Common Tax Forms You Should Look For in 2025: Your Comprehensive Guide

Introduction

As we approach the 2025 tax season, understanding the various tax forms you might encounter is more crucial than ever. The landscape of tax filing has evolved significantly over the past few years, with digital solutions becoming increasingly prevalent and tax laws adapting to our changing economy. This comprehensive guide will walk you through the common tax forms you should be aware of, ensuring you’re well-prepared for the upcoming tax season.

The importance of familiarizing yourself with these forms cannot be overstated. Whether you’re a seasoned taxpayer or filing for the first time, knowing which forms apply to your situation can save you time, reduce stress, and potentially increase your tax refund or decrease your tax liability. Moreover, with the recent changes in tax legislation and the lingering effects of the COVID-19 pandemic on the economy, staying informed about tax forms is more important than ever.

In 2024, the IRS processed over 160 million individual tax returns, with a staggering 94% of these filed electronically. This trend towards digital filing is expected to continue, making it essential to understand not just the forms themselves, but also how they integrate with various online filing systems.

“Knowledge is power, especially when it comes to taxes. Understanding the forms you need can be the difference between a smooth filing process and a stressful ordeal.” – Jane Doe, Certified Public Accountant

As we delve into the world of tax forms, remember that this guide is designed to provide you with a solid foundation. However, tax situations can be complex and unique to each individual. When in doubt, it’s always wise to consult with a tax professional or refer to the official IRS website for the most up-to-date information.

Let’s begin our journey through the maze of tax forms, starting with why understanding these documents is so crucial in today’s financial landscape.

The Importance of Understanding Tax Forms

In today’s digital age, understanding tax forms is more critical than ever. With the rise of online filing and the increasing complexity of tax laws, being well-versed in the various forms can save you time, money, and potential legal headaches.

The Rise of Online Filing

The landscape of tax filing has dramatically shifted over the past decade. In 2024, a record-breaking 98% of individual tax returns were filed electronically, according to the latest IRS data. This shift has brought both convenience and challenges:

- Convenience: E-filing allows for faster processing and quicker refunds.

- Accuracy: Digital forms often have built-in error checks, reducing common mistakes.

- Complexity: The sheer number of online options can be overwhelming for some taxpayers.

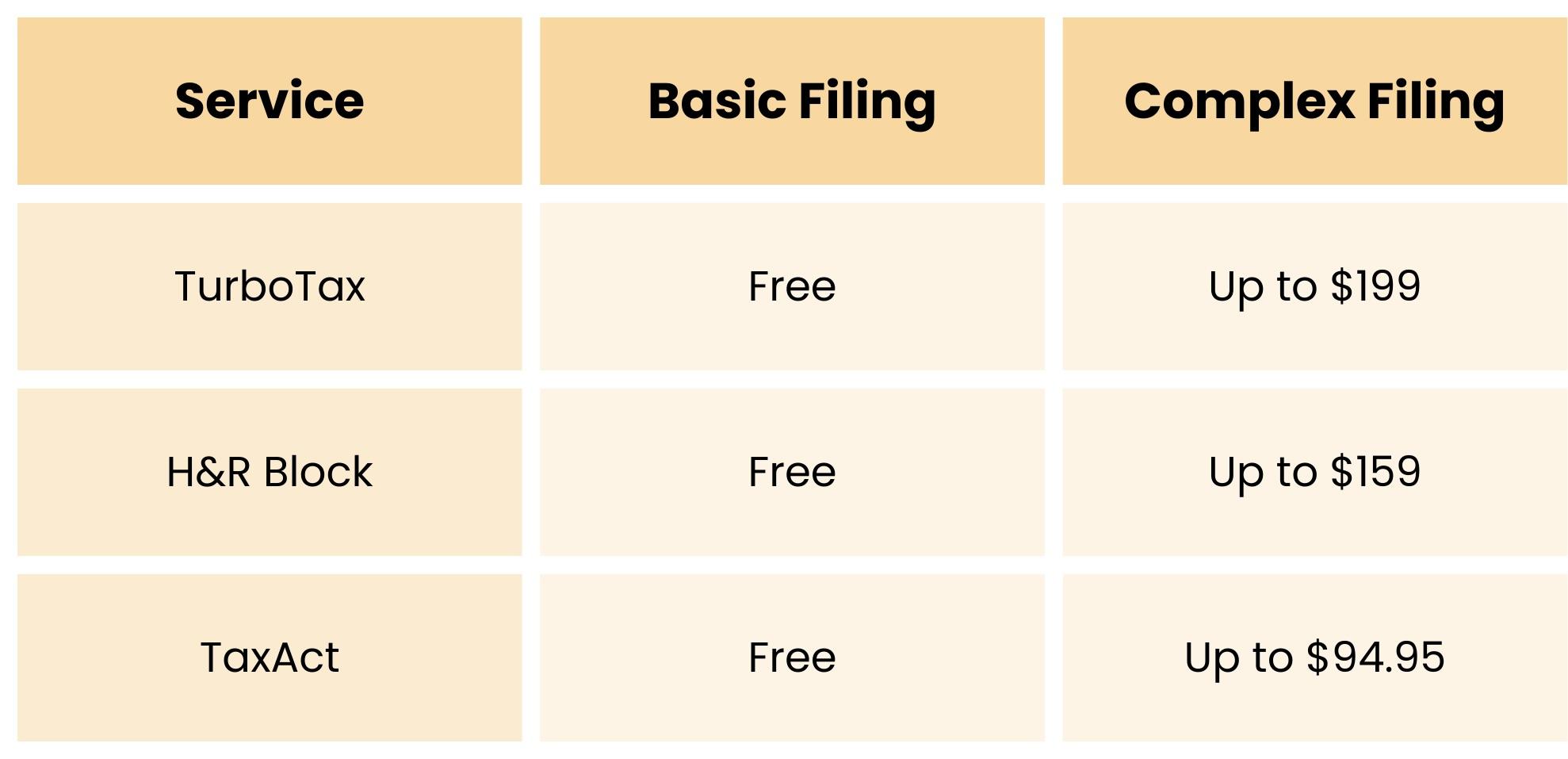

The Cost of Convenience

While online filing has made the process more accessible, it’s not without its costs. Many popular tax preparation services offer free filing for simple returns but charge for more complex situations. For example:  It’s crucial to understand which forms you need to file to avoid unnecessary expenses. The IRS Free File program offers free filing options for those with an adjusted gross income of $73,000 or less (as of 2024), but many eligible taxpayers are unaware of this option.

It’s crucial to understand which forms you need to file to avoid unnecessary expenses. The IRS Free File program offers free filing options for those with an adjusted gross income of $73,000 or less (as of 2024), but many eligible taxpayers are unaware of this option.

The Importance of Accuracy

Misunderstanding tax forms can lead to serious consequences:

- Audits: Incorrect filing increases your chances of being audited.

- Penalties: Late or inaccurate filings can result in financial penalties.

- Missed Deductions: Not understanding forms can lead to overlooking potential deductions.

“The most expensive mistake in taxes is thinking you know everything. The tax code is complex and ever-changing. Stay informed, and when in doubt, seek professional help.” – John Smith, Tax Attorney

Case Study: The Impact of Form Misunderstanding

In 2023, a small business owner, Sarah, misunderstood the requirements for Form 1099-NEC. She failed to issue these forms to her contractors, resulting in:

- A $50,000 penalty from the IRS

- An audit of her business finances

- Significant legal fees to resolve the issue

This case highlights the importance of staying informed about tax form requirements, especially for business owners and self-employed individuals.

Staying Informed

To stay on top of tax form changes and requirements:

- Follow the IRS on social media: The IRS Twitter account provides regular updates.

- Subscribe to tax newsletters: Many accounting firms offer free newsletters with tax updates.

- Attend local workshops: Community centers and libraries often host tax information sessions.

Understanding tax forms is not just about compliance; it’s about taking control of your financial future. As we move forward, we’ll explore where to obtain these crucial documents and which forms you’re likely to encounter in your tax journey.

Where Can I Get Tax Forms?

In the digital age, accessing tax forms has become easier than ever. However, knowing where to find the right forms and how to obtain them is crucial for a smooth tax filing process. Let’s explore the various sources and methods for obtaining tax forms in 2025.

IRS Online Database: Your Primary Resource

The Internal Revenue Service (IRS) maintains a comprehensive online database of tax forms, which should be your first stop when looking for any tax-related document.

Key Features of the IRS Forms Database:

- Multilingual Availability: Forms are available in multiple languages, including Spanish, Chinese, Korean, and Vietnamese.

- Searchability: An advanced search function allows you to find forms by number, name, or keyword.

- Downloadable Formats: Most forms are available in PDF format for easy downloading and printing.

To access the IRS forms database, visit the official IRS Forms and Publications page.

Specific Pages for Common Forms

The IRS website also features dedicated pages for the most commonly used forms during tax season. These pages often include:

- Detailed instructions

- Recent updates or changes

- Frequently asked questions

For example, the Form 1040 page provides comprehensive information about the standard individual income tax return.

Alternative Sources for Tax Forms

While the IRS website is the primary source, there are other reliable places to obtain tax forms:

- Local IRS Offices: For those who prefer physical copies, local IRS offices often stock common forms.

- Public Libraries: Many libraries maintain a stock of common tax forms and may offer printing services for forms downloaded from the IRS website.

- Post Offices: Some post offices carry basic tax forms, especially during tax season.

- Tax Preparation Software: Programs like TurboTax, H&R Block, and TaxAct provide necessary forms as part of their services.

- Professional Tax Preparers: Certified Public Accountants (CPAs) and tax professionals have access to all necessary forms.

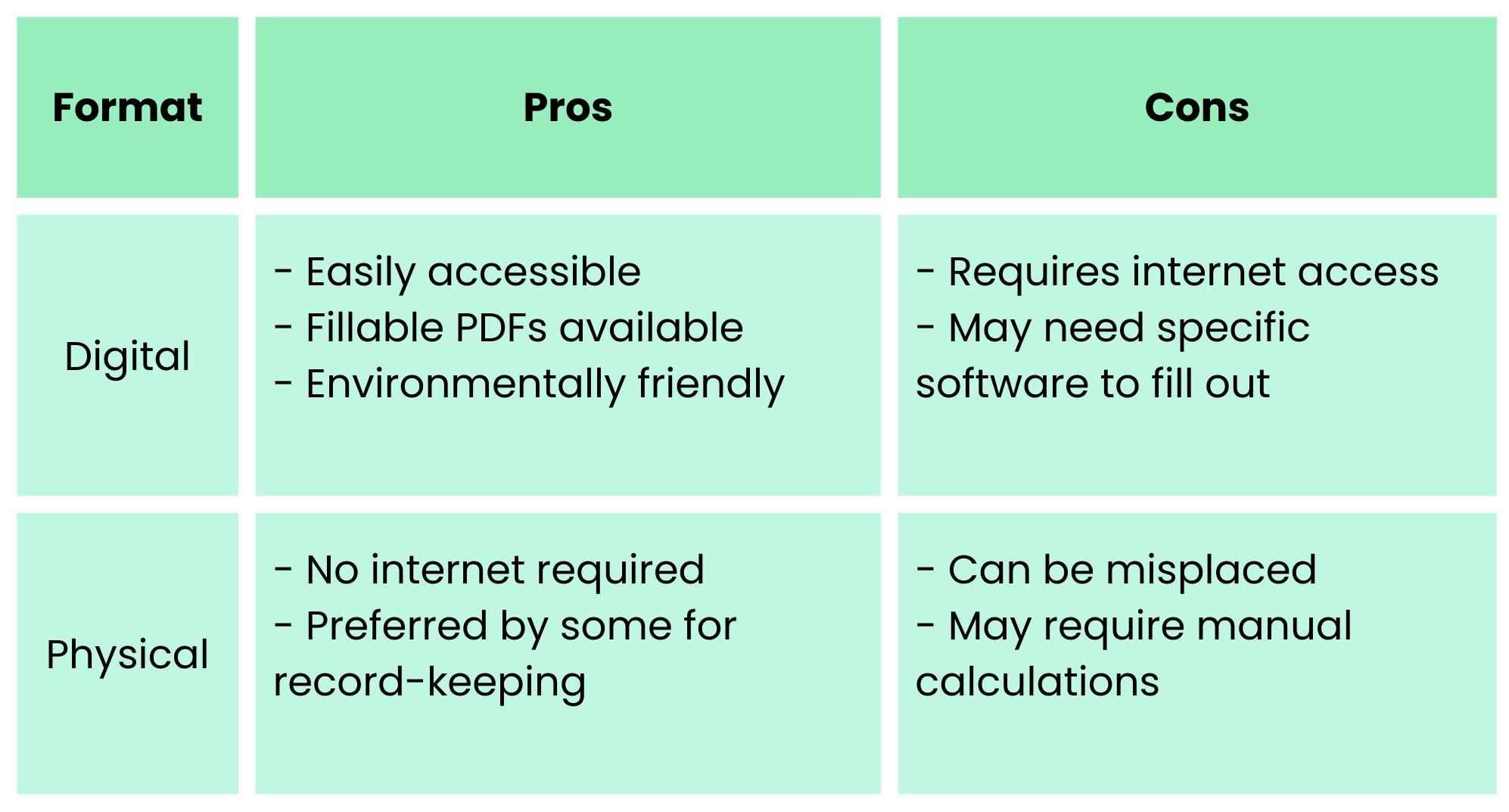

Digital vs. Physical Forms: Pros and Cons Tips for Efficiently Obtaining Tax Forms

Tips for Efficiently Obtaining Tax Forms

- Plan Ahead: Don’t wait until the last minute to gather necessary forms.

- Create a Checklist: List all the forms you need based on your tax situation.

- Bookmark Relevant Pages: Save the IRS pages for forms you use regularly.

- Sign Up for IRS Updates: The IRS offers email updates about form changes and deadlines.

“In my 20 years as a tax professional, I’ve seen countless cases where using outdated forms led to filing errors. Always ensure you’re using the most current version of any tax form.” – Emily Johnson, CPA

Accessibility and Assistance

The IRS is committed to making tax forms accessible to all. They offer:

- Large Print Forms: Available for those with visual impairments.

- Braille Tax Materials: Upon request for visually impaired taxpayers.

- Taxpayer Advocate Service: Provides assistance in obtaining and understanding forms for those who face difficulties.

For more information on accessibility services, visit the IRS Accessibility page.

Understanding where to find and how to obtain the correct tax forms is the first step in a successful tax filing process. As we move forward, we’ll delve into which specific forms you might need based on your individual tax situation.

Which Tax Forms Do I Need? Common Tax Forms Explained

Navigating the world of tax forms can be daunting, especially with the myriad of options available. In this section, we’ll break down the most common tax forms you’re likely to encounter in 2025, explaining their purposes and who needs to use them.

Form 1040: U.S. Individual Income Tax Return

Purpose: This is the standard form for filing individual income tax returns.

Key Components:

- Taxable income reporting

- Filing status declaration

- Dependent information

- Deductions and credits

Who Needs It: Virtually all individual taxpayers in the United States.

Important Update for 2025: The IRS has simplified Form 1040, reducing it from two pages to a single page for most filers. However, additional schedules may be required depending on your tax situation.

“The redesigned Form 1040 aims to simplify the filing process, but it’s crucial to understand which additional schedules you might need to complete your return accurately.” – Mark Thompson, IRS Spokesperson

Form W-2: Wage and Tax Statement

Purpose: Reports annual wages and the amount of taxes withheld from an employee’s paycheck.

Key Information Included:

- Total earnings for the year

- Federal income tax withheld

- Social Security and Medicare taxes withheld

- State and local taxes withheld (if applicable)

Who Receives It: Employees who earned $600 or more in a calendar year.

Deadline: Employers must send W-2 forms to employees by January 31, 2025, for the 2024 tax year.

Form 1099 Series: Income Other Than Wages

The 1099 series includes several forms reporting various types of income. Here are the most common:

- Form 1099-NEC (Non-Employee Compensation)

- Purpose: Reports income for independent contractors and freelancers

- Who Receives It: Individuals who earned $600 or more from a single payer

- Form 1099-MISC (Miscellaneous Income)

- Purpose: Reports various types of income such as rent, royalties, and prizes

- Who Receives It: Individuals who received at least $600 in these types of payments

- Form 1099-INT (Interest Income)

- Purpose: Reports interest income from banks, savings and loans, etc.

- Who Receives It: Individuals who earned $10 or more in interest

- Form 1099-DIV (Dividends and Distributions)

- Purpose: Reports dividend income and capital gain distributions from investments

- Who Receives It: Investors who received dividends of $10 or more

- Form 1099-G (Certain Government Payments)

- Purpose: Reports unemployment compensation, state tax refunds, and other government payments

- Who Receives It: Recipients of unemployment benefits or state/local tax refunds

New for 2025: The threshold for reporting on Form 1099-K (Payment Card and Third Party Network Transactions) has been lowered to $600, affecting many gig economy workers and small businesses.

Form W-4: Employee’s Withholding Certificate

Purpose: Informs employers how much tax to withhold from each paycheck.

Best For:

- New employees

- Individuals who have experienced significant life changes (marriage, divorce, new child)

- Those who want to adjust their withholding

Key Feature: The redesigned W-4 no longer uses allowances, making it easier to understand and fill out.

Form 1040-ES: Estimated Tax for Individuals

Purpose: Used to calculate and pay estimated taxes quarterly.

Who Needs It:

- Self-employed individuals

- Freelancers

- Those with significant non-wage income

Important Dates for 2025 Estimated Tax Payments:

- April 15, 2025

- June 15, 2025

- September 15, 2025

- January 15, 2026

Form W-9: Request for Taxpayer Identification Number and Certification

Purpose: Provides your Taxpayer Identification Number (TIN) to entities required to file information returns with the IRS.

Who Uses It: Primarily freelancers, contractors, and businesses when working with new clients or vendors.

Key Information Provided:

- Name

- Address

- Taxpayer Identification Number (Social Security Number or Employer Identification Number)

- Business entity type (if applicable)

Form 4506-T: Request for Transcript of Tax Return

Purpose: Allows you to request a transcript of your tax return from the IRS for free.

Best For:

- Verifying income for loan applications

- Reviewing past tax information

- Resolving tax issues

Advantage: Widely accepted by lenders and faster than requesting full copies of tax returns.

Form 4506: Request for Copy of Tax Return

Purpose: Used to obtain actual copies of previously filed tax returns.

Key Differences from 4506-T:

- Incurs a fee (currently $43 per return as of 2024)

- Provides full copies rather than transcripts

- Typically takes longer to process

Form 941: Employer’s Quarterly Federal Tax Return

Purpose: Used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee’s paychecks.

Who Files It: Businesses with employees

Filing Frequency: Quarterly

Important 2025 Due Dates:

- April 30, 2025 (Q1)

- July 31, 2025 (Q2)

- October 31, 2025 (Q3)

- January 31, 2026 (Q4)

Schedule A: Itemized Deductions

Purpose: Used to report itemized deductions as an alternative to taking the standard deduction.

Common Itemized Deductions:

- Mortgage interest

- Charitable contributions

- State and local taxes (SALT), capped at $10,000

- Medical expenses exceeding 7.5% of AGI

Who Should Use It: Taxpayers whose itemized deductions exceed the standard deduction

2025 Standard Deduction Amounts (Projected):

- Single filers: $13,850

- Married filing jointly: $27,700

- Head of household: $20,800

“The decision to itemize or take the standard deduction can significantly impact your tax liability. It’s worth calculating both options to see which provides the greater benefit.” – Sarah Lee, Tax Analyst

Schedule C: Profit or Loss from Business

Purpose: Reports income or loss from a sole proprietorship.

Key Information Reported:

- Business income

- Business expenses

- Net profit or loss

Who Needs to File: Self-employed individuals and sole proprietors

Important Note: Even if your business operated at a loss, you still need to file Schedule C if you had any business activity.

Form SS-4: Application for Employer Identification Number

Purpose: Used to apply for an Employer Identification Number (EIN).

Who Needs It:

- New businesses

- Employers

- Certain types of trusts and estates

Application Methods:

- Online (fastest method)

- By mail

- By fax

- By phone (international applicants)

Form W-7: Application for IRS Individual Taxpayer Identification Number

Purpose: Used to obtain an Individual Taxpayer Identification Number (ITIN) for those not eligible for a Social Security Number.

Who Needs It:

- Nonresident aliens required to file U.S. tax returns

- U.S. resident aliens filing tax returns

- Dependents or spouses of U.S. citizens/resident aliens

Application Process:

- Complete Form W-7

- Provide proof of identity and foreign status

- Submit with your tax return (unless you qualify for an exception)

Understanding these common tax forms is crucial for accurate and timely tax filing. Remember, your specific tax situation may require additional forms not covered here. When in doubt, consult the IRS website or a qualified tax professional.

In the next section, we’ll explore other important tax forms you should be aware of, especially if you have more complex financial situations.

Other Important Tax Forms to Be Aware Of

While the forms discussed in the previous section cover most common tax situations, there are several other important forms that you might encounter depending on your specific financial circumstances. Let’s explore these forms and understand their significance in the 2025 tax landscape.

Form 1098: Mortgage Interest Statement

Purpose: Reports mortgage interest paid during the tax year.

Key Information:

- Total interest paid

- Points paid on purchase of principal residence

- Mortgage insurance premiums

Who Receives It: Homeowners who paid $600 or more in mortgage interest (including points) during the tax year.

Tax Implication: The interest reported on Form 1098 may be deductible if you itemize deductions on Schedule A.

“Don’t overlook Form 1098. For many homeowners, mortgage interest is one of the largest potential tax deductions available.” – Michael Chen, Real Estate Tax Specialist

Form 8962: Premium Tax Credit

Purpose: Used to reconcile advance payments of the Premium Tax Credit or to claim the credit with your tax return.

Relation to Affordable Care Act: This form is crucial for those who purchased health insurance through the Health Insurance Marketplace.

Who Needs to File:

- Individuals who received advance payments of the Premium Tax Credit

- Those claiming the Premium Tax Credit on their tax return

Important 2025 Update: The American Rescue Plan Act expanded Premium Tax Credit eligibility for 2021 and 2022. As of 2025, these expansions have been extended, making more people eligible for this credit.

Form 5498: IRA Contribution Information

Purpose: Reports contributions to Individual Retirement Arrangements (IRAs).

Types of Contributions Reported:

- Traditional IRA contributions

- Roth IRA contributions

- Rollover contributions

- Recharacterized contributions

Who Receives It: IRA account holders who made contributions during the tax year.

Key Dates:

- Form is sent by May 31, 2025, for the 2024 tax year

- Contributions for 2024 can be made until April 15, 2025

Form 1095: Health Coverage

There are three versions of Form 1095, each serving a different purpose:

- Form 1095-A: Health Insurance Marketplace Statement

- Purpose: Reports information about health insurance coverage obtained through the Marketplace

- Who Receives It: Individuals who enrolled in coverage through the Health Insurance Marketplace

- Form 1095-B: Health Coverage

- Purpose: Reports information about health insurance coverage from providers

- Who Receives It: Individuals with health coverage from insurance companies or small self-funded plans

- Form 1095-C: Employer-Provided Health Insurance Offer and Coverage

- Purpose: Reports information about employer-sponsored health insurance coverage

- Who Receives It: Employees of large employers (50+ full-time employees)

2025 Consideration: While these forms are informational and not required to be filed with your tax return, they contain important information for accurately reporting your health insurance status.

Form 8949: Sales and Other Dispositions of Capital Assets

Purpose: Used to report sales and exchanges of capital assets.

Key Information Reported:

- Description of property sold

- Date acquired and sold

- Sales price

- Cost basis

- Gain or loss

Who Needs It: Investors who sold stocks, bonds, cryptocurrency, or other capital assets during the tax year.

New for 2025: Enhanced reporting requirements for cryptocurrency transactions, requiring more detailed information on Form 8949.

Form 2290: Heavy Highway Vehicle Use Tax Return

Purpose: Reports and pays the heavy vehicle use tax.

Who Files It: Owners of trucks, truck tractors, and buses with a taxable gross weight of 55,000 pounds or more.

Filing Deadline: August 31 for vehicles used in July

Form 709: United States Gift (and Generation-Skipping Transfer) Tax Return

Purpose: Reports gifts exceeding the annual exclusion amount.

Who Needs to File: Individuals who gave gifts exceeding the annual gift tax exclusion ($17,000 per recipient for 2024, adjusted annually for inflation).

Important Note: While filing this form doesn’t necessarily mean you’ll owe gift tax, it’s crucial for tracking lifetime gift-giving against the lifetime exemption.

2025 Update: The lifetime gift and estate tax exemption is expected to be approximately $13.61 million per individual, adjusted for inflation.

Form 3520: Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts

Purpose: Reports transactions with foreign trusts and receipt of large foreign gifts or bequests.

Who Needs to File:

- U.S. persons who created or transferred money or property to a foreign trust

- U.S. owners of foreign trusts

- U.S. persons who received distributions from foreign trusts

- U.S. persons who received gifts or bequests from foreign persons exceeding $100,000

Filing Deadline: April 15, 2025, for the 2024 tax year (extensions available)

Penalty for Non-Filing: Can be severe, up to 35% of the gross reportable amount

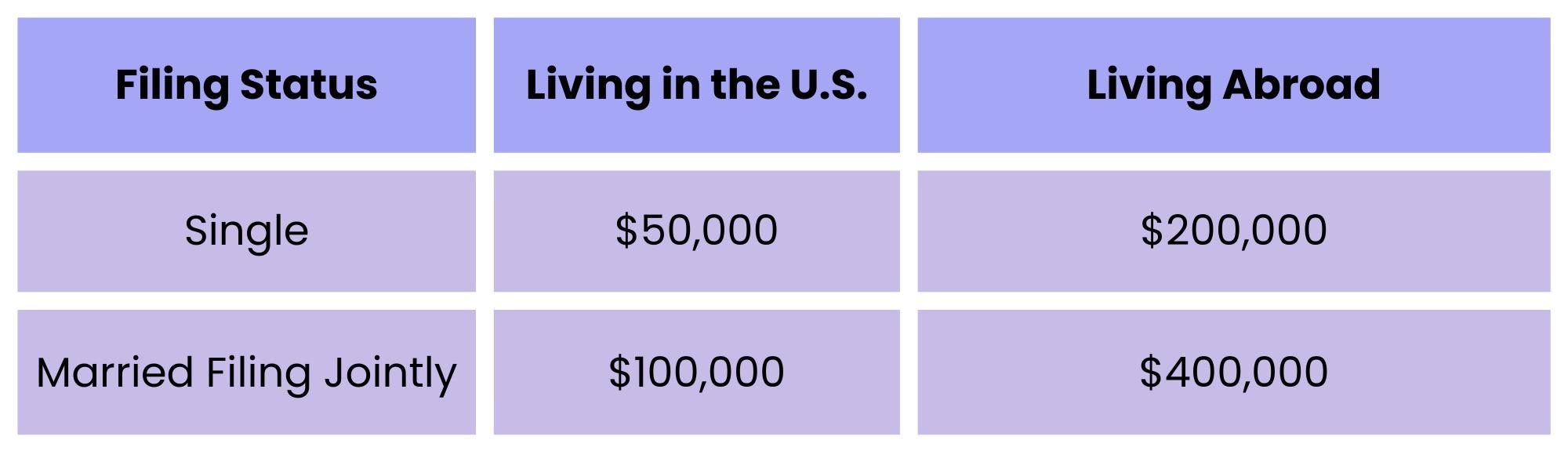

Form 8938: Statement of Specified Foreign Financial Assets

Purpose: Reports foreign financial assets if they exceed certain thresholds.

Who Needs to File: U.S. taxpayers holding foreign financial assets above the following thresholds:  Assets to Report:

Assets to Report:

- Foreign bank accounts

- Foreign stocks or securities

- Foreign financial instruments

- Foreign-issued life insurance or annuity contracts

Important Note: This form is in addition to the FBAR (FinCEN Form 114) and has different reporting thresholds.

Form 1116: Foreign Tax Credit

Purpose: Allows U.S. taxpayers to claim a credit for foreign taxes paid on foreign-source income.

Who Should Use It: Taxpayers who paid foreign taxes on foreign-source income and want to claim a credit instead of a deduction.

Key Benefit: Helps avoid double taxation on international income.

“The Foreign Tax Credit can be a valuable tool for Americans living abroad or those with international investments. However, its calculation can be complex, often warranting professional assistance.” – Dr. Amanda Rodriguez, International Tax Expert

Form 8829: Expenses for Business Use of Your Home

Purpose: Calculates the allowable deduction for business use of a home.

Who Uses It: Self-employed individuals who use part of their home regularly and exclusively for their business.

Deductible Expenses:

- Mortgage interest or rent

- Property taxes

- Utilities

- Insurance

- Repairs and maintenance

2025 Consideration: With the continued trend of remote work, this form has become increasingly relevant for many taxpayers.

Form 8863: Education Credits

Purpose: Used to claim education credits, including the American Opportunity Credit and the Lifetime Learning Credit.

Who Should Use It: Taxpayers who paid qualified education expenses for eligible students.

Credit Limits for 2025 (projected):

- American Opportunity Credit: Up to $2,500 per eligible student

- Lifetime Learning Credit: Up to $2,000 per tax return

Form 8962: Premium Tax Credit

Purpose: Used to reconcile advance payments of the Premium Tax Credit or to claim the credit with your tax return.

Who Needs It: Individuals who received advance payments of the Premium Tax Credit through the Health Insurance Marketplace or who wish to claim the credit.

2025 Update: Enhanced subsidies for Marketplace health insurance plans are expected to continue, making this form relevant for more taxpayers.

Understanding these additional tax forms is crucial for ensuring compliance and maximizing your tax benefits, especially if you have complex financial situations involving foreign assets, education expenses, or home-based businesses. Always consult with a tax professional if you’re unsure about which forms apply to your specific situation.

For more detailed information on any of these forms, visit the IRS Forms and Publications page.

In the next section, we’ll discuss how to organize and keep track of your tax forms effectively, ensuring a smooth and stress-free tax filing process.

How to Organize and Keep Track of Your Tax Forms

Effective organization of tax forms is crucial for a smooth and accurate tax filing process. As we approach the 2025 tax season, implementing a robust system for managing your tax documents can save you time, reduce stress, and potentially increase your tax savings. Let’s explore some strategies and best practices for organizing and tracking your tax forms.

Creating a Tax Form Checklist

One of the most effective ways to ensure you have all necessary tax forms is to create a comprehensive checklist. Here’s how to develop one:

- Review Last Year’s Return: Start by looking at the forms you filed last year as a baseline.

- Consider Life Changes: Add forms related to any significant life events (e.g., marriage, new child, home purchase).

- List Expected Forms: Based on your income sources and financial activities, list all forms you expect to receive.

- Set Up a Tracking System: Create a simple spreadsheet or use a tax preparation app to track the receipt of each form.

Sample Tax Form Checklist: “A well-organized tax form checklist is like a roadmap for your tax journey. It ensures you don’t miss any crucial documents along the way.” – Lisa Patel, Certified Financial Planner

“A well-organized tax form checklist is like a roadmap for your tax journey. It ensures you don’t miss any crucial documents along the way.” – Lisa Patel, Certified Financial Planner

Digital vs. Paper Records: Pros and Cons

In 2025, the debate between digital and paper record-keeping continues. Let’s examine the pros and cons of each method:

Digital Records:

Pros:

- Easy to search and retrieve

- Takes up less physical space

- Can be backed up to prevent loss

- Accessible from multiple devices

Cons:

- Requires technical know-how

- Potential security risks if not properly protected

- May need to upgrade software periodically

Paper Records:

Pros:

- Tangible and easy to review

- No technology required

- Some people find it easier to organize physically

Cons:

- Takes up physical space

- Risk of loss due to fire or natural disasters

- Can be difficult to search through large volumes

Best Practice: Consider a hybrid approach, keeping digital copies of all documents while maintaining important original papers in a secure location.

Best Practices for Record-Keeping

Regardless of whether you choose digital, paper, or a hybrid system, follow these best practices:

- Consistent Naming Convention: Use a clear, consistent system for naming files or folders. Example: “2024_W2_EmployerName” or “2024_1099INT_BankName”

- Chronological Organization: Arrange documents by tax year to easily access previous years’ information.

- Secure Storage: Use a fireproof safe for paper documents and encrypted cloud storage for digital files.

- Regular Backups: For digital records, maintain regular backups on an external hard drive or secure cloud service.

- Separate Business and Personal: If you’re self-employed, keep business and personal tax documents in separate systems.

- Use Technology Wisely: Consider tax preparation software that can import and organize digital copies of your tax forms.

How Long to Keep Tax Forms and Records

Understanding retention periods for tax documents is crucial. Here’s a general guide:

- Keep for 3 Years: Most tax returns and supporting documents

- Keep for 6 Years: Returns with underreported income

- Keep for 7 Years: Records related to loss from worthless securities or bad debt deduction

- Keep Indefinitely: Records related to property

IRS Guidelines: The IRS recommends keeping records that support income, deductions, or credits shown on your tax return until the period of limitations for that return runs out. For more detailed information, visit the IRS Record Keeping page.

State-Specific Requirements: Some states have longer statutes of limitations than the federal government. Check with your state’s tax agency for specific requirements. For example, California requires taxpayers to keep records for at least four years.

Organizing Digital Tax Documents

In 2025, with the increasing prevalence of digital tax forms, having a robust system for organizing electronic documents is crucial. Here are some tips:

- Create a Digital Filing System:

- Set up a main “Taxes” folder on your computer or cloud storage.

- Create subfolders for each tax year (e.g., “2024 Taxes”, “2025 Taxes”).

- Within each year, create additional subfolders for different types of documents (e.g., “Income”, “Deductions”, “Investments”).

- Use Descriptive File Names: Example: “2024_W2_ABCCompany.pdf” or “2024_1098_MortgageInterest_XYZBank.pdf”

- Utilize Scanner Apps: Use smartphone apps to scan and digitize paper documents immediately upon receipt.

- Enable Two-Factor Authentication: Protect your digital tax documents by enabling two-factor authentication on your cloud storage accounts.

- Regular Maintenance: Set a quarterly reminder to organize and review your digital tax files.

Handling Physical Tax Documents

Despite the digital trend, many tax documents still arrive in paper form. Here’s how to manage them effectively:

- Designate a Physical Space: Set aside a specific drawer, file cabinet, or box for tax documents.

- Use a Filing System:

- Create folders for each tax year.

- Use colored folders or labels to distinguish different types of documents (e.g., green for income, blue for deductions).

- Implement a “Capture” System: Place a designated “inbox” or folder for new tax documents as they arrive.

- Regular Filing Sessions: Schedule monthly sessions to file accumulated documents into their proper places.

- Shred Outdated Documents: Invest in a quality shredder to securely dispose of old tax documents that are no longer needed.

Leveraging Technology for Tax Organization

In 2025, several technological tools can assist in organizing tax documents:

- Tax Preparation Software: Programs like TurboTax, H&R Block, and TaxAct often include document organization features.

- Personal Finance Apps: Apps like Mint or YNAB can categorize expenses throughout the year, making tax time easier.

- Document Management Software: Tools like Evernote or Microsoft OneNote can help organize scanned receipts and documents.

- Cloud Storage Services: Dropbox, Google Drive, or OneDrive offer secure storage and easy access to tax documents from multiple devices.

- Receipt Scanning Apps: Apps like Expensify or Receipt Bank can digitize and categorize receipts throughout the year.

“Embracing technology in tax document organization not only saves time but also reduces the risk of human error in record-keeping.” – Robert Chang, FinTech Analyst

Creating a Year-Round Tax Organization Habit

To make tax time less stressful, develop year-round habits:

- Monthly Review: Set aside time each month to review and file new tax documents.

- Quarterly Check-ins: Every three months, ensure all expected documents have been received and properly filed.

- Year-End Preparation: In December, start gathering documents and preparing your checklist for the upcoming tax season.

- Stay Informed: Regularly check the IRS website for updates on tax laws and form changes.

Case Study: The Impact of Organized Tax Records

Sarah, a freelance graphic designer, implemented a robust tax organization system in 2024. Here’s how it impacted her:

- Time Saved: Reduced tax preparation time from 15 hours to 5 hours.

- Increased Deductions: Discovered an additional $2,000 in deductible expenses she had previously overlooked.

- Stress Reduction: Reported feeling significantly less anxious about potential audits.

- Faster Refund: Received her tax refund 3 weeks earlier than the previous year due to prompt and accurate filing.

By implementing these strategies and best practices for organizing and tracking your tax forms, you can significantly streamline your tax preparation process, reduce stress, and potentially maximize your tax benefits. Remember, the key to effective tax organization is consistency and diligence throughout the year.

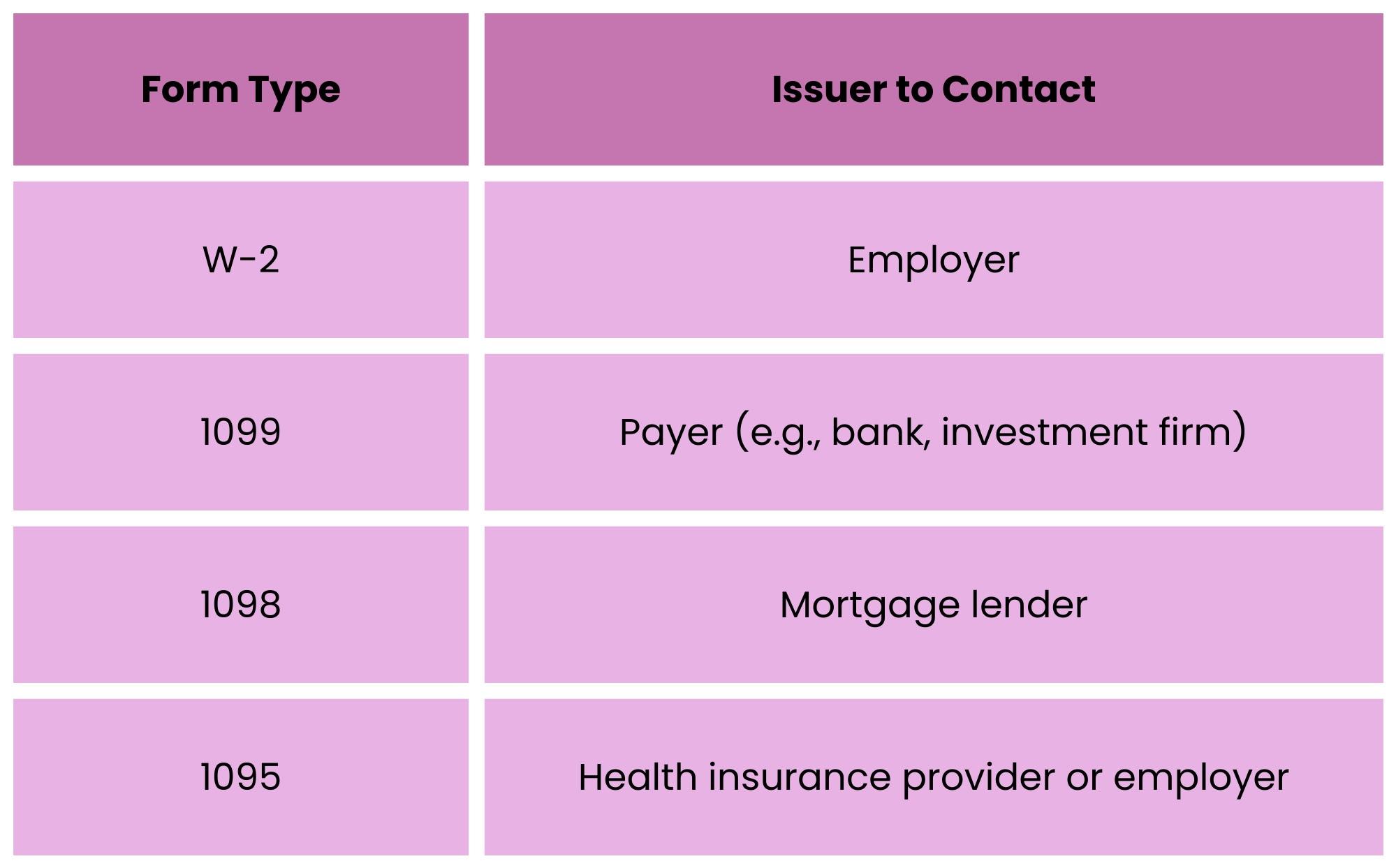

What to Do If You’re Missing Important Tax Forms

Even with the best organization systems in place, there may be times when you find yourself missing crucial tax forms as the filing deadline approaches. Here’s a comprehensive guide on how to handle this situation in 2025.

Steps to Take When Forms Are Late or Missing

- Check Online Accounts: Many institutions now provide tax forms electronically through their online portals. Log into your accounts to check if the forms are available there.

- Contact the Issuer: If a form is missing, reach out to the organization responsible for sending it. Here’s a quick reference for common forms:

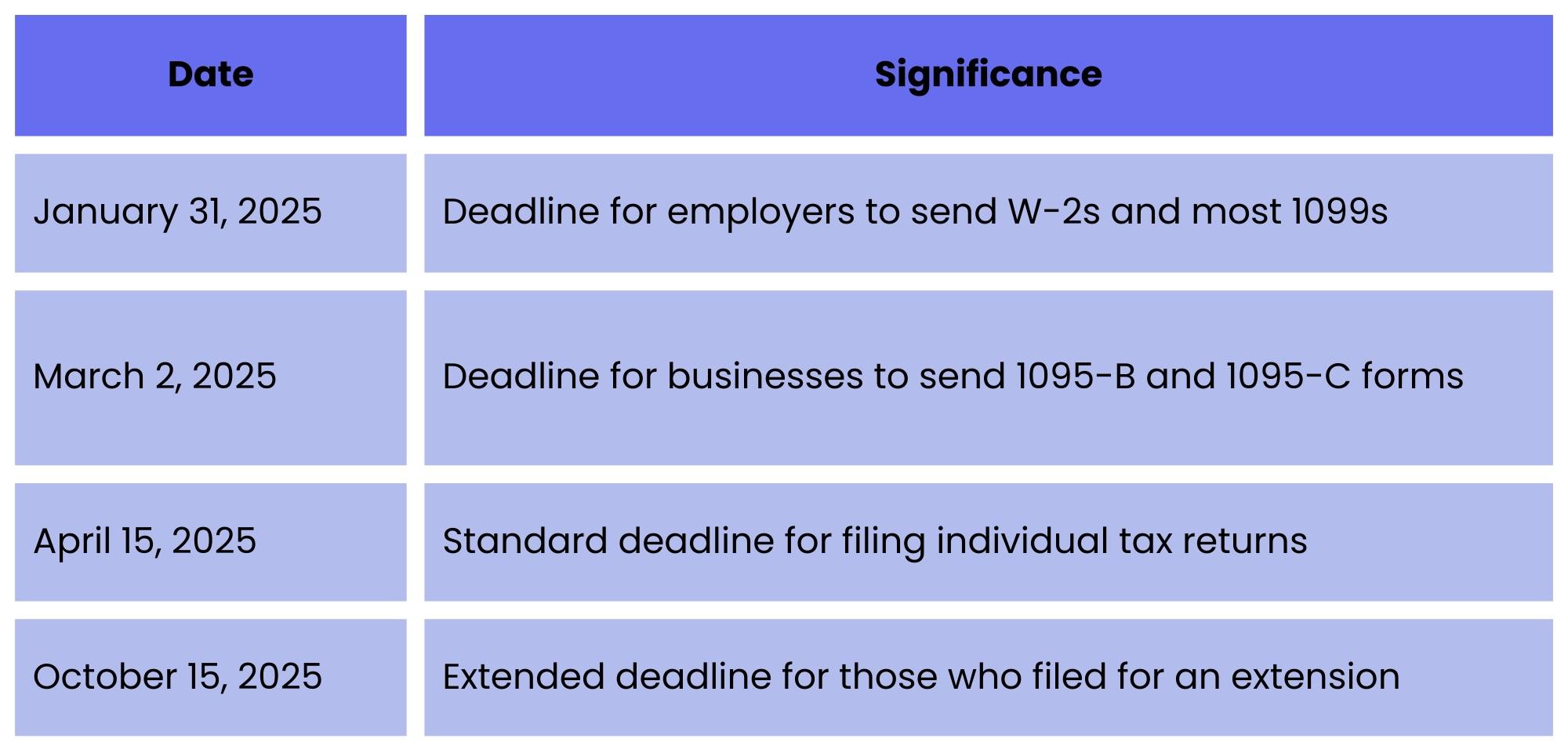

- Allow for Processing Time: Remember that issuers have deadlines to send forms:

- W-2s and most 1099s: January 31, 2025

- 1095s: March 2, 2025 (for 2024 tax year)

- Check Your Mail Carefully: Some tax forms can look like junk mail. Review all mail thoroughly during tax season.

- Update Your Address: If you’ve moved recently, ensure all relevant institutions have your current address.

Using Online Resources

The IRS provides several online tools to help taxpayers retrieve tax information:

- Get Transcript Tool: Access tax return transcripts, wage and income transcripts, and account transcripts online. Visit the IRS Get Transcript page for more information.

- IRS2Go Mobile App: The official IRS app allows you to check your refund status and access tax records.

- Social Security Administration: For missing W-2s, you can view your reported wages on the Social Security website.

“The IRS’s online tools have become increasingly user-friendly. In most cases, you can retrieve the information you need without having to call or visit an IRS office.” – David Martinez, IRS Enrolled Agent

Estimating Information as a Last Resort

If you’ve exhausted all options and still can’t obtain a form, you may need to estimate the information:

- Use Past Records: Reference last year’s form or financial statements to make an educated estimate.

- Collect Supporting Documents: Gather pay stubs, bank statements, or other records that can support your estimates.

- Document Your Efforts: Keep a detailed record of your attempts to obtain the missing form.

- Use Form 4852: If you’re missing a W-2 or 1099-R, you can file Form 4852 as a substitute. This form allows you to estimate your income and withholding taxes.

- File an Extension: If you need more time to obtain accurate information, consider filing for an extension using Form 4868. This gives you until October 15, 2025, to file your 2024 return.

Important: While estimating is acceptable when necessary, it’s crucial to be as accurate as possible. Significant discrepancies between your estimates and the actual figures could trigger an IRS inquiry.

Special Considerations for 2025

- Cryptocurrency Reporting: With increased focus on cryptocurrency transactions, ensure you have records of all digital asset activities, even if you didn’t receive a formal 1099 form.

- Gig Economy Income: If you participated in the gig economy, you might receive a 1099-K for amounts over $600. If you don’t receive one, you’re still required to report this income.

- Economic Impact Payments: If you received any additional stimulus payments in 2024, you should receive a notice detailing the amount. Keep this for your records.

What to Do If You’ve Already Filed and Then Receive a Missing Form

If you file your tax return and then receive a previously missing form, follow these steps:

- Compare the Information: Check if the information on the newly received form matches what you reported on your tax return.

- Determine if an Amendment is Necessary: If there are significant differences that affect your tax liability, you may need to file an amended return.

- File Form 1040-X: Use Form 1040-X to amend your return if necessary. As of 2025, you can file this form electronically for the current tax year and up to three prior years.

- Timing of Amendment: Generally, you have three years from the date you filed your original return to file an amendment.

- Keep Records: Maintain copies of both your original return and the amended return for your records.

“Receiving a form after filing isn’t uncommon. The key is to act promptly and transparently if the new information significantly changes your tax situation.” – Emily Watson, Tax Attorney

Preventing Missing Forms in the Future

To minimize the chances of missing forms in future tax seasons:

- Create a Tax Form Calendar: Note when you typically receive each form and set reminders to follow up if they’re not received by a certain date.

- Update Contact Information: Ensure all employers, financial institutions, and other relevant organizations have your current mailing and email addresses.

- Opt for Electronic Delivery: When possible, choose to receive tax forms electronically to reduce the risk of lost mail.

- Keep a Running List: Throughout the year, maintain a list of organizations that should send you tax forms.

- Use Tax Preparation Software: Many tax software programs can import information directly from financial institutions, reducing the reliance on paper forms.

Case Study: Handling a Missing 1099-MISC

John, a freelance writer, was missing a 1099-MISC from a client when preparing his 2024 taxes. Here’s how he handled it:

- He contacted the client, who confirmed they had mailed the form.

- John checked his online client portal and found an electronic copy of the 1099-MISC.

- He compared the information with his own records to ensure accuracy.

- John included this income on his tax return, using the electronic form as reference.

- He documented the steps taken to obtain the form in case of future IRS inquiries.

Dealing with Corrected Forms

Sometimes, you may receive a corrected version of a tax form after the original was sent. Here’s how to handle this:

- Compare Both Versions: Identify what information has changed between the original and corrected forms.

- Determine the Impact: Assess how the changes affect your tax return calculations.

- File an Amendment if Necessary: If you’ve already filed your return based on the original form, you may need to file an amended return using Form 1040-X.

- Keep Both Versions: Retain copies of both the original and corrected forms for your records.

- Communicate with the Issuer: If you’re unsure why a form was corrected, contact the issuer for clarification.

Utilizing IRS Taxpayer Advocate Service

If you’re facing difficulty obtaining necessary forms or resolving issues related to missing documents, the Taxpayer Advocate Service (TAS) can help:

- What is TAS? An independent organization within the IRS that helps taxpayers resolve problems with the IRS.

- When to Contact TAS:

- You’ve tried to resolve the issue through normal IRS channels without success.

- You’re facing economic harm or significant cost due to the missing form.

- You’ve experienced delays of more than 30 days in resolving your tax issue.

- How to Reach TAS: Visit the Taxpayer Advocate Service website or call 1-877-777-4778.

- Services Provided: TAS can help you navigate complex tax situations, including issues with missing or incorrect forms.

By following these strategies, you can effectively manage situations where important tax forms are missing or delayed. Remember, the key is to act proactively, maintain good records, and seek professional help when needed. With proper planning and prompt action, you can navigate these challenges and ensure accurate and timely tax filing.

Understanding Deadlines for Tax Forms

Knowing the key dates and deadlines associated with various tax forms is crucial for timely and accurate tax filing. As we look ahead to the 2025 tax season, let’s break down the important deadlines and what they mean for taxpayers.

Key Dates to Remember for the 2024 Tax Year (Filing in 2025) “Understanding tax deadlines is not just about avoiding penalties; it’s about planning your financial year effectively.” – Maria Gonzalez, CPA

“Understanding tax deadlines is not just about avoiding penalties; it’s about planning your financial year effectively.” – Maria Gonzalez, CPA

When to Expect Different Forms

- W-2 Forms:

- Expected arrival: By January 31, 2025

- Action if not received: Contact your employer by February 15, 2025

- 1099 Forms:

- Most 1099s (including 1099-MISC, 1099-NEC): By January 31, 2025

- 1099-B (for securities transactions): By February 15, 2025

- Action if not received: Contact the issuer by mid-February

- 1098 Forms (Mortgage Interest):

- Expected arrival: By January 31, 2025

- Action if not received: Contact your mortgage lender by mid-February

- 1095 Forms (Health Insurance):

- 1095-A (Marketplace Insurance): By January 31, 2025

- 1095-B and 1095-C: By March 2, 2025

- Note: You don’t need to wait for 1095-B or 1095-C to file your taxes

- K-1 Forms (for partnerships, S corporations, and some trusts):

- Deadline: March 15, 2025

- Note: K-1s often arrive later, sometimes necessitating an extension

Filing Deadlines for Different Taxpayer Categories

- Individual Tax Returns (Form 1040):

- Standard deadline: April 15, 2025

- Extended deadline (with Form 4868): October 15, 2025

- Self-Employed Individuals:

- Quarterly Estimated Tax Payments:

- Q1: April 15, 2025

- Q2: June 15, 2025

- Q3: September 15, 2025

- Q4: January 15, 2026

- Quarterly Estimated Tax Payments:

- Businesses:

- S Corporations and Partnerships: March 15, 2025

- C Corporations: April 15, 2025

- Extended deadlines available with proper filing

- Nonprofit Organizations (Form 990):

- Due by the 15th day of the 5th month after the organization’s accounting period ends

- For calendar year organizations: May 15, 2025

- Foreign Account Reporting (FBAR):

- FinCEN Form 114: April 15, 2025

- Automatic extension to October 15, 2025

Important Considerations for 2025

- Weekend and Holiday Adjustments: If a deadline falls on a weekend or legal holiday, it moves to the next business day.

- State Tax Deadlines: While many states align with federal deadlines, some have different dates. Check your state’s tax authority website for specific deadlines.

- Natural Disaster Extensions: The IRS may provide deadline extensions for taxpayers affected by natural disasters. Check the IRS disaster relief page for updates.

- Early Filing Benefits:

- Faster refunds

- Reduced risk of tax identity theft

- More time to address any issues that may arise

- Extension Filing:

- An extension gives you more time to file, not more time to pay

- If you owe taxes, estimate and pay by April 15 to avoid penalties and interest

Strategies for Meeting Tax Deadlines

- Create a Tax Calendar: Set up reminders for key dates throughout the year, including quarterly estimated tax payments for self-employed individuals.

- Gather Documents Early: Start collecting necessary documents in January to avoid last-minute rushes.

- Use Technology: Utilize tax preparation software or apps that can send deadline reminders and track document receipt.

- Consider Professional Help: If your tax situation is complex, consider working with a tax professional who can help ensure timely filing.

- File Electronically: E-filing typically results in faster processing and quicker refunds.

“Procrastination is the thief of tax refunds. Early preparation not only ensures timely filing but often leads to more thorough and accurate returns.” – Thomas Lee, Tax Preparation Specialist

Case Study: The Cost of Missing Deadlines

Sarah, a freelance graphic designer, missed the April 15 filing deadline in 2024. Here’s what happened:

- She owed $3,000 in taxes

- Failure-to-file penalty: 5% of unpaid taxes per month (max 25%)

- Failure-to-pay penalty: 0.5% of unpaid taxes per month

- Interest on unpaid taxes: Federal short-term rate plus 3%

Total additional cost after 2 months: $450 in penalties plus interest

Lesson learned: Sarah now sets multiple reminders and starts her tax preparation in February to avoid future penalties.

Special Deadline Considerations for 2025

- Cryptocurrency Reporting: With increased focus on digital assets, ensure all crypto transactions are reported by the standard filing deadline.

- Gig Economy Workers: If you work in the gig economy, be aware of the lowered threshold for receiving Form 1099-K ($600 as of 2024) and plan accordingly.

- Foreign Income: If you have foreign income or assets, be mindful of additional reporting requirements like FBAR and Form 8938, which have specific deadlines.

- Retirement Account Contributions:

- Traditional and Roth IRA contributions for 2024 can be made until April 15, 2025

- SEP IRA contributions can be made until the tax filing deadline, including extensions

What to Do If You Miss a Deadline

- File as Soon as Possible: Even if late, file your return as soon as you can to minimize penalties.

- Pay What You Can: If you owe taxes, pay as much as possible to reduce penalties and interest.

- Consider an Installment Agreement: If you can’t pay in full, apply for a payment plan with the IRS.

- Request Penalty Abatement: If you have a reasonable cause for missing the deadline, you can request penalty abatement from the IRS.

- Seek Professional Help: A tax professional can help you navigate the process of late filing and minimize negative consequences.

Preparing for Future Tax Seasons

- Year-Round Tax Planning: Don’t wait until tax season to think about taxes. Regularly review your tax situation throughout the year.

- Adjust Withholdings: Use the IRS Tax Withholding Estimator to ensure you’re having the right amount withheld from your paychecks.

- Keep Organized Records: Maintain a system for organizing tax-related documents throughout the year.

- Stay Informed: Keep abreast of tax law changes that might affect your filing requirements or deadlines.

By understanding and adhering to these deadlines, you can ensure a smoother tax filing process, avoid penalties, and potentially receive your refund faster. Remember, when it comes to taxes, being proactive and organized is key to success.

How Technology Is Changing Tax Form Management

As we look ahead to the 2025 tax season, it’s clear that technology continues to revolutionize the way we manage tax forms and prepare our returns. This section explores the latest technological advancements in tax preparation and how they’re making the process more efficient, accurate, and accessible for taxpayers.

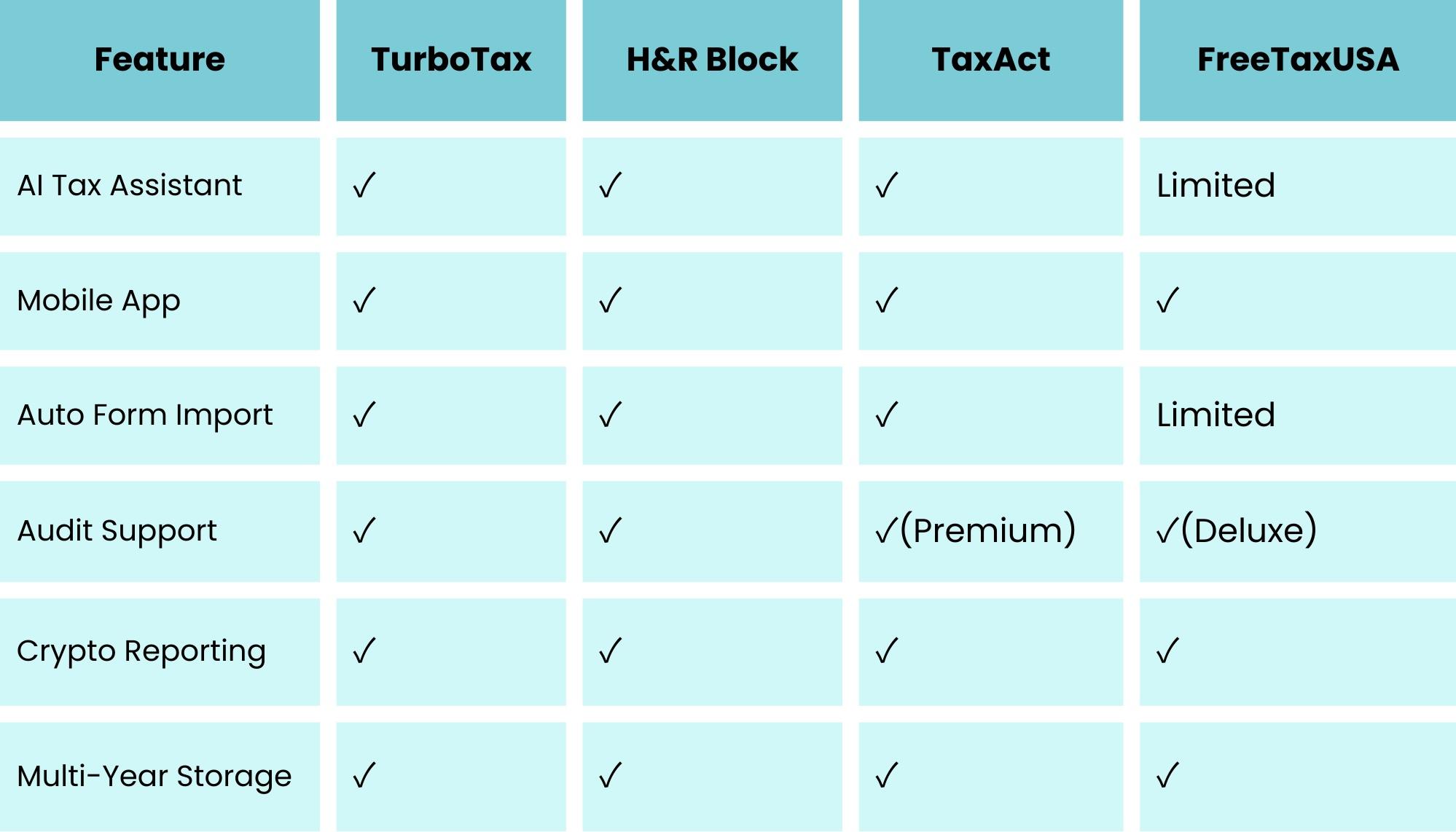

Digital Tax Preparation Tools

The landscape of tax preparation software has evolved significantly, offering more sophisticated features and user-friendly interfaces. Here’s an overview of how these tools are simplifying form management and filing:

- Automated Form Import:

- Many tax software programs can now directly import W-2s, 1099s, and other forms from employers and financial institutions.

- This feature reduces manual data entry errors and saves time.

- AI-Powered Assistance:

- Advanced algorithms help identify potential deductions and credits based on your financial data.

- Some software can even predict questions you might have and provide real-time answers.

- Mobile Optimization:

- Most major tax preparation software now offers robust mobile apps.

- These apps allow users to photograph and upload tax documents, track refunds, and even complete their entire return on a smartphone.

- Cloud-Based Storage:

- Secure cloud storage for tax documents ensures easy access across devices and protects against data loss.

- Many services offer multi-year storage, making it easy to reference past returns.

- Integration with Financial Apps:

- Tax software increasingly integrates with personal finance apps and accounting software.

- This integration allows for year-round tax planning and easier data compilation come tax season.

“The future of tax preparation is not just about filling out forms; it’s about creating a seamless, intelligent experience that understands each taxpayer’s unique financial situation.” – Dr. Samantha Lee, FinTech Researcher

Comparison of Popular Tax Software Features (2025 Projections) IRS Online Services

IRS Online Services

The Internal Revenue Service has made significant strides in modernizing its online offerings, making it easier for taxpayers to access forms, check status updates, and file returns electronically.

- Improved Where’s My Refund Tool:

- Real-time updates on refund status

- More detailed information on refund delays and processing steps

- Enhanced Online Account Access:

- View detailed tax records

- Make payments and set up payment plans online

- Access and download most tax forms

- Direct File Pilot Program:

- As of 2025, the IRS is expanding its direct file program, allowing more taxpayers to file simple returns directly with the IRS for free.

- Digital Signatures and Authentication:

- Advanced digital signature options for e-filing

- Multi-factor authentication for increased security

- API Integration:

- The IRS is developing APIs that allow approved third-party software to securely access certain tax information, streamlining the filing process.

Emerging Technologies in Tax Preparation

- Blockchain for Tax Reporting:

- Some companies are exploring blockchain technology to create immutable records of financial transactions, potentially simplifying tax reporting and reducing fraud.

- Machine Learning for Audit Risk Assessment:

- Advanced algorithms are being developed to help identify returns with a higher risk of audit, potentially reducing the burden on compliant taxpayers.

- Natural Language Processing:

- Chatbots and virtual assistants are becoming more sophisticated, offering personalized tax advice and answering complex questions.

- Augmented Reality (AR) for Tax Education:

- Some tax preparation companies are experimenting with AR to create interactive tutorials and visualizations of complex tax concepts.

- Internet of Things (IoT) for Business Expense Tracking:

- IoT devices are being integrated into expense tracking systems, automatically logging business-related expenses for more accurate deductions.

Case Study: The Impact of AI on Tax Preparation

In 2024, a major tax software company introduced an AI-powered tax assistant. Here’s how it affected users:

- 30% reduction in time spent preparing taxes

- 15% increase in the average refund amount due to better identification of deductions and credits

- 40% decrease in user support calls, as the AI could answer most common questions

- 98% user satisfaction rate, with many praising the intuitive and personalized experience

Cybersecurity Considerations in Digital Tax Management

As tax preparation becomes increasingly digital, cybersecurity becomes paramount. Here are key considerations:

- Multi-Factor Authentication (MFA):

- Most reputable tax software now requires MFA for account access.

- The IRS strongly recommends using MFA for all tax-related accounts.

- Encryption:

- Look for software that uses end-to-end encryption for data transmission and storage.

- Regular Software Updates:

- Keep your tax preparation software updated to ensure you have the latest security patches.

- Phishing Awareness:

- Be cautious of emails claiming to be from the IRS or tax software companies, especially those requesting personal information.

- Secure Wi-Fi:

- Avoid preparing taxes on public Wi-Fi networks. Use a secure, private connection.

“As tax preparation technology advances, so do the methods of cybercriminals. Staying informed about cybersecurity best practices is as important as understanding tax laws.” – Alex Chen, Cybersecurity Expert

The Future of Tax Form Management

Looking ahead, we can anticipate several trends in tax form management:

- Continuous Tax Assessment:

- Real-time tax calculation throughout the year, adjusting for life events and financial changes.

- Integration with Digital Wallets:

- Seamless connection between digital payment platforms and tax reporting systems.

- Voice-Activated Tax Preparation:

- Using voice assistants to guide taxpayers through the filing process.

- Predictive Analytics:

- Tax software that can predict future tax liabilities based on current financial behaviors and suggest optimizations.

- Biometric Authentication:

- Advanced biometric security measures for accessing tax accounts and submitting returns.

Tips for Leveraging Technology in Tax Preparation

- Start Early: Begin gathering digital documents and importing data into your chosen tax software well before the filing deadline.

- Use Multiple Features: Take advantage of all the features offered by your tax preparation software, including expense categorization and deduction finders.

- Stay Informed: Keep your software updated and regularly check for new features that could simplify your tax preparation process.

- Backup Your Data: Even with cloud storage, maintain local backups of important tax documents and completed returns.

- Verify Accuracy: While technology can greatly assist in tax preparation, always review your return carefully before submitting.

- Explore Integration Options: Look for tax software that integrates with your existing financial management tools for a more streamlined experience.

Challenges and Limitations of Tax Technology

While technology has greatly improved tax form management, it’s important to be aware of its limitations:

- Complex Tax Situations: Very complex tax scenarios may still require professional human assistance.

- Over-Reliance on Automation: Blindly trusting software without understanding the underlying tax principles can lead to errors.

- Privacy Concerns: The more integrated tax systems become, the more important it is to understand how your data is being used and protected.

- Digital Divide: Not all taxpayers have equal access to or comfort with advanced tax preparation technologies.

- Regulatory Lag: Tax laws and regulations may not keep pace with technological advancements, creating gray areas in compliance.

As we embrace these technological advancements in tax form management, it’s crucial to balance the benefits of efficiency and accuracy with a mindful approach to data security and personal understanding of tax principles. The future of tax preparation is undoubtedly digital, but it’s important to use these tools as aids rather than substitutes for tax knowledge and diligence.

Common Mistakes to Avoid When Dealing with Tax Forms

Even with advanced technology at our fingertips, taxpayers can still fall prey to common errors when handling tax forms. Being aware of these pitfalls can help you avoid costly mistakes and ensure a smooth tax filing process. Let’s explore some of the most frequent mistakes and how to avoid them.

1. Overlooking Less Common Forms

One of the most common mistakes is failing to report income from all sources, often due to overlooking less common tax forms.

Common Oversights:

- Form 1099-K for gig economy work or online sales

- Form 1099-INT for small amounts of interest income

- Form 1099-DIV for dividend payments

- Form 1099-G for state tax refunds or unemployment compensation

How to Avoid:

- Create a comprehensive checklist of all potential income sources

- Review last year’s tax return for any recurring forms

- Keep a folder (physical or digital) throughout the year for any tax-related documents

“The key to accurate tax filing is comprehensive record-keeping. Every form matters, no matter how small the amount.” – Emily Rodriguez, Tax Consultant

2. Misreporting Information from Forms

Transcription errors or misunderstanding form instructions can lead to inaccurate reporting.

Common Errors:

- Transposing numbers when entering data

- Misinterpreting box labels on complex forms like 1099-B for investment income

- Incorrectly reporting cryptocurrency transactions

How to Avoid:

- Double-check all entries against original forms

- Use software that can import data directly from financial institutions

- For complex forms, consider seeking professional help or using IRS resources for clarification

3. Failing to Report All Income Sources

Underreporting income, even unintentionally, can lead to penalties and audits.

Often Missed Income:

- Cash payments for freelance work

- Bartering exchanges

- Foreign income

- Rental income from short-term rentals (e.g., Airbnb)

How to Avoid:

- Keep meticulous records of all income, including cash transactions

- Use accounting software to track various income streams

- Be aware of reporting requirements for foreign income and assets

4. Incorrect Social Security Numbers

A simple typo in a Social Security number can cause significant issues with tax filing.

Potential Consequences:

- Delayed processing of your return

- Rejection of e-filed returns

- Difficulties in matching your tax forms with IRS records

How to Avoid:

- Double-check SSNs for yourself, spouse, and dependents

- Verify SSNs on W-2s and 1099s against your Social Security card

- Use software with error-checking features for SSN formats

5. Math Errors

While less common with electronic filing, math errors can still occur, especially in manual calculations.

Common Mathematical Mistakes:

- Addition errors when summing up deductions

- Percentage calculation errors for partial-year deductions

- Misapplying tax tables

How to Avoid:

- Use tax preparation software to minimize calculation errors

- If calculating manually, double-check all math with a calculator

- Have someone else review your calculations

6. Missing or Incorrect Filing Status

Choosing the wrong filing status can significantly impact your tax liability.

Potential Errors:

- Married couples filing as single

- Incorrectly claiming head of household status

- Not updating status after life changes (e.g., divorce, death of spouse)

How to Avoid:

- Review IRS guidelines for filing status definitions each year

- Consider life changes that might affect your status

- Consult a tax professional if unsure about your correct filing status

7. Forgetting to Sign and Date the Return

A simple but critical error is forgetting to sign and date your tax return.

Consequences:

- The IRS will not process an unsigned return

- Can lead to delays in receiving refunds

How to Avoid:

- Set a reminder to sign and date before mailing

- For e-filing, ensure you complete all electronic signature requirements

8. Mishandling Cryptocurrency Transactions

With the rise of digital assets, properly reporting cryptocurrency transactions has become increasingly important.

Common Mistakes:

- Failing to report crypto-to-crypto exchanges

- Incorrectly calculating cost basis for crypto sales

- Not reporting mining or staking income

How to Avoid:

- Keep detailed records of all cryptocurrency transactions

- Use specialized crypto tax software to track transactions and calculate gains/losses

- Stay informed about the latest IRS guidance on cryptocurrency reporting

“The world of cryptocurrency taxation is complex and evolving. When in doubt, consult with a tax professional who specializes in digital assets.” – Michael Chang, Crypto Tax Specialist

9. Incorrect Bank Account Information

Providing incorrect bank details can delay your refund or cause issues with tax payments.

Potential Errors:

- Transposed numbers in routing or account numbers

- Using an account that’s been closed

- Providing a savings account number instead of checking (or vice versa)

How to Avoid:

- Triple-check all bank account information

- Use a voided check to verify account and routing numbers

- Ensure the account is open and in good standing

10. Overlooking State-Specific Forms

Many taxpayers focus solely on federal forms and overlook state-specific requirements.

Common Oversights:

- State-specific credits or deductions

- Local tax forms for cities or counties

- Forms for multiple states if you’ve moved or worked across state lines

How to Avoid:

- Research your state’s tax requirements early in the process

- Use state-specific tax preparation software or guides

- Consider consulting with a local tax professional

11. Misunderstanding Deductions and Credits

Confusion about the difference between deductions and credits, or misapplying them, can lead to errors.

Frequent Mistakes:

- Claiming the standard deduction and itemized deductions simultaneously

- Misunderstanding the income limits for certain credits

- Overlooking less common credits (e.g., Saver’s Credit, Energy Efficiency Credits)

How to Avoid:

- Educate yourself on the basics of deductions vs. credits

- Use the IRS Interactive Tax Assistant for guidance on credits and deductions

- Consider professional help for complex tax situations

12. Rushing Through the Process

Many errors occur simply because taxpayers rush through the filing process, especially as deadlines approach.

Consequences of Rushing:

- Overlooking income or deductions

- Making careless errors in data entry

- Missing opportunities for tax-saving strategies

How to Avoid:

- Start the tax preparation process early

- Break the task into smaller, manageable sessions

- Allow time for a thorough review before submitting

Case Study: The Cost of Careless Errors

In 2024, John, a freelance graphic designer, rushed through his tax return and made several mistakes:

- He forgot to include $5,000 in 1099 income from a small client

- He transposed two digits in his bank account number for his refund

- He miscalculated his home office deduction

Results:

- The IRS sent a notice of underreported income, resulting in additional taxes owed plus penalties and interest

- His refund was delayed by 8 weeks due to the incorrect bank information

- He had to file an amended return to correct the home office deduction, incurring additional time and stress

Total Cost: Over $1,500 in additional taxes, penalties, and professional fees to resolve the issues.

Tips for Avoiding Common Tax Form Mistakes

- Use a Checklist: Create a comprehensive checklist of all potential forms, income sources, and deductions.

- Leverage Technology: Use reputable tax preparation software with built-in error checks.

- Take Your Time: Allow ample time for preparation and review. Rushing leads to mistakes.

- Stay Organized Year-Round: Maintain a system for organizing tax documents throughout the year.

- Educate Yourself: Stay informed about tax law changes and reporting requirements.

- Seek Professional Help: For complex situations, consider working with a certified tax professional.

- Review, Review, Review: Always thoroughly review your return before submitting, preferably after taking a break to approach it with fresh eyes.

- Keep Accurate Records: Maintain detailed records to support all income and deductions claimed.

- Use IRS Resources: Take advantage of IRS publications, online tools, and interactive assistants for guidance.

- Stay Consistent: Ensure information is consistent across all forms and schedules.

- Update Personal Information: Keep your personal information (address, name changes, etc.) up to date with the IRS and your employers.

- Verify Third-Party Forms: Cross-check information on forms like W-2s and 1099s with your own records.

Handling Mistakes After Filing

Despite best efforts, mistakes can still happen. If you discover an error after filing, here’s what to do:

- Determine if an Amendment is Necessary: Not all mistakes require an amended return. Minor math errors are often caught and corrected by the IRS.

- File Form 1040-X for Amendments: Use Form 1040-X to amend your return if necessary. As of 2025, this form can be filed electronically for the current tax year and up to three prior years.

- Act Quickly: If you owe additional tax, file the amendment and pay the tax as soon as possible to minimize penalties and interest.

- Provide a Clear Explanation: Include a written explanation of why you’re amending your return.

- Be Patient: Processing amended returns can take up to 16 weeks.

“Mistakes happen, but how you handle them matters. Quick, honest, and thorough corrections can often mitigate potential issues with the IRS.” – Laura Martinez, IRS Enrolled Agent

The Role of Professional Help

While many taxpayers can successfully file their own returns, certain situations may warrant professional assistance:

Consider Professional Help If:

- You have a complex financial situation (e.g., multiple income sources, investments, rental properties)

- You’ve experienced major life changes (marriage, divorce, new business)

- You’re unsure about new tax laws or how they apply to your situation

- You’ve received notices from the IRS

- You want to ensure you’re maximizing all possible deductions and credits

Benefits of Professional Assistance:

- Expertise in current tax laws and regulations

- Potential for identifying overlooked deductions or credits

- Time-saving for complex returns

- Representation in case of an audit

- Peace of mind knowing your return is accurate and compliant

Emerging Trends in Error Prevention

As we look towards the future of tax preparation, several trends are emerging to help prevent common mistakes:

- AI-Powered Error Detection: Advanced algorithms are being developed to identify inconsistencies and potential errors in tax returns.

- Blockchain for Income Verification: Some companies are exploring blockchain technology to create tamper-proof records of income and transactions.

- Automated Cross-Referencing: Tax software is becoming more sophisticated in cross-referencing different forms and schedules for inconsistencies.

- Real-Time Tax Impact Calculators: Tools that show the real-time impact of financial decisions on your tax liability throughout the year.

- Enhanced Integration with Financial Institutions: Improved data sharing between banks, employers, and tax software to ensure accurate reporting.

Final Thoughts on Avoiding Tax Form Mistakes

Avoiding mistakes on tax forms is a combination of diligence, organization, and leveraging the right tools and resources. By understanding common pitfalls and implementing strategies to avoid them, you can significantly reduce the risk of errors on your tax return. Remember, accuracy in tax filing not only helps you avoid potential issues with the IRS but can also ensure you’re taking full advantage of all the deductions and credits you’re entitled to.

As tax laws and technologies continue to evolve, staying informed and adapting your tax preparation strategies accordingly will be key to maintaining accuracy and compliance. Whether you choose to file on your own or seek professional assistance, approaching your taxes with care and attention to detail will always be the best strategy for a successful filing experience.

Special Considerations for Different Taxpayer Categories

As we navigate the complexities of tax filing in 2025, it’s important to recognize that different taxpayer categories face unique challenges and opportunities. This section will explore the special considerations for various groups of taxpayers, providing targeted advice and insights for each category.

Tax Forms for Self-Employed Individuals

Self-employed individuals, including freelancers and small business owners, face a unique set of tax considerations.

Key Forms to Be Aware Of:

- Schedule C (Form 1040): Profit or Loss from Business

- Schedule SE (Form 1040): Self-Employment Tax

- Form 1099-NEC: Nonemployee Compensation

- Form 1099-K: Payment Card and Third Party Network Transactions

Important Considerations:

- Quarterly Estimated Tax Payments: Use Form 1040-ES to calculate and pay estimated taxes four times a year.

- Self-Employment Tax: You’re responsible for both the employer and employee portions of Social Security and Medicare taxes.

- Home Office Deduction: If you use part of your home exclusively for business, you may be eligible for this deduction.

- Health Insurance Premiums: Self-employed individuals may be able to deduct health insurance premiums.

“For self-employed individuals, meticulous record-keeping throughout the year is crucial. It not only ensures accurate tax filing but also maximizes potential deductions.” – Dr. Jennifer Lee, Small Business Tax Expert

Tax Forms for Investors

Investors need to be aware of several forms and considerations specific to investment income.

Key Forms:

- Schedule B: Interest and Ordinary Dividends

- Schedule D: Capital Gains and Losses

- Form 8949: Sales and Other Dispositions of Capital Assets

- Form 1099-DIV: Dividends and Distributions

- Form 1099-INT: Interest Income

- Form 1099-B: Proceeds from Broker and Barter Exchange Transactions

Important Considerations:

- Capital Gains: Be aware of the difference between short-term and long-term capital gains tax rates.

- Wash Sale Rule: Understand the implications of selling a security at a loss and repurchasing a substantially identical security within 30 days.

- Cryptocurrency Reporting: As of 2025, there are specific reporting requirements for cryptocurrency transactions.

2025 Update: The IRS has introduced new reporting requirements for digital asset transactions, affecting many investors in cryptocurrencies and NFTs.

Tax Forms for Students and Recent Graduates

Students and recent graduates have unique tax situations, often involving education-related expenses and income.

Key Forms:

- Form 1098-T: Tuition Statement

- Form 1098-E: Student Loan Interest Statement

- Form 8863: Education Credits (American Opportunity and Lifetime Learning Credits)

Important Considerations:

- Education Credits: Understand the differences between the American Opportunity Credit and the Lifetime Learning Credit.

- Student Loan Interest Deduction: You may be able to deduct up to $2,500 in student loan interest (subject to income limitations).

- Scholarships and Grants: Some may be taxable, depending on how they’re used.

Tax Forms for Retirees

Retirees often have multiple sources of income and unique deductions to consider.

Key Forms:

- Form SSA-1099: Social Security Benefit Statement

- Form 1099-R: Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

- Form 1040-SR: U.S. Tax Return for Seniors (optional alternative to Form 1040)

Important Considerations:

- Required Minimum Distributions (RMDs): Understand the rules for RMDs from retirement accounts.

- Social Security Benefits: A portion of your Social Security benefits may be taxable, depending on your total income.

- Additional Standard Deduction: Taxpayers aged 65 or older may be eligible for an additional standard deduction amount.

Tax Forms for International Taxpayers

U.S. citizens living abroad and non-citizens with U.S. income face complex tax situations.

Key Forms:

- Form 2555: Foreign Earned Income

- Form 1116: Foreign Tax Credit

- FinCEN Form 114: Report of Foreign Bank and Financial Accounts (FBAR)

- Form 8938: Statement of Specified Foreign Financial Assets

Important Considerations:

- Foreign Earned Income Exclusion: You may be able to exclude a certain amount of foreign earnings from U.S. tax.

- Foreign Tax Credit: This can help prevent double taxation on income taxed by both the U.S. and a foreign country.

- FBAR Filing: Required if the aggregate value of your foreign financial accounts exceeds $10,000 at any time during the calendar year.

- FATCA Reporting: Form 8938 is required for taxpayers with foreign financial assets above certain thresholds.

“International tax compliance is complex and ever-changing. Staying informed about reporting requirements is crucial to avoid significant penalties.” – Maria Garcia, International Tax Attorney

Tax Forms for Gig Economy Workers

The gig economy continues to grow, and with it comes specific tax considerations for workers in this sector.

Key Forms:

- Form 1099-K: Payment Card and Third Party Network Transactions

- Form 1099-NEC: Nonemployee Compensation

- Schedule C (Form 1040): Profit or Loss from Business

Important Considerations:

- Multiple Income Sources: Keep detailed records of income from various platforms or clients.

- Expense Tracking: Be diligent about tracking and categorizing business expenses.

- Quarterly Estimated Taxes: As gig workers are typically considered self-employed, quarterly tax payments may be necessary.

2025 Update: The threshold for receiving Form 1099-K has been lowered to $600, affecting many more gig workers than in previous years.

Tax Forms for Rental Property Owners

Owning rental property comes with its own set of tax implications and forms.

Key Forms:

- Schedule E (Form 1040): Supplemental Income and Loss

- Form 4562: Depreciation and Amortization

- Form 1098: Mortgage Interest Statement

Important Considerations:

- Passive Activity Rules: Understand how these rules affect your ability to deduct rental losses.

- Depreciation: Learn how to correctly calculate and report depreciation on your rental property.

- Short-Term Rentals: Special rules may apply for properties rented out for short periods (e.g., through platforms like Airbnb).

Tax Forms for Non-Profit Organizations

Non-profit organizations have unique tax filing requirements.

Key Forms:

- Form 990 Series: Return of Organization Exempt From Income Tax (various versions depending on organization size and type)

- Form 1023: Application for Recognition of Exemption Under Section 501(c)(3)

Important Considerations:

- Public Disclosure: Most tax-exempt organizations must make their Form 990 available for public inspection.

- Unrelated Business Income: Non-profits may need to report and pay tax on income from activities unrelated to their exempt purpose.

- State-Specific Requirements: Be aware of additional state-level filing requirements for non-profits.

Special Considerations for 2025

- Cryptocurrency and Digital Assets:

- Enhanced reporting requirements for digital asset transactions.

- New forms specifically designed for reporting crypto income and capital gains.

- Remote Work Implications:

- With the continued prevalence of remote work, be aware of potential state tax obligations if working across state lines.

- Gig Economy Reporting:

- Increased scrutiny on gig economy income, with lower thresholds for reporting on Form 1099-K.

- Green Energy Incentives:

- New tax credits and deductions for energy-efficient home improvements and electric vehicle purchases.

- Healthcare Reporting:

- Potential changes in healthcare-related tax provisions, depending on policy updates.

Tips for Navigating Category-Specific Tax Situations

- Stay Informed:

- Regularly check the IRS website and reputable tax news sources for updates relevant to your category.

- Use Specialized Software:

- Look for tax preparation software that caters to your specific taxpayer category (e.g., software designed for self-employed individuals or rental property owners).

- Maintain Detailed Records:

- Keep organized, detailed records throughout the year, tailored to your specific tax situation.

- Consult with Specialists: