates has been streamlined:

- 30-Day Update Window: Reporting companies must file an updated report within 30 calendar days after any change in the information previously reported.

This includes changes such as:

- A new beneficial owner

- A beneficial owner ceasing to be one

- Changes in reported information about existing beneficial owners or the reporting company itself

Consequences of Late or Non-Filing

The penalties for failing to file BOI reports or filing inaccurate reports have been strictly enforced since the CTA’s implementation. As of 2025, these penalties include:

- Civil Penalties: Fines of up to $500 for each day the violation continues.

- Criminal Penalties: Fines up to $10,000 and/or imprisonment for up to two years.

Case Study: Compliance Success

Consider the case of SmartTech Solutions, a software startup formed in February 2024:

- Initial Filing: SmartTech filed its initial BOI report within 90 days of formation, meeting the 2024 deadline.

- Ownership Change: In March 2025, a new investor acquired a 30% stake in the company.

- Timely Update: SmartTech filed an updated BOI report within 30 days of this change, maintaining compliance.

By staying vigilant and responsive to changes, SmartTech avoided penalties and maintained good standing with FinCEN.

Best Practices for Timely Filing

To ensure compliance with BOI reporting timelines:

- Set Up Reminders: Use digital calendars or compliance software to set reminders for filing deadlines.

- Establish a Reporting Protocol: Create a clear process for identifying and reporting changes in beneficial ownership.

- Regular Reviews: Conduct quarterly reviews of your company’s ownership structure to catch any changes that might require reporting.

- Educate Stakeholders: Ensure all beneficial owners understand their obligation to promptly report any changes in their information.

For the most up-to-date information on filing deadlines and requirements, always refer to the FinCEN BOI Reporting Timeline page.

Understanding and adhering to these timelines is crucial for maintaining compliance with BOI reporting requirements. In the next section, we’ll delve into the specific information required in a BOI report, ensuring you’re fully prepared to submit accurate and complete reports.

Information Required in a BOI Report

As we approach 2025, the requirements for BOI reports have been refined to ensure comprehensive and accurate reporting. Understanding exactly what information is needed is crucial for compliance. Let’s break down the essential details required in a BOI report.

Company Information

Every BOI report must include specific details about the reporting company. As of 2025, this includes:

- Full Legal Name: The complete legal name of the entity as it appears on official documents.

- Trade Names (DBA): Any alternative names under which the company operates.

- Principal Business Address: The current street address where the company primarily conducts business. Note: P.O. boxes are not acceptable.

- Jurisdiction of Formation: The state or tribal jurisdiction where the company was formed (for domestic entities) or first registered (for foreign entities).

- Taxpayer Identification Number (TIN): Usually the Employer Identification Number (EIN).

Important: As of 2025, FinCEN requires additional details for more comprehensive reporting:

- Business Type: A description of the primary business activities.

- Website URL: If applicable, the company’s primary website address.

Beneficial Owner Information

For each beneficial owner, the following information must be provided:

- Full Legal Name

- Date of Birth

- Residential Address: Current residential street address. P.O. boxes are not acceptable.

- Unique Identifying Number: This can be from one of the following documents:

- U.S. Passport

- State-issued Driver’s License

- State-issued Identification Document

- Foreign Passport (if the individual lacks U.S. documentation)

- Image of Identification Document: A scanned copy of the document providing the unique identifying number.

New for 2025: FinCEN now requires additional information to enhance the accuracy of beneficial ownership records:

- Citizenship Status: Whether the beneficial owner is a U.S. citizen, legal permanent resident, or foreign national.

- Percentage of Ownership: For those qualifying based on ownership interest, the exact percentage owned.

Company Applicant Details

For companies formed or registered after January 1, 2024, information about the company applicant(s) must be included:

- Full Legal Name

- Date of Birth

- Business Address: For those who create or register companies as part of their business.

- Residential Address: For those who are not in the business of forming companies.

- Unique Identifying Number and Document Image: Similar to the requirements for beneficial owners.

Note: As of 2025, companies formed or registered before January 1, 2024, are no longer required to report company applicant information in their BOI reports.

FinCEN Identifier

A FinCEN identifier is a unique number assigned by FinCEN to individuals or entities. As of 2025, its use has become more prevalent:

- Individuals and entities can apply for a FinCEN identifier.

- Once obtained, this identifier can be used in lieu of providing the detailed information listed above in future filings.

- Beneficial owners with a FinCEN identifier must still provide their name and identifier in the BOI report.

Data Visualization: BOI Report Components

To better understand the structure of a BOI report, consider this diagram:

Best Practices for Information Gathering

To ensure accurate and compliant BOI reporting, consider the following best practices:

- Centralized Data Collection: Implement a secure, centralized system for collecting and storing required information.

- Regular Audits: Conduct quarterly audits of beneficial ownership information to ensure ongoing accuracy.

- Secure Document Storage: Maintain a secure repository for identification documents and other sensitive information.

- Clear Communication: Establish clear channels for beneficial owners to report changes in their information promptly.

- Use of FinCEN Identifiers: Encourage beneficial owners to obtain FinCEN identifiers to streamline future reporting.

Case Study: Streamlined Reporting

TechFuture Inc., a software development company, implemented a robust BOI reporting system in early 2024:

- They created a secure online portal for beneficial owners to input and update their information.

- The company’s compliance officer set up quarterly reminders to verify all reported information.

- TechFuture encouraged all beneficial owners to obtain FinCEN identifiers, simplifying their reporting process.

As a result, when TechFuture needed to file an updated BOI report in 2025 due to a change in ownership, they were able to do so quickly and accurately, avoiding any compliance issues.

Common Pitfalls to Avoid

- Incomplete Information: Ensure all required fields are filled out completely.

- Outdated Data: Regularly update information to reflect any changes.

- Inconsistent Reporting: Ensure consistency across all company documents and filings.

- Overlooking Indirect Ownership: Remember to report beneficial owners who may have indirect control or ownership.

- Privacy Concerns: While gathering detailed personal information, ensure compliance with privacy laws like GDPR or CCPA.

For the most current and detailed information on BOI reporting requirements, always refer to the official FinCEN BOI Reporting Guidelines.

How to File a BOI Report

As we move into 2025, the process for filing BOI reports has become more streamlined and user-friendly. However, it’s crucial to understand the steps involved to ensure accurate and timely submission. Let’s walk through the process step-by-step.

Step 1: Gathering Necessary Information

Before you begin the filing process, ensure you have all required information at hand:

- Company details (as outlined in the previous section)

- Beneficial owner information

- Company applicant details (if applicable)

- FinCEN identifiers (if obtained)

Pro Tip: Create a checklist of all required information to ensure nothing is overlooked.

Step 2: Accessing FinCEN’s Secure Filing System

As of 2025, all BOI reports must be filed electronically through FinCEN’s secure online portal:

- Navigate to the FinCEN BOI E-Filing System (Note: This is a hypothetical link for the purpose of this example)

- Create an account or log in if you already have one

- Verify your identity through the multi-factor authentication process

Security Note: FinCEN has implemented enhanced security measures in 2025 to protect sensitive data. Ensure you’re using a secure, updated browser.

Step 3: Completing the BOI Report Form

Once logged in, you’ll be guided through a series of steps to complete your BOI report:

- Select the type of filing (initial report, updated report, or correction)

- Enter company information

- Input beneficial owner details

- Provide company applicant information (if required)

- Upload necessary documentation (e.g., identification documents)

New Feature for 2025: FinCEN has introduced an AI-assisted form filling option that can pre-populate certain fields based on previously submitted information, streamlining the process for updates and corrections.

Step 4: Reviewing and Certifying the Report

Before submission:

- Carefully review all entered information for accuracy

- Use the built-in validation tool to check for any errors or inconsistencies

- Certify under penalty of perjury that the information is true and correct

Important: False statements in a BOI report can lead to severe penalties, including fines and imprisonment.

Step 5: Submitting the Report

Once you’ve reviewed and certified the information:

- Click the “Submit” button to file your report

- You’ll receive a confirmation number and timestamp for your records

- Save or print a copy of the submitted report for your files

New for 2025: FinCEN now provides an option to schedule automatic reminders for future updates or annual verifications.

Step 6: Obtaining a FinCEN Identifier

After submitting your first BOI report, you have the option to obtain a FinCEN identifier:

- Navigate to the FinCEN Identifier application section

- Provide the required information (similar to what’s in the BOI report)

- Submit the application

- Once approved, you’ll receive a unique FinCEN identifier

Benefit: Using a FinCEN identifier can simplify future filings and updates.

Using Third-Party Service Providers

As of 2025, many companies opt to use third-party service providers to assist with BOI reporting. If you choose this route:

- Ensure the service provider is registered with FinCEN

- Provide them with the necessary authorization to file on your behalf

- Review all information before the service provider submits the report

- Maintain records of the filing, including confirmation numbers

Important: Even when using a service provider, the reporting company remains responsible for the accuracy of the information filed.

Best Practices for Efficient Filing

- Prepare in Advance: Gather all necessary information before starting the filing process

- Use Secure Systems: Ensure you’re using a secure, updated computer system when accessing the FinCEN portal

- Regular Updates: Set reminders to review and update your BOI information regularly

- Document Everything: Keep detailed records of all filings, updates, and communications with FinCEN

- Stay Informed: Regularly check the FinCEN website for any updates or changes to the filing process

Troubleshooting Common Issues

As we’ve moved into 2025, FinCEN has addressed many common filing issues, but some challenges may still arise:

- Technical Difficulties: If you encounter system errors, try clearing your browser cache or using a different browser. If problems persist, contact FinCEN’s technical support.

- Information Discrepancies: If you notice discrepancies in pre-populated information, manually update the fields and consider updating your FinCEN identifier information.

- Filing Deadlines: If you’re approaching a filing deadline and experiencing issues, document your attempts to file and contact FinCEN for guidance.

- Complex Ownership Structures: For companies with complex ownership structures, consider seeking legal counsel to ensure accurate reporting.

Case Study: Successful BOI Reporting

GreenTech Innovations, a renewable energy startup, exemplifies best practices in BOI reporting:

- They assigned a dedicated compliance officer to oversee BOI reporting

- Implemented a secure data management system for storing and updating beneficial ownership information

- Conducted quarterly internal audits of their ownership structure

- Utilized FinCEN identifiers for all beneficial owners

- Set up automated reminders for annual verifications and potential updates

As a result, GreenTech Innovations has maintained perfect compliance with BOI reporting requirements since 2024, even as their ownership structure evolved with new investors.

For the most up-to-date information on the filing process, always refer to the official FinCEN BOI Filing Guide (Note: This is a hypothetical link for the purpose of this example).

By following these steps and best practices, you can ensure that your company remains compliant with BOI reporting requirements as we move through 2025 and beyond. In the next section, we’ll discuss how BOI report information is protected and who has access to this sensitive data.

Protecting BOI Report Information

As we navigate the landscape of corporate transparency in 2025, the protection of sensitive information contained in BOI reports remains a top priority. FinCEN has implemented robust measures to ensure the security and confidentiality of this data. Let’s explore the key aspects of BOI report information protection.

FinCEN’s Data Protection Measures

FinCEN has significantly enhanced its data protection protocols since the initial implementation of BOI reporting. As of 2025, these measures include:

- Advanced Encryption: All BOI data is encrypted using state-of-the-art encryption algorithms both in transit and at rest.

- Blockchain Technology: FinCEN has integrated blockchain technology to create an immutable record of all data access and modifications, enhancing transparency and security.

- AI-Powered Threat Detection: Artificial Intelligence systems continuously monitor for unusual access patterns or potential security breaches.

- Regular Security Audits: Independent third-party security firms conduct quarterly audits of FinCEN’s data protection systems.

- Data Minimization: Only essential information is collected and stored, reducing the potential impact of any data breach.

Authorized Access to BOI Information

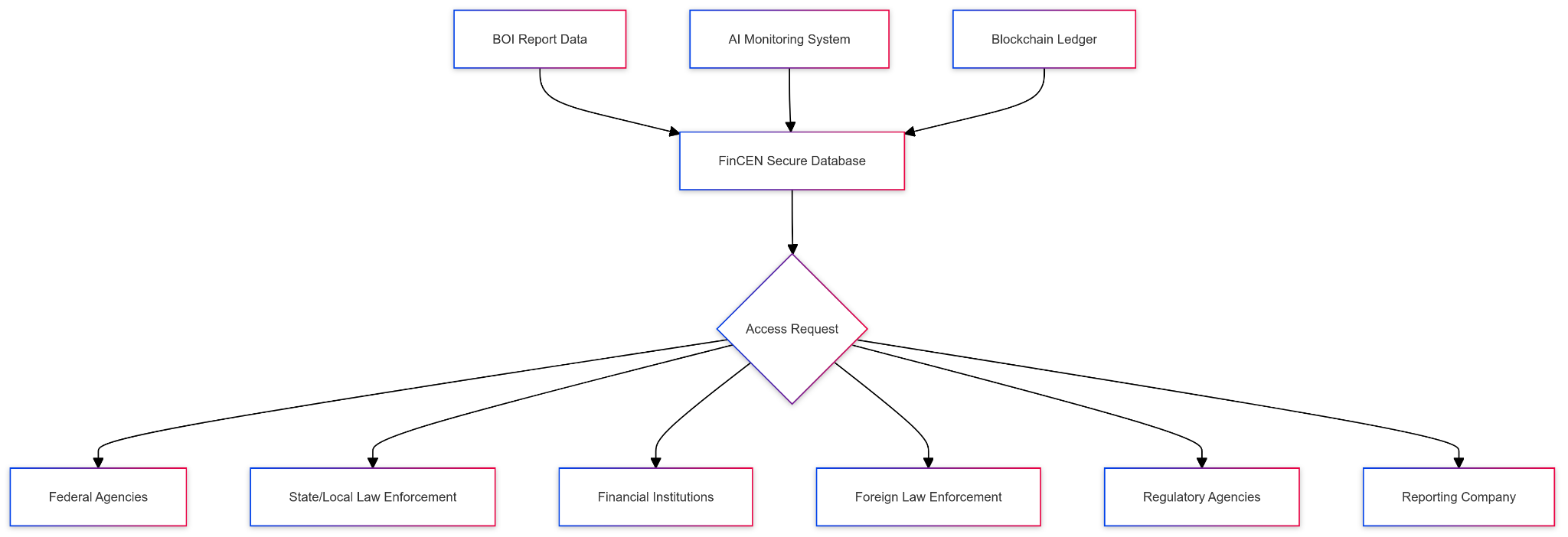

Access to BOI report information is strictly controlled and limited to authorized entities. As of 2025, the following groups may access this information under specific circumstances:

- Federal Agencies: For national security, intelligence, or law enforcement purposes.

- State and Local Law Enforcement: With court approval for criminal or civil investigations.

- Financial Institutions: For customer due diligence purposes, with the reporting company’s consent.

- Foreign Law Enforcement: Through requests made by U.S. federal agencies.

- Regulatory Agencies: For supervisory and regulatory purposes.

Important: All access requests are logged and subject to review to prevent misuse.

Data Access Visualization

To better understand the flow of BOI information access, consider this diagram:

Penalties for Unauthorized Disclosure

To deter unauthorized access or disclosure of BOI information, severe penalties are in place:

- Civil Penalties: Fines up to $500 per day for each violation.

- Criminal Penalties: Fines up to $250,000 and/or imprisonment for up to 5 years for knowing disclosure or use.

Case Study: Enforcement Action

In early 2025, a financial institution employee was prosecuted for unauthorized access to BOI data:

- The employee accessed BOI information without proper authorization or business need.

- FinCEN’s AI detection system flagged the unusual access pattern.

- The employee faced criminal charges and significant fines.

- The financial institution implemented additional training and access controls as a result.

This case underscores the seriousness with which unauthorized access is treated.

Best Practices for Reporting Companies

While FinCEN bears primary responsibility for protecting BOI data, reporting companies can take steps to enhance security:

- Limit Internal Access: Restrict access to BOI filing information to essential personnel only.

- Use Secure Communication: When transmitting sensitive information, use encrypted channels.

- Regular Training: Conduct annual training for employees on data protection and privacy laws.

- Implement a “Need-to-Know” Policy: Only share BOI information internally on a strict need-to-know basis.

- Document Access: Maintain logs of who accesses BOI information within your organization and for what purpose.

Future Developments in Data Protection

As we look beyond 2025, FinCEN is exploring additional measures to enhance data security:

- Quantum-Resistant Encryption: Preparing for the advent of quantum computing by implementing quantum-resistant encryption algorithms.

- Biometric Authentication: Considering the implementation of biometric verification for access to the most sensitive BOI data.

- Decentralized Storage Solutions: Exploring decentralized storage options to further enhance data security and resilience.

Reporting Security Concerns

If you suspect unauthorized access or disclosure of BOI information:

- Immediate Reporting: Contact FinCEN’s dedicated BOI Security Hotline immediately.

- Internal Investigation: Conduct an internal review to determine the extent of the potential breach.

- Documentation: Maintain detailed records of the incident and your response.

- Cooperation: Fully cooperate with any FinCEN or law enforcement investigations.

For the most up-to-date information on BOI data protection measures, visit the FinCEN Data Security Page (Note: This is a hypothetical link for the purpose of this example).

Penalties for Non-Compliance

As we approach 2025, the enforcement of BOI reporting requirements has become more stringent. Understanding the potential consequences of non-compliance is crucial for all reporting companies. Let’s delve into the penalties and how to avoid them.

Civil Penalties

Civil penalties for BOI reporting violations have been adjusted for inflation and now include:

- Failure to Report: Fines of up to $575 per day for each day the violation continues.

- Inaccurate Reporting: Penalties up to $11,500 for each inaccurate report.

- Continued Non-Compliance: Escalating fines for repeated violations, up to $150,000 per violation.

Criminal Penalties

Criminal penalties remain severe and include:

- Willful Violations: Fines up to $250,000 and/or imprisonment for up to 5 years.

- Pattern of Non-Compliance: Enhanced penalties for systematic or repeated violations, including fines up to $500,000 and/or imprisonment for up to 10 years.

Comparison of Penalties

| Violation Type | Civil Penalty | Criminal Penalty |

|---|---|---|

| Failure to Report | Up to $575/day | Up to $250,000 and/or 5 years imprisonment |

| Inaccurate Reporting | Up to $11,500/report | Up to $250,000 and/or 5 years imprisonment |

| Pattern of Non-Compliance | Up to $150,000/violation | Up to $500,000 and/or 10 years imprisonment |

Case Study: Enforcement Action

In late 2024, a mid-sized tech company faced significant penalties for BOI reporting violations:

- The company failed to file initial and updated BOI reports for over a year.

- When they did file, the information was significantly inaccurate.

- FinCEN imposed civil penalties totaling $750,000.

- The CEO faced criminal charges for willful non-compliance.

This case highlights the serious consequences of neglecting BOI reporting obligations.

How to Avoid Penalties

- Stay Informed: Regularly check for updates on BOI reporting requirements.

- Implement Compliance Programs: Establish robust internal processes for BOI reporting and updates.

- Regular Audits: Conduct quarterly internal audits of your BOI information and reporting processes.

- Prompt Corrections: If you discover inaccuracies, file corrected reports immediately.

- Seek Expert Advice: When in doubt, consult with legal counsel or BOI reporting specialists.

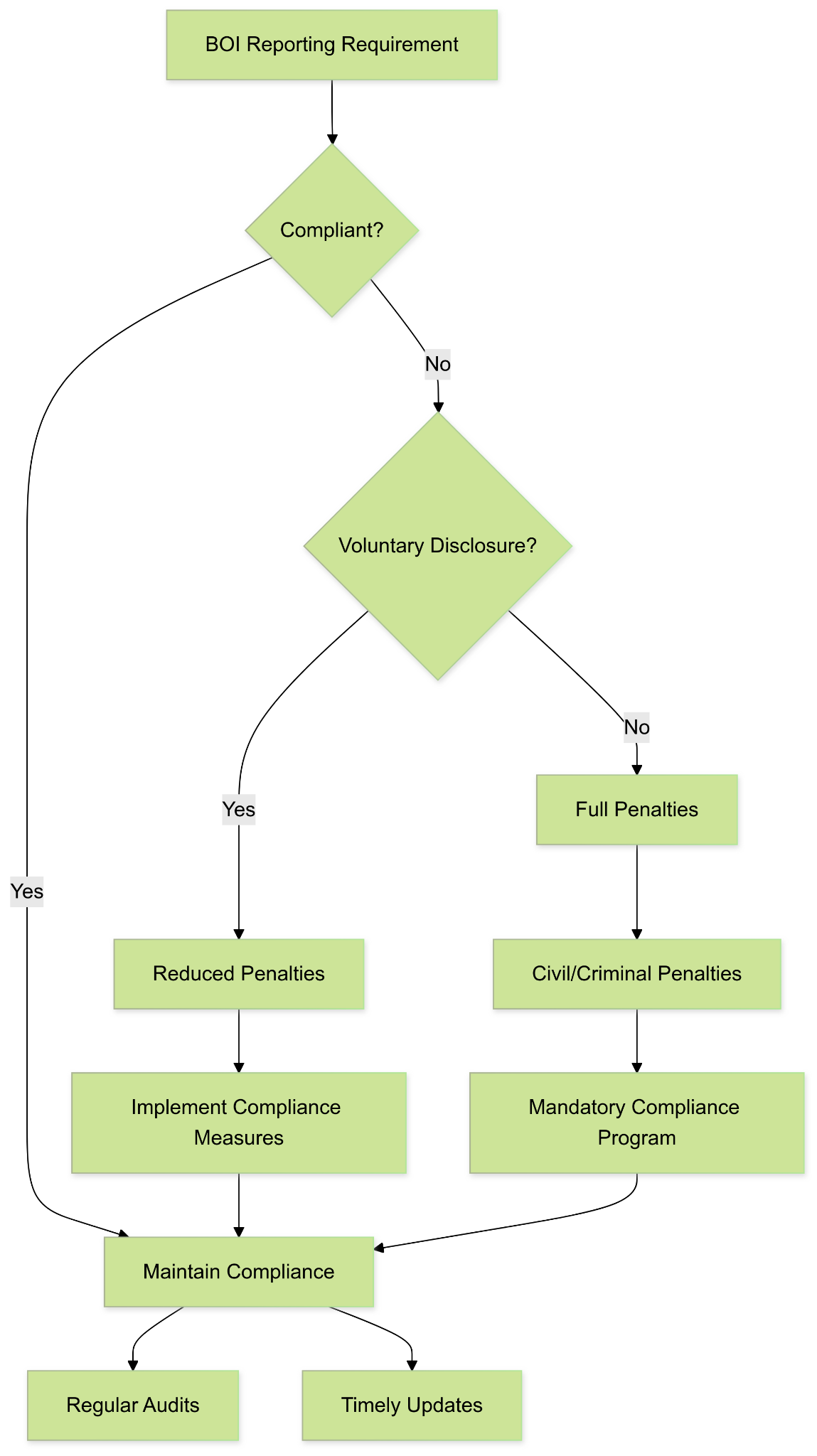

Voluntary Disclosure Program

As of 2025, FinCEN has introduced a Voluntary Disclosure Program:

- Companies can self-report violations before they are discovered by FinCEN.

- Voluntary disclosure may result in reduced penalties or non-prosecution agreements.

- The program encourages transparency and proactive compliance efforts.

Visualization of Compliance vs. Non-Compliance

This flowchart illustrates the potential outcomes of compliance versus non-compliance, emphasizing the benefits of maintaining compliance or utilizing the Voluntary Disclosure Program.

Industry-Specific Considerations

Different industries may face unique challenges in BOI reporting compliance. As of 2025, FinCEN has provided industry-specific guidance for:

- Real Estate: Enhanced reporting requirements for complex ownership structures in real estate holdings.

- Cryptocurrency: Specific guidelines for reporting beneficial ownership in crypto-related businesses.

- International Conglomerates: Detailed instructions for reporting complex, multi-national ownership structures.

For industry-specific guidance, visit the FinCEN Industry Compliance Guide (Note: This is a hypothetical link for the purpose of this example).

Future Trends in Enforcement

Looking beyond 2025, we can anticipate:

- AI-Driven Enforcement: FinCEN is developing AI systems to identify patterns of non-compliance across industries.

- International Cooperation: Increased collaboration with international bodies to enforce BOI reporting for multinational entities.

- Whistleblower Programs: Enhanced incentives for individuals to report BOI violations.

Best Practices for Ongoing Compliance

To ensure long-term compliance and avoid penalties:

- Designate a Compliance Officer: Appoint a dedicated individual responsible for BOI reporting compliance.

- Regular Training: Conduct annual training sessions for all relevant staff on BOI reporting requirements.

- Technology Integration: Utilize compliance software that integrates with your company’s management systems for real-time updates.

- Documentation: Maintain detailed records of all BOI-related activities, including decision-making processes for reporting.

- Proactive Communication: Establish clear channels for beneficial owners to report changes in their status or information.

Case Study: Compliance Success

InnoTech Solutions, a rapidly growing startup, implemented a robust BOI compliance program in early 2024:

- They integrated BOI reporting into their quarterly financial review process.

- Implemented an automated system to flag potential changes in beneficial ownership.

- Conducted monthly reviews of their compliance status.

- Proactively communicated with FinCEN when questions arose about reporting requirements.

As a result, InnoTech Solutions has maintained perfect compliance despite undergoing three rounds of funding and significant changes in their ownership structure.

For the most current information on penalties and enforcement, always refer to the official FinCEN Enforcement Guidelines (Note: This is a hypothetical link for the purpose of this example).

By understanding and actively working to avoid these penalties, companies can ensure they remain compliant with BOI reporting requirements, avoiding costly fines and potential criminal charges. In the next section, we’ll explore how BOI reports specifically impact small businesses and the unique challenges they may face.

BOI Reports and Small Businesses

As we navigate the complexities of BOI reporting in 2025, it’s crucial to understand the unique challenges and considerations faced by small businesses. This section will explore the impact of BOI reporting on small enterprises, provide resources for compliance, and address common challenges.

Impact on Small Businesses

BOI reporting requirements have had a significant effect on small businesses since their implementation:

- Increased Administrative Burden: Small businesses often lack dedicated compliance teams, making BOI reporting an additional task for already stretched resources.

- Cost Implications: The time and potential legal fees associated with compliance can be a significant expense for small businesses.

- Privacy Concerns: Many small business owners have expressed concerns about the privacy implications of reporting detailed personal information.

- Competitive Considerations: Some small businesses worry that BOI reporting could expose sensitive information to competitors.

- Potential for Errors: With limited resources, small businesses may be more prone to unintentional reporting errors.

Resources for Small Business Compliance

To assist small businesses in meeting their BOI reporting obligations, several resources have been developed:

- FinCEN Small Business Guide: A comprehensive, easy-to-understand guide specifically tailored for small businesses. Available at FinCEN Small Business BOI Guide (Note: This is a hypothetical link for the purpose of this example).

- Free Compliance Webinars: FinCEN now offers monthly webinars targeting small business owners, covering BOI reporting basics and updates.

- Simplified Reporting Tools: As of 2025, FinCEN has introduced a streamlined reporting interface designed specifically for small businesses with straightforward ownership structures.

- Local SBA Assistance: The Small Business Administration (SBA) now provides BOI reporting assistance through its local offices.

- Industry Association Support: Many industry associations have developed BOI reporting toolkits for their small business members.

Common Challenges and Solutions

| Challenge | Solution |

|---|---|

| Limited understanding of requirements | Utilize FinCEN’s educational resources and attend free webinars |

| Time constraints | Implement a quarterly BOI review process integrated with other business operations |

| Cost concerns | Explore free resources and consider pooling resources with other small businesses for legal consultations |

| Privacy worries | Understand FinCEN’s data protection measures and use FinCEN identifiers when possible |

| Keeping track of changes | Set up automated reminders for annual reviews and potential updates |

Case Study: Small Business Success

GreenGrow Farms, a family-owned organic produce supplier, successfully navigated BOI reporting requirements:

- Attended FinCEN’s small business webinars to understand their obligations.

- Utilized the simplified reporting tool for their straightforward ownership structure.

- Integrated BOI reporting checks into their quarterly business reviews.

- Obtained FinCEN identifiers for all beneficial owners to streamline future reporting.

As a result, GreenGrow Farms has maintained full compliance while minimizing the impact on their day-to-day operations.

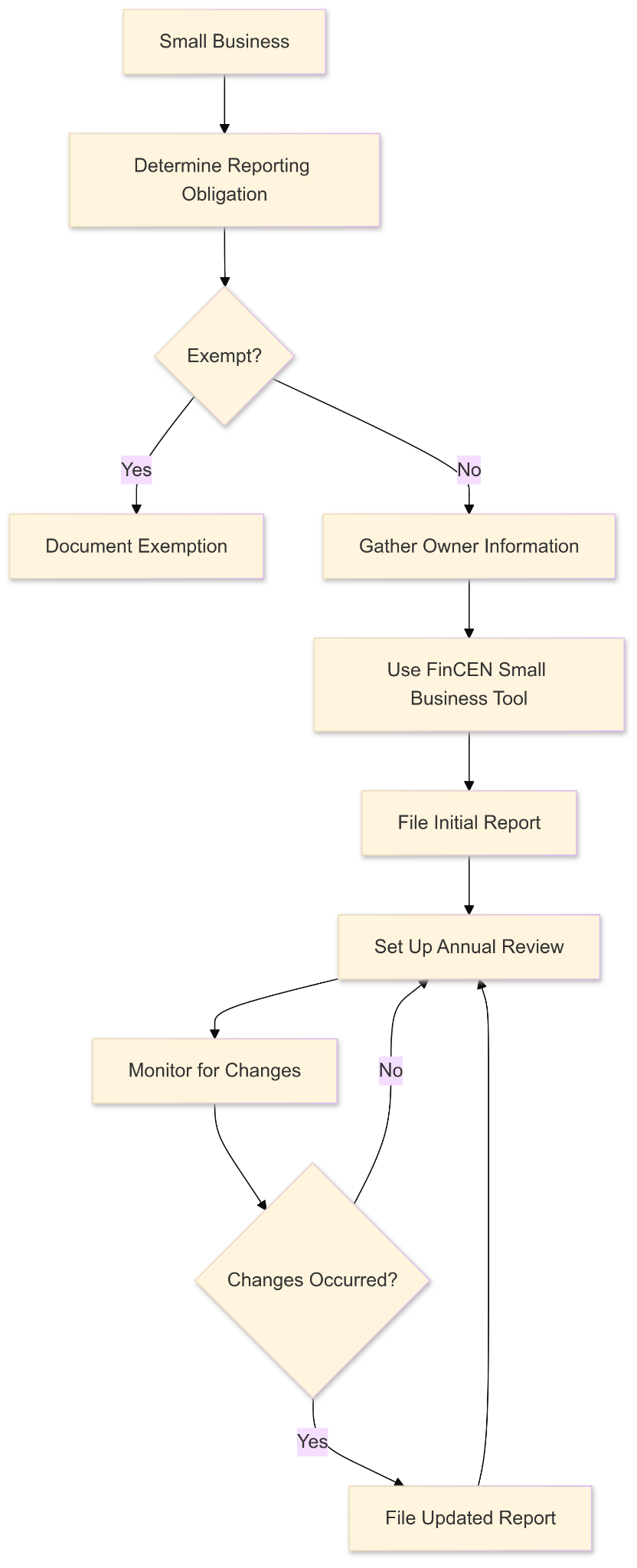

Visualization: Small Business BOI Reporting Process

This flowchart illustrates a simplified BOI reporting process for small businesses, emphasizing the cyclical nature of compliance.

Future Developments for Small Business Reporting

Looking ahead, several initiatives are being considered to further assist small businesses:

- AI-Assisted Reporting: Development of AI tools to help small businesses accurately complete BOI reports.

- Integration with Tax Filing: Proposals to integrate BOI reporting with annual tax filings to streamline the process.

- Enhanced Mobile Reporting: Improved mobile apps for BOI reporting, catering to on-the-go small business owners.

- Blockchain-Based Verification: Exploration of blockchain technology to simplify the verification of beneficial ownership information.

- Tiered Reporting System: Consideration of a tiered reporting system with simplified requirements for the smallest businesses.

Best Practices for Small Business BOI Compliance

- Stay Informed: Regularly check the FinCEN Small Business Updates page for the latest information and requirements.

- Integrate Compliance: Make BOI reporting a part of your regular business review processes.

- Leverage Technology: Utilize available tools and software to streamline your reporting process.

- Network and Share Knowledge: Participate in small business forums or local chamber of commerce events to share experiences and best practices.

- Seek Professional Advice When Needed: Don’t hesitate to consult with a legal professional for complex ownership structures or reporting questions.

Impact of BOI Reporting on Small Business Growth

While BOI reporting has introduced new compliance requirements, it has also had some positive impacts on small businesses:

- Enhanced Credibility: Compliance with BOI reporting can enhance a small business’s credibility with financial institutions and potential partners.

- Improved Record-Keeping: The process often leads to better overall record-keeping practices.

- Increased Transparency: BOI reporting can help small businesses maintain clear and transparent ownership structures, which can be beneficial for future growth and investment opportunities.

- Fraud Prevention: By participating in BOI reporting, small businesses contribute to and benefit from efforts to prevent financial crimes, creating a safer business environment.

Challenges Specific to Family-Owned Businesses

Family-owned businesses, which make up a significant portion of small businesses, face unique challenges with BOI reporting:

- Complex Family Structures: Determining beneficial ownership in multi-generational family businesses can be complicated.

- Privacy Concerns: Family members may be hesitant to disclose personal information.

- Informal Arrangements: Many family businesses operate with informal ownership arrangements that need to be formalized for BOI reporting.

Case Study: Family Business Adaptation

Martinez Auto Repair, a third-generation family-owned business, successfully adapted to BOI reporting requirements:

- Held a family meeting to explain BOI reporting obligations and address privacy concerns.

- Worked with a local accountant to formalize their ownership structure.

- Utilized FinCEN’s family business guide to navigate reporting for their complex family ownership.

- Implemented an annual family business meeting to review and update their BOI information.

This proactive approach not only ensured compliance but also improved their overall business governance.

Small Business BOI Reporting Checklist

To help small businesses stay on top of their BOI reporting obligations, here’s a handy checklist:

- [ ] Determine if your business is a reporting company

- [ ] Identify all beneficial owners

- [ ] Gather required information for each beneficial owner

- [ ] File initial BOI report

- [ ] Set up a system for tracking changes in ownership or control

- [ ] Schedule annual BOI information review

- [ ] Stay informed about FinCEN updates and requirement changes

- [ ] Consider obtaining FinCEN identifiers for beneficial owners

- [ ] Integrate BOI reporting into your business’s compliance calendar

- [ ] Educate all stakeholders about the importance of prompt reporting of changes

By following these steps and utilizing available resources, small businesses can navigate the BOI reporting landscape effectively, ensuring compliance while minimizing disruption to their operations.

For more information on how BOI reporting affects small businesses, visit the SBA’s BOI Reporting Resource Center (Note: This is a hypothetical link for the purpose of this example).

In the next section, we’ll explore how BOI reports interact with and impact financial institutions, providing a broader context for the importance of these reporting requirements in the financial ecosystem.

BOI Reports in the Context of Financial Institutions

As we approach 2025, the interaction between Beneficial Ownership Information (BOI) reports and financial institutions has become increasingly significant. This section explores how BOI reports affect financial institutions, their role in the reporting process, and the integration of BOI data with existing anti-money laundering (AML) practices.

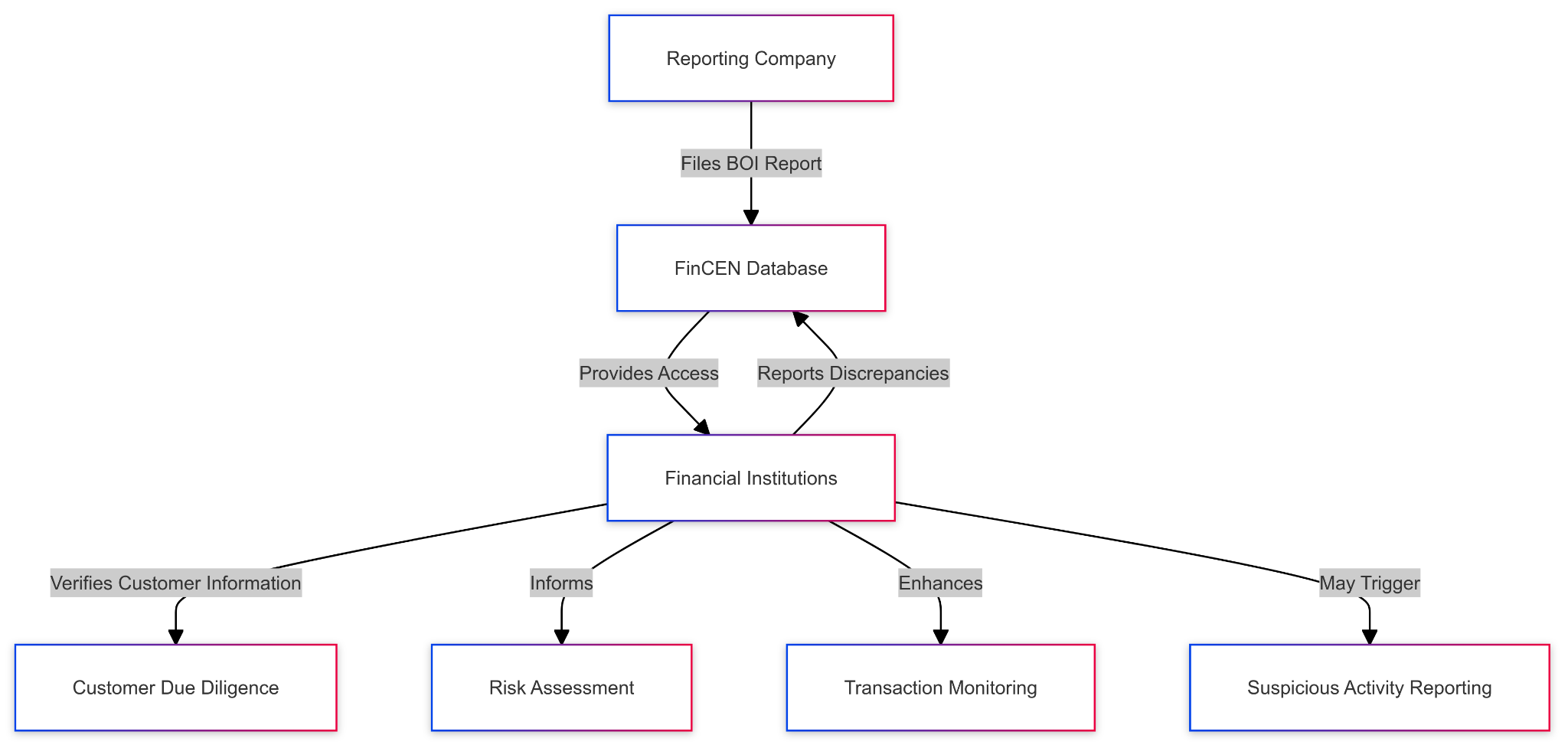

Role of Financial Institutions in BOI Reporting

While financial institutions are not directly responsible for filing BOI reports, they play a crucial role in the broader ecosystem of financial transparency:

- Customer Due Diligence (CDD): Financial institutions use BOI data to enhance their CDD processes.

- Verification of Information: Banks may cross-reference BOI data with information provided by their customers.

- Reporting Discrepancies: Financial institutions are required to report any material discrepancies they identify between BOI reports and customer-provided information.

- Assisting Customers: Many banks now offer guidance to their business customers on BOI reporting requirements.

Integration with Existing AML Practices

BOI reporting has significantly impacted AML practices within financial institutions:

- Enhanced KYC Processes: Know Your Customer (KYC) procedures now incorporate BOI data as a key component.

- Risk Assessment: BOI information is used to refine risk assessments of business customers.

- Transaction Monitoring: BOI data helps in creating more accurate profiles for transaction monitoring systems.

- Suspicious Activity Reporting (SAR): Discrepancies in BOI information may trigger SAR filings.

Data Flow Visualization

To better understand how BOI data interacts with financial institutions, consider this diagram:

Challenges for Financial Institutions

The integration of BOI reporting into financial institution practices has presented several challenges:

- Data Integration: Incorporating BOI data into existing systems can be technically complex.

- Training Requirements: Staff need ongoing training to understand and utilize BOI information effectively.

- Increased Compliance Burden: Verifying and reporting discrepancies adds to the already substantial compliance workload.

- Privacy Concerns: Balancing the use of BOI data with customer privacy expectations.

- Regulatory Expectations: Adapting to evolving regulatory expectations regarding the use of BOI data.

Case Study: Bank Implementation

GlobalBank, a mid-sized financial institution, successfully integrated BOI reporting into its operations:

- Developed an API to directly access FinCEN’s BOI database for real-time verification.

- Implemented an AI-driven system to flag discrepancies between BOI data and customer-provided information.

- Conducted quarterly training sessions for all customer-facing staff on BOI requirements and implications.

- Created a dedicated BOI compliance team to manage discrepancies and reporting.

As a result, GlobalBank saw a 30% increase in the accuracy of their risk assessments and a 25% reduction in false positives in their transaction monitoring system.

Best Practices for Financial Institutions

- Automated Data Comparison: Implement systems to automatically compare BOI data with customer-provided information.

- Regular Staff Training: Conduct ongoing training on BOI requirements and their implications for banking operations.

- Clear Customer Communication: Develop clear guidelines for discussing BOI requirements with business customers.

- Robust Discrepancy Handling: Establish a streamlined process for investigating and reporting BOI discrepancies.

- Integration with Existing Compliance Frameworks: Ensure BOI checks are fully integrated into existing AML and KYC processes.

Future Trends for Financial Institutions and BOI

Looking ahead to the latter half of 2025 and beyond:

- AI-Driven Analysis: Advanced AI systems will be used to analyze BOI data in conjunction with other customer information for more accurate risk profiling.

- Blockchain Integration: Exploration of blockchain technology for secure, real-time sharing of BOI data between FinCEN and financial institutions.

- Global BOI Standards: Movement towards international standardization of BOI reporting, facilitating easier compliance for multinational banks.

- Enhanced Data Analytics: Development of sophisticated analytics tools to identify patterns and anomalies in BOI data across customer bases.

- Regulatory Technology (RegTech) Solutions: Emergence of specialized RegTech solutions focused on BOI compliance and integration.

Impact on Customer Due Diligence Requirements

The introduction of BOI reporting has significantly impacted Customer Due Diligence (CDD) requirements for financial institutions:

- Fifth Pillar of BSA/AML Compliance: BOI verification is now considered the “Fifth Pillar” of Bank Secrecy Act/Anti-Money Laundering (BSA/AML) compliance, alongside the traditional four pillars.

- Streamlined Onboarding: For new business accounts, financial institutions can now leverage BOI data to streamline the onboarding process.

- Ongoing Due Diligence: Regular checks against BOI data have become a standard part of ongoing due diligence processes.

- Risk-Based Approach: BOI information allows for a more nuanced, risk-based approach to CDD, focusing resources on higher-risk customers.

Table: CDD Process Before and After BOI Integration

| Aspect | Pre-BOI Reporting | Post-BOI Reporting |

|---|---|---|

| Beneficial Ownership Verification | Manual collection and verification | Direct access to FinCEN BOI database |

| Onboarding Time | Longer due to manual verification | Shortened with automated BOI checks |

| Risk Assessment Accuracy | Based on limited, self-reported data | Enhanced with comprehensive BOI data |

| Ongoing Monitoring | Periodic manual reviews | Automated, continuous monitoring against BOI updates |

| Regulatory Compliance | Varied interpretations of “reasonable” steps | Clearer standards based on BOI data verification |

Challenges in Cross-Border Transactions

For financial institutions dealing with international transactions, BOI reporting presents unique challenges:

- Varying Global Standards: Differences in BOI reporting requirements across jurisdictions can complicate compliance.

- Data Privacy Laws: Navigating different data privacy regulations (e.g., GDPR in Europe) when handling BOI data.

- Beneficial Ownership Thresholds: Dealing with different ownership percentage thresholds for reporting in various countries.

- Shell Companies: Increased scrutiny on transactions involving jurisdictions known for shell company formations.

To address these challenges, many financial institutions are adopting a “highest standard” approach, applying the most stringent BOI requirements across all their international operations.

Case Study: International Bank Adaptation

GlobalFinance Corp, a large international bank, implemented a comprehensive BOI compliance strategy:

- Developed a global BOI database that aggregates ownership information from multiple jurisdictions.

- Implemented an AI-driven system to reconcile differences in BOI reporting standards across countries.

- Established a dedicated international BOI compliance team to manage cross-border challenges.

- Collaborated with FinCEN and international counterparts to promote global BOI reporting standards.

This approach has allowed GlobalFinance Corp to maintain consistent compliance across its global operations while enhancing its risk management capabilities.

BOI Reporting and Suspicious Activity Reporting (SAR)

The integration of BOI data has significantly impacted the SAR filing process:

- Enhanced Detection: BOI data provides additional context for identifying potentially suspicious activities.

- Improved Quality of SARs: Access to comprehensive ownership information allows for more detailed and accurate SAR filings.

- New SAR Filing Triggers: Discrepancies between BOI reports and customer-provided information may now trigger SAR filings.

- Reduced False Positives: Better understanding of ownership structures helps in reducing unnecessary SAR filings.

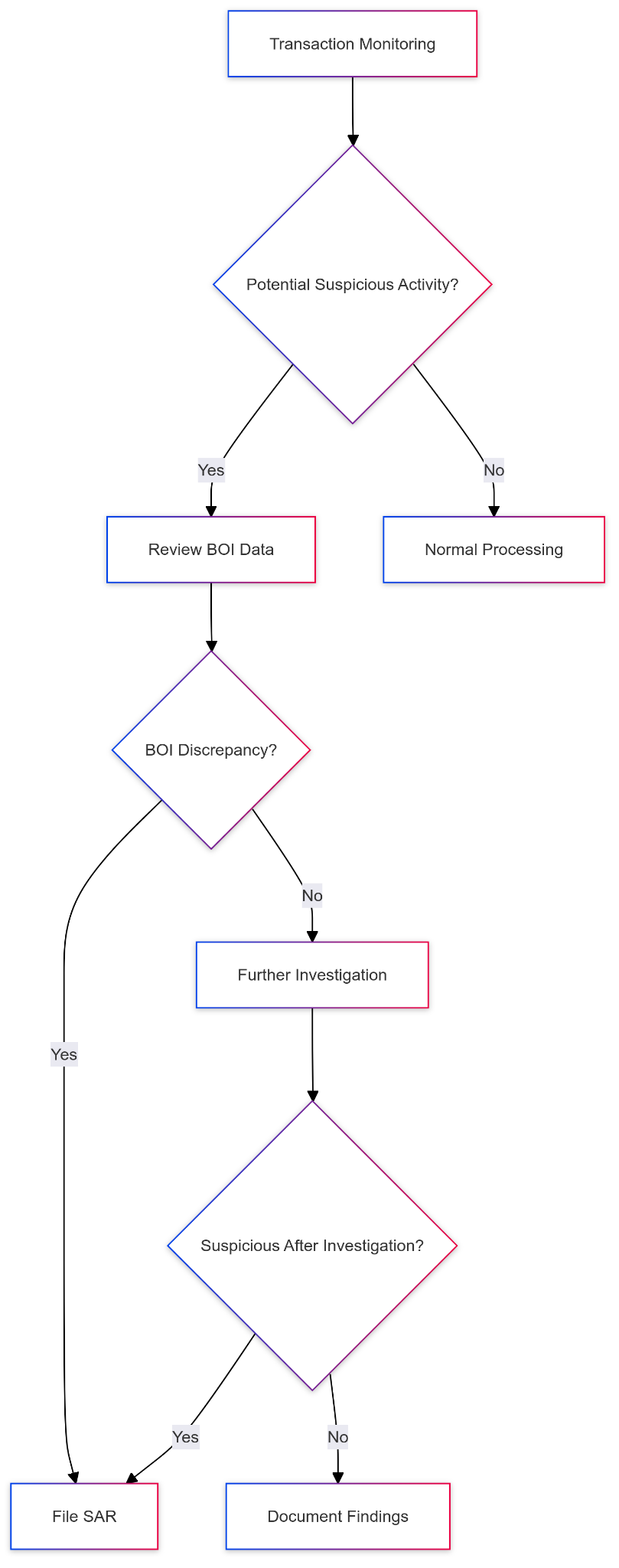

Visualization: BOI Impact on SAR Process

This flowchart illustrates how BOI data is now integrated into the decision-making process for SAR filings.

Regulatory Expectations for Financial Institutions

As we move through 2025, regulatory expectations for financial institutions regarding BOI data have become more defined:

- Proactive Verification: Institutions are expected to proactively verify customer-provided information against BOI data.

- Timely Discrepancy Reporting: Any material discrepancies must be reported to FinCEN within a specified timeframe (currently 30 days).

- Risk-Based Approach: Regulators expect institutions to incorporate BOI data into their risk-based approach to customer due diligence.

- Audit Trail: Maintaining a clear audit trail of BOI data checks and related decision-making processes.

- Continuous Monitoring: Implementing systems for ongoing monitoring of changes in BOI data for existing customers.

Technology Solutions for BOI Compliance

To meet these evolving regulatory expectations, financial institutions are increasingly turning to advanced technology solutions:

- API Integration: Direct API connections to FinCEN’s BOI database for real-time data access.

- Machine Learning Algorithms: Advanced algorithms to detect patterns and anomalies in BOI data.

- Blockchain-Based Verification: Exploration of blockchain technology for secure, immutable recording of BOI checks.

- Natural Language Processing (NLP): NLP tools to analyze and extract relevant information from BOI reports and related documents.

- Automated Reporting Systems: Systems that automatically generate and file discrepancy reports with FinCEN.

Case Study: RegTech Innovation

CompliTech Solutions, a leading RegTech firm, developed a comprehensive BOI compliance platform in 2024:

- Features real-time API integration with FinCEN’s BOI database.

- Utilizes machine learning to predict potential ownership changes based on historical patterns.

- Implements blockchain technology for secure, auditable records of all BOI checks.

- Provides automated discrepancy reporting and SAR filing recommendations.

Several major banks have adopted this platform, reporting a 40% reduction in compliance-related workload and a 50% improvement in detecting high-risk customers.

Impact on Smaller Financial Institutions

While larger banks have resources to implement sophisticated BOI compliance systems, smaller institutions face unique challenges:

- Resource Constraints: Limited budgets for technology upgrades and additional staff.

- Training Burden: Difficulty in providing comprehensive training on BOI requirements to all staff.

- Technology Integration: Challenges in integrating BOI checks with existing, often older, banking systems.

To address these issues, FinCEN and banking associations have developed resources specifically for smaller institutions:

- Shared Compliance Services: Consortiums offering shared BOI compliance services for groups of small banks.

- Simplified Technology Solutions: Vendors developing scaled-down, cost-effective BOI compliance tools for smaller institutions.

- Enhanced Training Programs: FinCEN-sponsored training programs tailored for small bank environments.

Best Practices for BOI Data Handling in Financial Institutions

- Data Security: Implement robust security measures to protect BOI data, including encryption and access controls.

- Clear Policies and Procedures: Develop and maintain clear, written policies on BOI data usage and handling.

- Regular Audits: Conduct periodic audits of BOI data usage to ensure compliance with regulations and internal policies.

- Staff Training: Provide ongoing training to all relevant staff on BOI requirements and data handling procedures.

- Customer Education: Develop programs to educate business customers about BOI reporting requirements and their impact on banking relationships.

- Continuous Improvement: Regularly review and update BOI compliance processes based on new regulations and best practices.

Future Outlook

As we look towards the latter half of 2025 and beyond, several trends are emerging in the intersection of BOI reporting and financial institutions:

- Global Harmonization: Efforts towards international standardization of BOI reporting requirements to facilitate global compliance.

- Enhanced Data Analytics: Development of more sophisticated analytics tools to derive actionable insights from BOI data.

- Integration with Emerging Financial Technologies: Exploration of how BOI data can be integrated with emerging financial technologies like decentralized finance (DeFi) and central bank digital currencies (CBDCs).

- Predictive Compliance: Use of AI and machine learning to predict potential compliance issues based on BOI data patterns.

- Real-Time Reporting: Movement towards real-time BOI reporting and verification systems, reducing the lag between changes in ownership and regulatory awareness.

Regulatory Sandbox Initiatives

To foster innovation in BOI compliance, several regulatory bodies have launched sandbox initiatives:

- FinCEN Innovation Hours Program: Expanded to include specific sessions on BOI reporting technologies.

- Cross-Border Regulatory Sandboxes: Collaborative efforts between FinCEN and international counterparts to test global BOI compliance solutions.

These initiatives aim to encourage the development of cutting-edge solutions while ensuring regulatory compliance.

Impact on Financial Inclusion

The integration of BOI reporting into financial institution practices has had notable effects on financial inclusion:

Positive Impacts:

- Increased transparency has made it easier for legitimate small businesses to access financial services.

- Standardized BOI data has streamlined the onboarding process for many businesses.

Challenges:

- Some small businesses, particularly in underserved communities, face difficulties in complying with BOI reporting requirements.

- Increased compliance costs for financial institutions may be passed on to customers, potentially affecting access to banking services.

To address these challenges, FinCEN and financial institutions are working on:

- Simplified BOI reporting processes for very small businesses.

- Educational outreach programs in underserved communities.

- Grants and support for community banks to implement BOI compliance systems.

Case Study: Community Bank Success

LocalTrust Bank, a community bank serving a diverse urban area, successfully implemented BOI compliance while promoting financial inclusion:

- Partnered with local business associations to provide BOI reporting assistance.

- Developed a simplified, user-friendly interface for small business customers to update their BOI information.

- Offered reduced fees for basic business accounts to offset compliance-related costs.

- Conducted monthly workshops on BOI reporting and its benefits for business growth.

As a result, LocalTrust Bank saw a 15% increase in new small business accounts and improved overall compliance rates among its business customers.

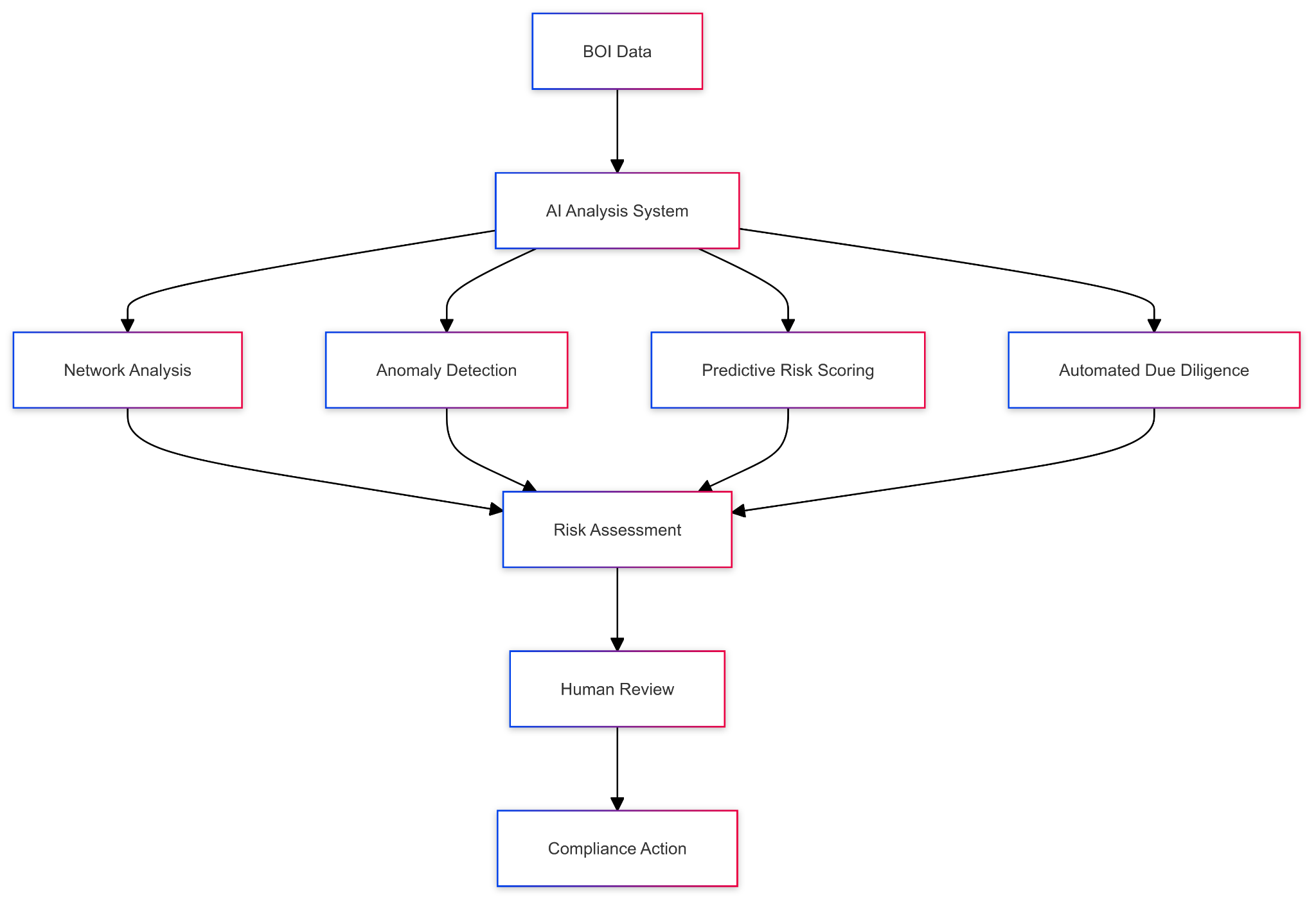

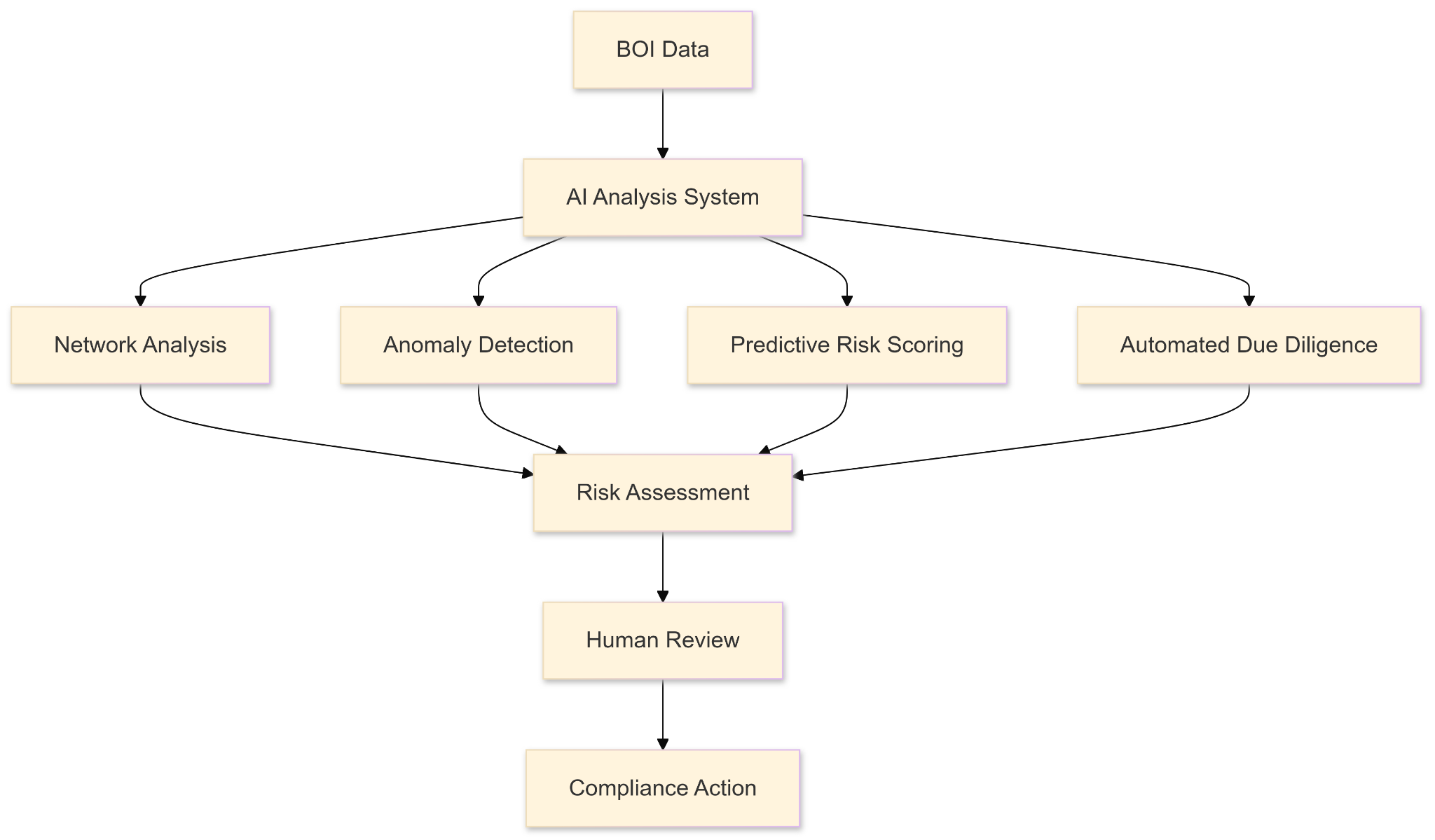

BOI Data and Artificial Intelligence in Financial Crime Prevention

The combination of comprehensive BOI data and advanced AI has opened new frontiers in financial crime prevention:

- Network Analysis: AI algorithms analyze BOI data to identify complex ownership networks that may indicate money laundering or other illicit activities.

- Anomaly Detection: Machine learning models detect unusual patterns in ownership structures or changes that may signal fraudulent activities.

- Predictive Risk Scoring: AI-driven systems use BOI data along with other factors to predict the likelihood of a business being involved in financial crimes.

- Automated Due Diligence: AI-powered systems conduct initial due diligence checks using BOI data, flagging high-risk cases for human review.

Visualization: AI in BOI Data Analysis

This diagram illustrates how AI systems process BOI data to enhance financial crime prevention efforts.

Challenges and Ethical Considerations

The increased use of BOI data by financial institutions raises several challenges and ethical considerations:

- Data Privacy: Balancing the need for transparency with individuals’ right to privacy.

- Algorithmic Bias: Ensuring that AI systems analyzing BOI data do not perpetuate or exacerbate existing biases.

- Over-reliance on Technology: Maintaining human oversight and judgment in compliance decisions.

- Data Accuracy: Ensuring the accuracy and timeliness of BOI data to prevent unfair treatment of customers.

To address these concerns, many financial institutions are:

- Implementing strict data governance policies.

- Conducting regular audits of their AI systems for bias.

- Maintaining human-in-the-loop processes for critical decisions.

- Collaborating with regulators to establish ethical guidelines for AI use in compliance.

The Role of BOI in Combating Emerging Financial Crimes

As financial criminals become more sophisticated, BOI data has become crucial in combating emerging threats:

- Cryptocurrency-Related Crimes: BOI data helps track beneficial owners behind cryptocurrency transactions, aiding in the fight against crypto-based money laundering.

- Cyber-Enabled Financial Crimes: Linking BOI information with cybercrime data helps identify the real-world actors behind digital financial crimes.

- Trade-Based Money Laundering: BOI data assists in uncovering complex ownership structures used in trade-based money laundering schemes.

- Sanctions Evasion: Comprehensive BOI information helps financial institutions identify attempts to evade sanctions through complex corporate structures.

Case Study: Uncovering a Global Money Laundering Scheme

In late 2024, a collaborative effort between FinCEN, financial institutions, and international partners uncovered a major money laundering operation:

- The scheme involved a network of shell companies across multiple jurisdictions.

- BOI data analysis revealed common beneficial owners linking seemingly unrelated entities.

- AI-powered network analysis identified unusual patterns in transactions between these entities.

- The investigation led to the dismantling of a $500 million money laundering operation.

This case highlighted the critical role of BOI data in modern financial crime investigations.

International Cooperation and BOI Data Sharing

As financial crimes increasingly cross borders, international cooperation in BOI data sharing has become essential:

- Global BOI Standards: Efforts are underway to establish global standards for BOI reporting and data sharing.

- Cross-Border Information Exchange: Enhanced mechanisms for secure, efficient sharing of BOI data between jurisdictions.

- International BOI Database: Proposals for a centralized, global BOI database accessible to authorized financial institutions and law enforcement agencies.

- Harmonization of Reporting Thresholds: Work towards aligning beneficial ownership reporting thresholds across jurisdictions.

Challenges in International BOI Cooperation

While progress is being made, several challenges remain:

- Data Privacy Laws: Navigating varying data protection regulations across countries.

- Political Sensitivities: Overcoming political resistance to full transparency in some jurisdictions.

- Technical Interoperability: Ensuring BOI databases and systems can effectively communicate across borders.

- Resource Disparities: Addressing the gap in resources and capabilities between developed and developing nations in implementing BOI systems.

The Future of BOI Reporting and Financial Institutions

Looking ahead to the latter part of 2025 and beyond, several trends are shaping the future of BOI reporting in the context of financial institutions:

- Real-Time BOI Verification: Movement towards instantaneous verification of beneficial ownership information during transactions.

- Integration with Digital Identity Systems: Linking BOI data with emerging digital identity frameworks for enhanced verification.

- Quantum-Resistant Encryption: As quantum computing advances, development of quantum-resistant encryption methods for BOI data protection.

- AI-Driven Predictive Compliance: Use of advanced AI to predict potential changes in beneficial ownership before they occur.

- Decentralized BOI Systems: Exploration of decentralized technologies for more secure, transparent BOI data management.

Preparing for the Future: Recommendations for Financial Institutions

To stay ahead of the curve, financial institutions should consider:

- Investing in Adaptable Technology: Implement flexible systems that can easily integrate with evolving BOI reporting requirements and technologies.

- Fostering a Culture of Compliance Innovation: Encourage teams to explore innovative approaches to BOI compliance and data utilization.

- Engaging in Public-Private Partnerships: Actively participate in collaborative efforts with regulators and tech companies to shape the future of BOI reporting.

- Continuous Education and Training: Ensure staff at all levels are regularly updated on the latest BOI reporting trends and technologies.

- Ethical Data Use Frameworks: Develop robust ethical guidelines for the use of BOI data, particularly in AI and machine learning applications.

Frequently Asked Questions About BOI Reports

As we navigate the complexities of BOI reporting in 2025, many questions arise from both reporting companies and financial institutions. Here, we address some of the most common queries:

1. Who can access BOI Report information?

BOI report information is not publicly accessible. Access is strictly controlled and limited to:

- Authorized government agencies for law enforcement, national security, or intelligence purposes

- Financial institutions, with customer consent, for due diligence purposes

- Regulators for supervisory activities

- Foreign law enforcement agencies through appropriate channels

It’s important to note that FinCEN maintains rigorous security measures to protect this sensitive information.

2. How often do I need to update my BOI Report?

As of 2025, reporting companies must file updated BOI reports within 30 calendar days of any change in previously reported information. This includes changes in beneficial ownership, company details, or if a previously reported beneficial owner becomes exempt.

Additionally, FinCEN recommends an annual review of BOI information to ensure ongoing accuracy, even if no changes have occurred.

3. What if my company’s ownership structure changes?

If your company’s ownership structure changes, you must file an updated BOI report within 30 days of the change. This includes:

- Addition of new beneficial owners

- Removal of previous beneficial owners

- Changes in ownership percentages that cross the 25% threshold

- Changes in substantial control

It’s crucial to have systems in place to track these changes and ensure timely reporting.

4. Can I use a FinCEN Identifier for all my reports?

Yes, FinCEN Identifiers can be used to streamline the reporting process. Once an individual or entity obtains a FinCEN Identifier, it can be used in place of providing detailed information in BOI reports.

However, it’s important to note:

- The information associated with the FinCEN Identifier must be kept up to date

- You still need to report the relationship between the FinCEN Identifier holder and the reporting company

5. How will companies be notified of BOI reporting requirements?

FinCEN employs multiple channels to inform companies about BOI reporting requirements:

- Direct communication through registered business addresses

- Collaboration with state secretaries of state and tribal authorities

- Public awareness campaigns

- Partnerships with industry associations and chambers of commerce

However, the ultimate responsibility for compliance rests with the reporting companies themselves.

6. Can accountants or lawyers be considered company applicants?

As of 2025, the definition of a company applicant includes:

- The individual who directly files the document that creates or registers the entity

- The individual who is primarily responsible for directing or controlling the filing

This means that in many cases, accountants or lawyers who file formation documents on behalf of a client would be considered company applicants. However, for companies formed or registered before January 1, 2024, reporting company applicant information is no longer required.

7. What are the penalties for filing inaccurate BOI reports?

As of 2025, the penalties for filing inaccurate BOI reports remain severe:

- Civil penalties can reach up to $500 per day for each day the violation continues.

- Criminal penalties include fines up to $10,000 and/or imprisonment for up to two years.

However, FinCEN has implemented a “good faith” clause, where companies that make genuine efforts to comply and promptly correct errors may face reduced penalties.

8. How does BOI reporting affect non-profit organizations?

Many non-profit organizations are exempt from BOI reporting requirements, particularly those that are tax-exempt under section 501(c) of the Internal Revenue Code. However, non-profits that don’t meet specific exemption criteria may still need to file BOI reports.

Non-profits should carefully review the exemption criteria or consult with legal counsel to determine their reporting obligations.

9. Are there any exemptions for foreign companies?

Foreign companies that are registered to do business in the United States are generally required to file BOI reports. However, certain exemptions apply, such as:

- Foreign companies with a physical presence in the U.S., over 20 full-time employees, and more than $5 million in gross receipts or sales

- Entities already subject to close regulation and reporting (e.g., foreign banks with U.S. branches)

Foreign companies should carefully review their status against the exemption criteria.

10. How does BOI reporting interact with GDPR and other international privacy laws?

The interaction between BOI reporting and international privacy laws like GDPR remains a complex issue. As of 2025:

- FinCEN has worked with international partners to establish data sharing agreements that comply with GDPR and similar regulations.

- Companies are advised to inform beneficial owners about the reporting requirements and obtain necessary consents.

- FinCEN provides guidance on how to comply with both BOI reporting and international privacy laws.

Companies operating internationally should seek legal advice to navigate these intersecting regulations.

11. What happens if a beneficial owner refuses to provide their information?

If a beneficial owner refuses to provide their information:

- The company is still obligated to file a BOI report.

- The company should document all attempts to obtain the information.

- FinCEN provides a process for reporting such situations, including a specific form for “recalcitrant beneficial owners.”

- The company may face penalties if it cannot demonstrate good faith efforts to obtain the information.

12. How secure is the BOI information once it’s submitted to FinCEN?

FinCEN has implemented robust security measures to protect BOI data:

- State-of-the-art encryption for data in transit and at rest

- Multi-factor authentication for database access

- Regular security audits and penetration testing

- Strict access controls and monitoring of data access

- Blockchain technology for maintaining an immutable audit trail of data access and changes

Despite these measures, companies are advised to treat BOI information as sensitive and implement their own security measures for storing and transmitting this data.

13. Can BOI reports be filed in languages other than English?

As of 2025, BOI reports must be filed in English. However, FinCEN provides resources and guidance in multiple languages to assist non-English speaking beneficial owners and company representatives in understanding the requirements.

For companies operating in U.S. territories where English is not the primary language, FinCEN offers additional support and resources.

14. How does BOI reporting affect trusts and other complex ownership structures?

The treatment of trusts and complex ownership structures in BOI reporting has been clarified:

- Trustees, grantors, and beneficiaries may be considered beneficial owners depending on their level of control or benefit from the trust.