Do I Need to File Tax Returns? A Comprehensive Guide for 2025

Introduction

Understanding your tax filing requirements is crucial for maintaining financial health and staying compliant with the law. As we approach the 2025 tax season, it’s essential to know whether you need to file a tax return. This comprehensive guide will walk you through the key factors that determine your filing requirement, helping you navigate the complex world of taxes with confidence.

The Importance of Understanding Tax Filing Requirements

Filing taxes is more than just a civic duty; it’s a financial responsibility that can have significant implications for your financial well-being. Whether you’re a seasoned taxpayer or new to the workforce, knowing if you need to file a return is the first step in managing your tax obligations effectively.

In 2025, the Internal Revenue Service (IRS) continues to emphasize the importance of timely and accurate tax filing. According to the IRS official website, millions of Americans file their taxes each year, with a significant portion doing so unnecessarily. On the flip side, many who should file fail to do so, potentially missing out on refunds or facing penalties.

Overview of Basic Criteria for Filing a Tax Return

The need to file a tax return primarily depends on three key factors:

- Your gross income

- Your filing status

- Your age

These factors work together to determine your filing threshold – the minimum amount of income you can earn before being required to file a return. It’s important to note that these thresholds are subject to change each year due to inflation adjustments and tax law changes.

Income Thresholds Based on Filing Status

For the 2025 tax year, the income thresholds vary depending on your filing status. Here’s a general overview:

| Filing Status | Income Threshold |

|---|---|

| Single (Under 65) | $14,600 |

| Single (65 or Older) | $16,550 |

| Married Filing Jointly (Both Under 65) | $29,200 |

| Married Filing Jointly (One Spouse 65 or Older) | $30,750 |

| Married Filing Jointly (Both 65 or Older) | $32,300 |

| Married Filing Separately (Both Under 65) | $5 |

| Married Filing Separately (65 or Older) | $5 |

| Head of Household (Under 65) | $21,900 |

| Head of Household (65 or Older) | $23,850 |

| Qualifying Surviving Spouse (Under 65) | $29,200 |

| Qualifying Surviving Spouse (65 or Older) | $30,750 |

Note: These figures are based on the most recent IRS guidelines and estimates for the 2025 tax year.

- For those who are self-employed, the filing threshold is $400 in net earnings, regardless of age or filing status.

- These thresholds are the minimum income levels at which you’re required to file a federal tax return for the 2025 tax year.

This table consolidates the most current data available and aligns it with the latest updates and projections for the 2025 tax year as provided by Jackson Hewitt(Jackson Hewitt), eFile.com(eFile), and The Finance Buff(The Finance Buff).

Understanding these basic criteria is just the beginning. As we delve deeper into the specifics of filing requirements, you’ll gain a clearer picture of your tax obligations for the 2025 tax year.

Factors Determining If You Need to File Tax Returns

Key Factors That Determine Your Filing Requirement

When assessing whether you need to file tax returns for the 2025 tax year, several crucial factors come into play. Let’s explore each of these in detail to help you make an informed decision.

A. Gross Income

Your gross income is perhaps the most significant factor in determining your filing requirement. Gross income includes all income you receive in the form of money, goods, property, and services that isn’t explicitly exempt from tax. This encompasses:

- Wages, salaries, and tips

- Self-employment income

- Investment income (dividends, interest, capital gains)

- Rental income

- Alimony (for agreements executed before 2019)

- Unemployment compensation

For 2025, the IRS has adjusted the gross income thresholds to account for inflation. It’s crucial to calculate your total gross income accurately to determine if you meet the filing threshold for your status.

Pro Tip: Keep meticulous records of all income sources throughout the year to simplify your tax filing process.

B. Filing Status

Your filing status significantly impacts your filing requirement threshold. The five filing statuses are:

- Single

- Married Filing Jointly

- Married Filing Separately

- Head of Household

- Qualifying Widow(er) with Dependent Child

Each status has different income thresholds and tax implications. For instance, married couples filing jointly generally have a higher income threshold than single filers.

C. Age and Blindness Considerations

Age plays a crucial role in determining filing requirements, especially for seniors. As of 2025, individuals who are:

- 65 or older

- Blind

may have higher income thresholds before they’re required to file. This is because these individuals are eligible for an additional standard deduction, which increases their filing threshold.

For example, a single filer who is 65 or older might not need to file unless their income exceeds $16,550 (estimated for 2025), compared to $14,600 for those under 65.

D. Dependency Status

Whether someone can claim you as a dependent on their tax return also affects your filing requirement. Dependents, including children and qualifying relatives, have different rules for filing:

- Earned Income: If a dependent’s earned income exceeds their standard deduction, they must file a return.

- Unearned Income: Dependents with unearned income above $1,300 (estimated for 2024) must file a return.

- Combination of Earned and Unearned Income: Special rules apply when a dependent has both types of income.

According to the Tax Policy Center, understanding dependency status is crucial as it affects not only the dependent’s filing requirement but also the tax situation of the person claiming them.

Important Note: Even if you don’t meet the income threshold for mandatory filing, you may still want to file a return to claim refundable credits or get a refund of withheld taxes.

By carefully considering these factors – gross income, filing status, age, and dependency status – you can accurately determine whether you need to file a tax return for the 2025 tax year. Remember, when in doubt, it’s always best to consult with a tax professional or use the IRS’s Interactive Tax Assistant tool for personalized guidance.

Filing Status and Income Thresholds

Understanding Filing Status and Income Thresholds

Your filing status is a crucial determinant in whether you need to file a tax return and how much tax you owe. For the 2025 tax year, it’s essential to understand the different filing statuses and their corresponding income thresholds.

A. Single Filers

Single filing status applies to unmarried individuals, or those considered unmarried for tax purposes.

Income Threshold for 2025 (estimated): $14,600

You must file a return if your gross income exceeds this amount. This threshold applies to individuals who:

- Have never married

- Are legally separated or divorced

- Are widowed and not eligible for another filing status

Case Study: Sarah, 28, earned $34,000 in 2025 from her part-time job. As a single filer, she exceeds the income threshold and must file a tax return.

B. Married Filing Jointly

Couples who are married and choose to combine their income and deductions must use this status.

Income Threshold for 2025 (estimated): $29,200

This higher threshold reflects the combined income of both spouses. Married couples often benefit from this status due to:

- Combined standard deduction

- Potentially lower tax brackets

- Eligibility for certain credits and deductions

C. Married Filing Separately

Some married couples may choose to file separate returns.

Income Threshold for 2025 (estimated): $5

Yes, you read that correctly. The threshold is extremely low because the IRS wants to encourage joint filing. However, filing separately might be beneficial in certain situations, such as:

- One spouse has significant medical expenses

- One spouse suspects tax fraud by the other

- Couples are separated but not yet divorced

D. Head of Household

This status is for unmarried individuals who pay more than half the cost of keeping up a home for themselves and a qualifying person.

Income Threshold for 2025 (estimated): $21,900

To qualify, you must:

- Be unmarried or considered unmarried on the last day of the year

- Pay more than half the cost of keeping up a home for the year

- Have a qualifying person living with you for more than half the year

E. Qualifying Widow(er) with Dependent Child

This status is for individuals whose spouse died in the previous two years and who have a dependent child.

Income Threshold for 2025 (estimated): $29,200

This status allows you to use joint return tax rates and the highest standard deduction amount for two years after your spouse’s death.

F. Special Circumstances Affecting Standard Deduction Limits

Certain factors can affect your standard deduction, which in turn impacts your filing requirement:

- Age: If you’re 65 or older, your standard deduction increases.

- Blindness: Legally blind individuals also receive an increased standard deduction.

- Dependency: If someone can claim you as a dependent, your standard deduction may be limited.

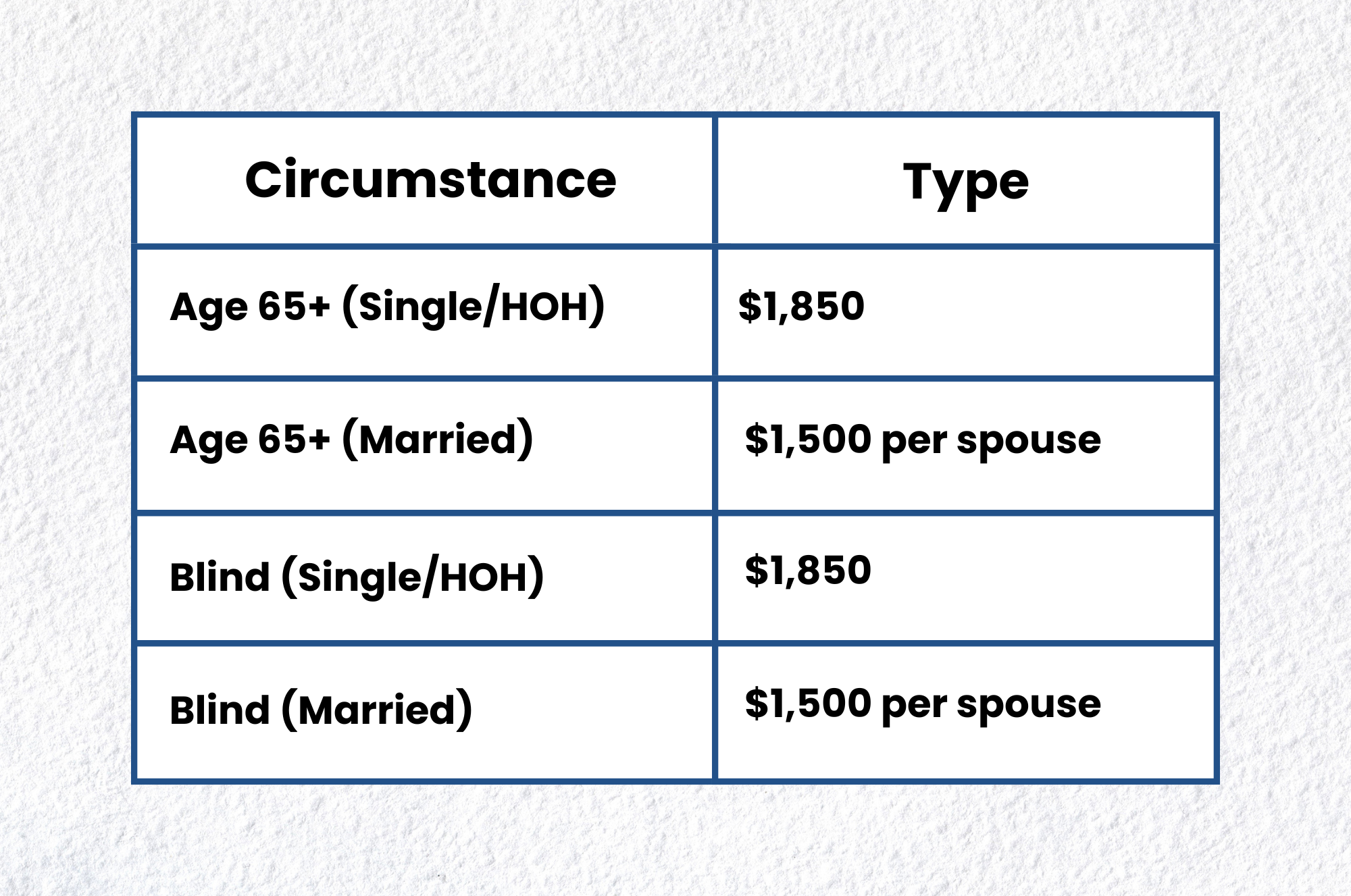

Table: Estimated Additional Standard Deduction Amounts for 2025

According to the Tax Foundation, these additional standard deduction amounts are adjusted annually for inflation, helping to maintain the purchasing power for seniors and visually impaired taxpayers.

Important: These thresholds and deductions are estimates based on historical trends. Always check the most current IRS publications or consult with a tax professional for the most accurate and up-to-date information for your specific situation.

Understanding your filing status and the corresponding income thresholds is crucial in determining whether you need to file a tax return. Remember, even if your income falls below these thresholds, you may still want to file to claim refundable credits or receive a refund of withheld taxes.

Types of Income and Their Impact on Filing Requirements

How Different Income Sources Affect Your Need to File Tax Returns

Understanding the various types of income and how they impact your filing requirements is crucial for accurate tax reporting. In 2025, the IRS continues to categorize income into different types, each with its own implications for tax filing.

A. Taxable vs. Tax-Free Income

Not all income is treated equally by the IRS. It’s essential to distinguish between taxable and tax-free income.

Taxable Income includes:

- Wages and salaries

- Tips

- Investment income

- Most retirement account distributions

- Rental income

- Some Social Security benefits

Tax-Free Income includes:

- Certain municipal bond interest

- Some life insurance proceeds

- Gifts and inheritances

- Roth IRA distributions (if conditions are met)

Important: Even if all your income is tax-free, you may still need to file a return in some cases. Always consult IRS guidelines or a tax professional.

B. W-2 Wages and Salary

This is the most common type of income for most taxpayers. If you receive a W-2 form, it means you’re an employee, and taxes are typically withheld from your paycheck.

Filing Requirement: You generally need to file if your W-2 income exceeds the standard deduction for your filing status.

Example: For a single filer under 65 in 2025, if your W-2 income exceeds $14,600 (estimated), you’ll need to file a return.

C. Self-Employment and Independent Contractor Income

If you’re self-employed or work as an independent contractor, you’ll receive 1099 forms instead of W-2s.

Filing Requirement: You must file a return if your net earnings from self-employment exceed $400.

Key Point: Self-employed individuals often need to pay self-employment tax in addition to income tax. The Small Business Administration offers resources to help self-employed individuals understand their tax obligations.

D. Unearned Income

Unearned income includes interest, dividends, and capital gains. The filing requirements for unearned income can be complex.

Filing Requirement: Depends on your total income and filing status. For example, if you’re single under 65 and your only income is from investments, you’d need to file if this income exceeds $1,300 (estimated for 2025).

E. Social Security Benefits

Social Security benefits may be taxable depending on your total income.

Filing Requirement: You may need to file if:

- You’re single, and your total income plus half of your Social Security benefits exceeds $25,000

- You’re married filing jointly, and your combined income plus half of your benefits exceeds $32,000

F. Investment Income

This includes income from stocks, bonds, and other investments.

Filing Requirement: Generally included in your total income calculation. However, certain types of investment income (like qualified dividends) may be taxed at different rates.

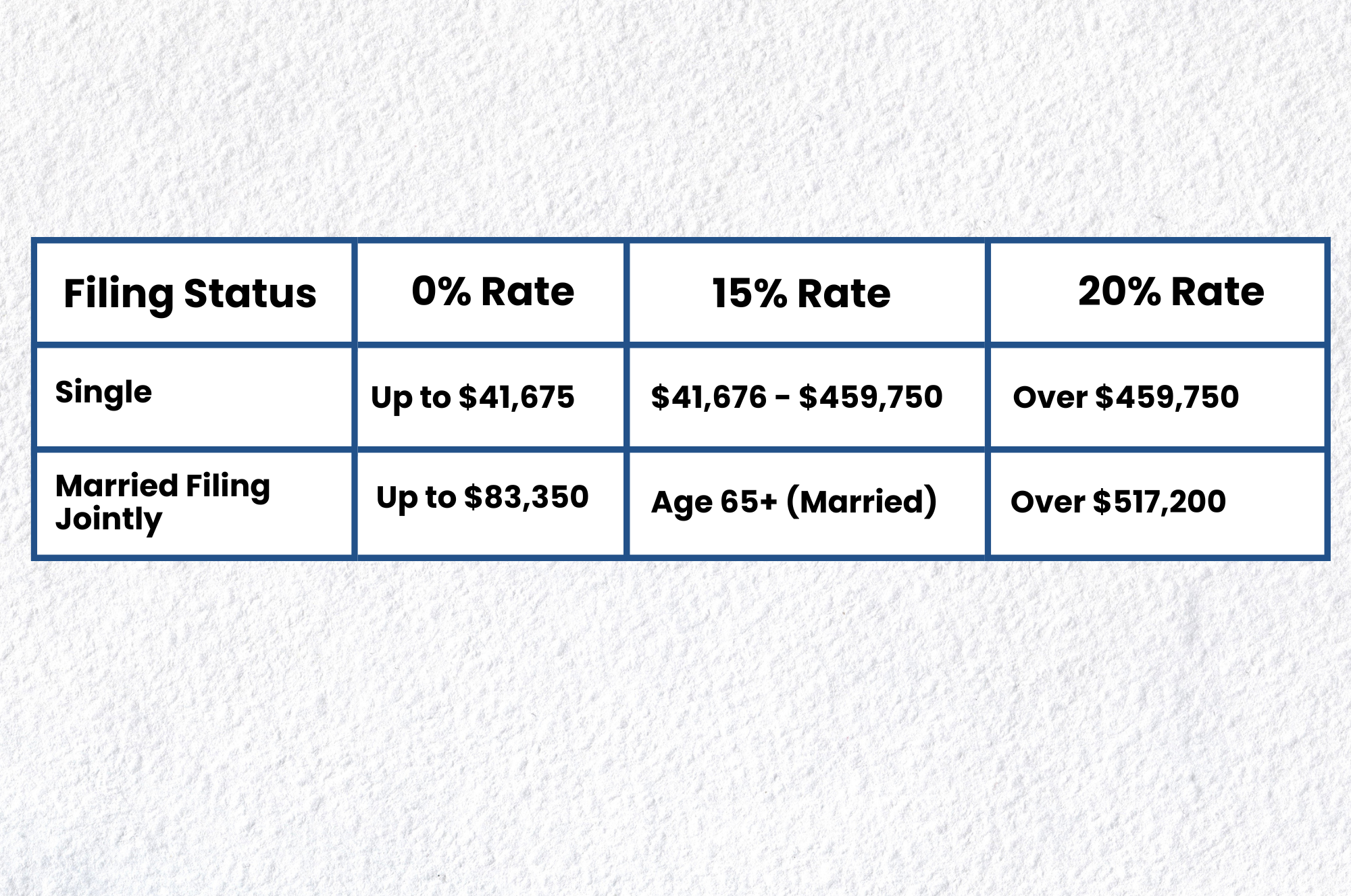

Table: Capital Gains Tax Rates for 2025 (Estimated)

G. Unemployment Compensation

Unemployment benefits are generally taxable and must be reported on your tax return.

Filing Requirement: Include unemployment compensation in your gross income calculation to determine if you meet the filing threshold.

H. Other Income Types

Other types of income that may affect your filing requirement include:

- Church employee income

- Foreign earned income

- Gambling winnings

- Health Savings Account (HSA) distributions

Case Study: John, a retired individual, received $18,000 in Social Security benefits and $10,000 in pension income in 2025. Half of his Social Security benefits ($9,000) plus his pension income ($10,000) equals $19,000, which is below the $25,000 threshold. However, John should still calculate his total taxable income to determine if he needs to file a return based on other factors.

Important Note: The IRS Publication 525 provides detailed information on taxable and nontaxable income. It’s an excellent resource for understanding how different types of income affect your tax situation.

Special Situations and Filing Requirements

Special Circumstances: Do You Still Need to File Tax Returns?

While general rules cover most taxpayers, certain situations may create unique filing requirements. Let’s explore some of these special circumstances for the 2025 tax year.

A. Self-Employed Individuals

Self-employed individuals face distinct tax obligations:

- Filing Threshold: You must file if net earnings from self-employment exceed $400.

- Self-Employment Tax: You’re responsible for paying both the employer and employee portions of Social Security and Medicare taxes.

- Estimated Tax Payments: You may need to make quarterly estimated tax payments.

Pro Tip: Keep detailed records of all business income and expenses. The IRS Self-Employed Individuals Tax Center offers valuable resources for managing your tax responsibilities.

B. Dependents

Dependents may need to file a return even if someone else claims them on their tax return. For 2025, a dependent must file if:

- Unearned income exceeds $1,300 (estimated)

- Earned income exceeds $12,950 (estimated)

- Gross income exceeds the larger of $1,150 or earned income (up to $12,550) plus $350

Example: A 16-year-old with a part-time job earning $5,000 and $200 in bank interest would not need to file, as neither their earned nor unearned income exceeds the thresholds.

C. Seniors and Retirees

Seniors often have unique filing requirements:

- Higher Standard Deduction: Those 65 and older get an increased standard deduction.

- Social Security: May be partially taxable based on total income.

- Required Minimum Distributions (RMDs): Must be taken from traditional IRAs and 401(k)s starting at age 72, potentially increasing taxable income.

Table: Estimated Filing Thresholds for Seniors (65+) in 2025

| Filing Status | Threshold |

|---|---|

| Single | $16,500 |

| Married Filing Jointly (both 65+) | $32,300 |

| Married Filing Jointly (one 65+) | $30,750 |

D. Students with Part-Time Jobs

Students often wonder about their filing requirements. Key points:

- Dependent Status: If claimed as a dependent, lower filing thresholds apply.

- Scholarships: Taxable portions of scholarships may count towards filing requirements.

- Education Credits: Filing may be beneficial to claim education-related tax credits.

E. Non-U.S. Citizens and Resident Aliens

Filing requirements for non-U.S. citizens depend on their residency status:

- Resident Aliens: Generally follow the same rules as U.S. citizens.

- Nonresident Aliens: Must file if engaged in a U.S. trade or business or have U.S. source income above the personal exemption amount.

The IRS Taxation of Nonresident Aliens page provides detailed guidance on this complex topic.

F. Alternative Minimum Tax (AMT) Situations

Some taxpayers may be subject to the Alternative Minimum Tax:

- Purpose: Ensures high-income taxpayers pay a minimum amount of tax.

- Triggers: Large deductions, certain types of income, or exercising stock options can trigger AMT.

- Filing Requirement: If you’re subject to AMT, you must file regardless of income level.

G. Homebuyer Credit Repayment

If you claimed the First-Time Homebuyer Credit in 2008:

- You may need to file to repay a portion of the credit.

- This applies even if you wouldn’t otherwise need to file.

Important: The repayment requirement for the First-Time Homebuyer Credit has specific rules and exceptions. Consult the IRS First-Time Homebuyer Credit page for detailed information.

Reasons to File Even If Not Required

Why You Might Want to File Tax Returns Even If Not Mandatory

Even if you’re not required to file a tax return based on your income and filing status, there are several compelling reasons why you might want to file anyway. Let’s explore these reasons for the 2025 tax year.

A. Potential Tax Refunds

One of the most common reasons to file a return, even when not required, is to claim a refund of withheld taxes. If you had federal income tax withheld from your paycheck or made estimated tax payments, you might be entitled to a refund.

Example: Sarah worked part-time and earned $5,000 in 2025. Her employer withheld $300 in federal income tax. Even though Sarah’s income is below the filing threshold, she should file a return to claim her $300 refund.

B. Claiming Refundable Credits

Refundable tax credits are particularly valuable because they can result in a refund even if you don’t owe any tax. Here are some key refundable credits for 2025:

- Earned Income Tax Credit (EITC)

- Designed for low to moderate-income workers

- Maximum credit for 2025 (estimated): $7,480 for a family with three or more children

- IRS EITC Assistant can help determine eligibility

- Child Tax Credit (CTC)

- Up to $2,000 per qualifying child under 17 (estimated for 2025)

- Partially refundable up to $1,600 per child

- American Opportunity Credit

- For eligible students in their first four years of higher education

- Maximum credit: $2,500 per student

- Up to $1,000 is refundable

- Recovery Rebate Credit

- Related to stimulus payments

- Relevant if you didn’t receive the full amount you were entitled to in previous years

Table: Estimated Income Limits for EITC (2025)

| Filing Status | No Children | One Child | Two Children | Three+ Children |

|---|---|---|---|---|

| Single | $16,580 | $44,725 | $50,399 | $54,050 |

| Married Filing Jointly | $22,610 | $50,875 | $56,550 | $60,000 |

C. Protecting Against Identity Theft

Filing a tax return can help protect you against identity theft. If someone tries to file a fraudulent return using your Social Security number, having already filed your legitimate return can make it easier to resolve the issue.

Pro Tip: File your return as early as possible to reduce the risk of tax-related identity theft.

D. Maintaining a Record for Future Benefits

Filing a tax return creates an official record of your income, which can be beneficial for:

- Applying for loans or mortgages

- Verifying income for rental applications

- Qualifying for government benefits

E. Eligibility for Additional Tax Credits and Deductions

Some credits and deductions require you to file a return to claim them, even if your income is below the filing threshold. These may include:

- Saver’s Credit for retirement contributions

- Health Coverage Tax Credit

- Credit for the Elderly or Disabled

Case Study: John, a 68-year-old retiree, has an income of $12,000 from a part-time job. While he’s below the filing threshold, by filing a return, he can claim the Credit for the Elderly or Disabled, potentially reducing his tax liability or increasing his refund.

According to the Taxpayer Advocate Service, many eligible taxpayers miss out on valuable credits simply because they don’t file a return. It’s always worth checking if you qualify for any credits or deductions that could benefit you financially.

Consequences of Not Filing When Required

What Happens If You Don’t File Required Tax Returns?

Understanding the potential consequences of failing to file a required tax return is crucial. For the 2025 tax year, the IRS continues to take non-filing seriously, and the repercussions can be significant.

A. Penalties and Interest

The IRS imposes several penalties for failing to file or pay taxes:

- Failure-to-File Penalty:

- 5% of unpaid taxes for each month the tax return is late

- Maximum penalty is 25% of unpaid taxes

- If you’re more than 60 days late, the minimum penalty is $435 or 100% of the tax owed, whichever is less

- Failure-to-Pay Penalty:

- 0.5% of unpaid taxes for each month the tax remains unpaid

- Maximum penalty is 25% of unpaid taxes

- Interest:

- Interest compounds daily on unpaid taxes and penalties

- Rate is federal short-term rate plus 3%

Example: If you owe $5,000 in taxes and file your return 6 months late, you could face penalties of up to $1,250 (25% of $5,000) plus interest.

The IRS Penalties page provides detailed information on various penalties and how they’re calculated.

B. Loss of Refunds

If you’re owed a refund, there’s a time limit to claim it:

- You generally have three years from the original due date of the return to file and claim your refund

- After this period, you forfeit your refund

Important: Even if you’re not required to file, if you’re owed a refund, you should file to claim it before the three-year window closes.

C. Statute of Limitations

The statute of limitations for the IRS to assess and collect taxes doesn’t begin until a return is filed:

- Typically, the IRS has 3 years from the date you file to audit your return

- If you never file, this time limit never starts, and the IRS can assess taxes indefinitely

Pro Tip: Filing your return, even if late, starts the statute of limitations clock.

D. Impact on Future Financial Transactions

Failing to file required returns can have far-reaching consequences:

- Loan Applications: Lenders often require copies of tax returns, making it difficult to secure loans

- Social Security Benefits: Self-employed individuals who don’t file may not receive credits toward Social Security retirement or disability benefits

- Bankruptcy: Unfiled tax returns can complicate bankruptcy proceedings

Case Study: Sarah didn’t file her 2025 tax return because she thought she wouldn’t owe anything. In 2028, she applied for a mortgage but was denied because she couldn’t provide the required tax documentation. She had to file her past-due return and wait for it to be processed before reapplying, delaying her home purchase.

According to the National Taxpayer Advocate, failing to file required returns is one of the most serious tax issues a taxpayer can face. The consequences can be long-lasting and affect multiple aspects of your financial life.

Additional Consequences

- Criminal Charges: In extreme cases of willful failure to file, the IRS may pursue criminal charges

- Substitute Returns: The IRS may file a substitute return on your behalf, often resulting in a higher tax bill as it won’t include all possible deductions or credits

- Tax Liens: The IRS may file a tax lien against your property, affecting your credit score and ability to sell assets

Important Note: If you’ve failed to file required returns, it’s crucial to address the situation promptly. The IRS often has programs to help taxpayers become compliant, such as payment plans or the Offer in Compromise program for those who can’t pay their full tax debt.

Remember, the consequences of not filing when required can be severe and long-lasting. It’s always better to file on time, even if you can’t pay the full amount owed. The IRS provides various payment options and is often willing to work with taxpayers who are making a good-faith effort to comply with their tax obligations.

How to Determine If You Need to File

Tools and Resources to Help You Decide If You Need to File Tax Returns

Determining whether you need to file a tax return can sometimes be complex. Fortunately, there are several tools and resources available to help you make this decision for the 2025 tax year.

A. IRS Interactive Tax Assistant

The IRS Interactive Tax Assistant (ITA) is a valuable online tool that can help you determine if you need to file a federal tax return.

How to Use the ITA:

- Visit the IRS Interactive Tax Assistant website

- Select the topic “Do I Need to File a Tax Return?”

- Answer a series of questions about your income, filing status, and other relevant factors

- Receive a recommendation based on your responses

Pro Tip: The ITA is updated annually to reflect current tax laws, making it a reliable resource for each tax year.

B. Tax Preparation Software

Many tax preparation software packages include tools to help you determine your filing requirement. These often provide a more comprehensive analysis, taking into account various credits and deductions that might affect your filing status.

Popular software options include:

- TurboTax

- H&R Block

- TaxAct

Benefits of Using Tax Software:

- User-friendly interfaces

- Up-to-date tax law information

- Ability to run different scenarios

C. Free Tax Calculators

Several websites offer free tax calculators that can help you estimate your tax liability and determine if you need to file. While not as comprehensive as full tax preparation software, these can provide a quick initial assessment.

Some reliable free calculators include:

Caution: These calculators provide estimates and should not be considered definitive. Always verify your filing requirement using official IRS resources or consult with a tax professional.

D. Consulting with a Tax Professional

For complex tax situations, consulting with a tax professional can provide personalized guidance on your filing requirements.

When to Consider Professional Help:

- You have multiple sources of income

- You’re self-employed or own a business

- You have significant investments or rental property

- You’ve experienced major life changes (marriage, divorce, new child)

According to the National Association of Tax Professionals, seeking professional advice can often save money in the long run by ensuring you comply with tax laws and maximize your deductions and credits.

Table: Comparison of Filing Determination Methods

| Method | Pros | Cons |

|---|---|---|

| IRS Interactive Tax Assistant | Free, official IRS tool | May not cover all complex situations |

| Tax Preparation Software | Comprehensive, user-friendly | May have associated costs |

| Free Tax Calculators | Quick, no-cost estimates | Less detailed, may not account for all factors |

| Tax Professional | Personalized advice, handles complex situations | Most expensive option |

Additional Resources

- IRS Publication 17: This comprehensive guide covers the general rules for filing a federal income tax return. It’s updated annually and available on the IRS website.

- IRS Withholding Calculator: If you’re an employee, this tool can help you determine if you’re having the right amount of tax withheld from your paycheck, which can affect your filing requirement. Access it on the IRS website.

- State Tax Agencies: Remember that state filing requirements may differ from federal requirements. Check with your state’s tax agency for specific guidelines.

Case Study: John, a retiree with Social Security income and a small pension, used the IRS Interactive Tax Assistant to determine if he needed to file. The tool indicated he wasn’t required to file based on his income level. However, John decided to use tax preparation software to double-check and discovered he was eligible for a refundable credit that made filing beneficial, even though it wasn’t required.

Filing Process Overview

A Quick Guide to Filing Your Tax Returns

Understanding the filing process is crucial, whether you’re required to file or choosing to do so voluntarily. Here’s an overview of the steps involved in filing your tax return for the 2025 tax year.

A. Gathering Necessary Documents

Before you begin, collect all relevant financial documents. This typically includes:

- Income documents:

- W-2 forms from employers

- 1099 forms for various types of income (e.g., freelance work, dividends, interest)

- Social Security benefit statements

- Deduction and credit information:

- Mortgage interest statements (Form 1098)

- Student loan interest statements

- Charitable donation receipts

- Education expenses

- Personal information:

- Social Security numbers for you, your spouse, and dependents

- Bank account and routing numbers for direct deposit of refund

Pro Tip: Create a checklist of necessary documents based on your specific situation. The IRS Tax Preparation Checklist can be a helpful starting point.

B. Choosing a Filing Method (e-file vs. paper)

You have two main options for filing your tax return:

- Electronic Filing (e-file):

- Faster processing

- More accurate (built-in error checks)

- Quicker refunds (if applicable)

- Confirmation of receipt by the IRS

- Paper Filing:

- Necessary for certain forms or situations

- May be preferred by some for privacy concerns

Statistics: According to the IRS, over 90% of individual tax returns are now filed electronically. E-filing is generally recommended for its speed and accuracy.

C. Meeting Deadlines and Extensions

Understanding key dates is crucial for timely filing:

- Standard Deadline: Typically April 15th (may vary if it falls on a weekend or holiday)

- Extension Deadline: October 15th (if you file for an automatic 6-month extension)

Important: An extension to file is not an extension to pay. If you owe taxes, you should estimate and pay the amount due by the original deadline to avoid penalties and interest.

Table: Key Tax Dates for 2025 (Estimated)

| Date | Event |

|---|---|

| January 31, 2026 | Deadline for employers to send W-2s and many 1099s |

| April 15, 2026 | Tax filing deadline for most individuals |

| April 15, 2026 | Deadline to request an automatic extension |

| June 15, 2026 | Deadline for U.S. citizens living abroad |

| October 15, 2026 | Extended filing deadline |

D. E-filing Considerations and IRS Launch Dates

The IRS typically announces the start date for electronic filing in January. For the 2025 tax year, this would be in January 2026.

Key Points:

- E-filing usually opens in late January

- Early filers should be aware that some forms and schedules might not be immediately available

- The IRS Free File program offers free e-filing options for eligible taxpayers

Case Study: Maria, a freelance graphic designer, gathered all her 1099 forms and expense receipts in early January 2026. She used tax preparation software to complete her return but had to wait until the IRS officially opened e-filing to submit it. By being prepared early, she was able to file as soon as the system opened, receiving her refund quickly.

Additional Filing Tips

- Double-Check Everything: Review all entries for accuracy before submitting.

- Keep Copies: Maintain a copy of your filed return and all supporting documents.

- Consider Professional Help: If your tax situation is complex, consider hiring a tax professional.

- Stay Informed: Tax laws can change. Stay updated through official IRS communications or trusted tax news sources.

Remember, filing your taxes accurately and on time is your responsibility. If you’re unsure about any aspect of the filing process, don’t hesitate to seek guidance from the IRS or a qualified tax professional.

State Tax Return Requirements

Do You Need to File State Tax Returns?

While federal tax requirements are uniform across the United States, state tax requirements can vary significantly. Understanding your state’s specific rules is crucial for complete tax compliance in 2025.

A. State-Specific Filing Requirements

Each state has its own set of rules for who must file a tax return. Here are some general considerations:

- Income Thresholds: States often have different income thresholds for filing than the federal government.

- Residency Status: Your obligation to file may depend on whether you’re a full-year resident, part-year resident, or non-resident.

- Source of Income: Some states require you to file if you earned income in that state, regardless of where you live.

- Reciprocity Agreements: Some neighboring states have agreements that may affect your filing requirements.

Example: California, known for its complex tax system, requires filing from residents if their income exceeds certain thresholds, which are generally lower than federal thresholds. You can find more details on the California Franchise Tax Board website.

B. Part-Year and Non-Resident Filing Rules

These rules can be particularly complex:

- Part-Year Residents:

- Typically must file a return in both their old and new states of residence

- Often required to report income earned in each state during the time they were a resident

- Non-Residents:

- Generally must file a return in states where they earned income

- May need to file even if they don’t meet the state’s income threshold for residents

Table: Examples of State Filing Requirements for Non-Residents (2025 Estimates)

| State | Non-Resident Filing Requirement |

|---|---|

| New York | Any income from NY sources |

| Florida | No state income tax |

| California | Income over $1 from CA sources |

| Texas | No state income tax |

Note: Always check with the specific state’s tax authority for the most accurate and up-to-date information.

C. State-Specific Forms and Thresholds

States often have their own versions of tax forms, which may differ from federal forms:

- State Equivalents of Federal Forms:

- Many states have their own version of Form 1040

- These forms often start with the federal adjusted gross income and make state-specific adjustments

- Additional Forms:

- States may require additional schedules or forms for specific types of income or deductions

- Filing Thresholds:

- Can vary based on factors like age, filing status, and dependency status

- May be tied to the state’s standard deduction or personal exemption amounts

Pro Tip: Use the state’s department of revenue website to find the most current forms and filing thresholds. For example, the New York State Department of Taxation and Finance provides comprehensive information for NY taxpayers.

Additional Considerations for State Tax Returns

- States Without Income Tax: As of 2025, several states do not have a state income tax, including:

- Alaska

- Florida

- Nevada

- South Dakota

- Texas

- Washington

- Wyoming

- New Hampshire (only taxes dividend and interest income)

- Flat vs. Progressive Tax Rates: States may use either a flat tax rate or a progressive tax system, which can affect your tax liability.

- Credits and Deductions: States often offer their own set of credits and deductions, which may differ from federal offerings.

- E-Filing Options: Many states offer free e-filing options, similar to the federal Free File program.

Case Study: John moved from New York to Florida in July 2025. He’ll need to file a part-year resident return in New York for his income earned there from January to June. He won’t need to file a Florida return since Florida doesn’t have a state income tax. However, if John earned income from a New York source after moving to Florida, he might also need to file a non-resident New York return for that income.

According to the Tax Foundation, understanding state tax requirements is becoming increasingly important as more people work remotely or move between states. It’s crucial to stay informed about the specific requirements of any state where you live or earn income.

Conclusion

Recap of Key Points

As we’ve explored the complexities of tax filing requirements for the 2025 tax year, several crucial points stand out:

- Income Thresholds: Your gross income, filing status, and age are primary factors in determining whether you need to file a federal tax return.

- Special Situations: Self-employed individuals, dependents, seniors, and non-U.S. citizens often have unique filing requirements.

- Reasons to File Voluntarily: Even if not required, filing can be beneficial for claiming refunds, tax credits, and maintaining financial records.

- Consequences of Not Filing: Failing to file when required can result in penalties, interest, and other serious financial repercussions.

- State Tax Considerations: State filing requirements can differ significantly from federal requirements and vary from state to state.

- Resources Available: The IRS provides numerous tools and resources to help determine filing requirements and complete returns accurately.

Importance of Staying Informed About Tax Obligations

Tax laws and regulations are subject to change, and staying informed is crucial for several reasons:

- Compliance: Understanding your obligations helps you remain compliant with tax laws, avoiding penalties and legal issues.

- Financial Planning: Knowledge of tax requirements aids in better financial planning and decision-making throughout the year.

- Maximizing Benefits: Being aware of tax credits and deductions can help you maximize your tax benefits and potentially increase your refund.

- Avoiding Mistakes: Staying informed reduces the likelihood of errors on your tax return, which can lead to audits or amended returns.

Expert Insight: According to the National Society of Tax Professionals, “Tax laws are constantly evolving. What applied last year may not be relevant this year. It’s crucial for taxpayers to stay updated or seek professional advice to ensure they’re meeting all their tax obligations.”

Final Recommendations

- Start Early: Begin gathering tax documents and information well before the filing deadline.

- Use Available Resources: Take advantage of IRS tools, tax preparation software, and educational materials.

- Consider Professional Help: If your tax situation is complex, consider consulting with a tax professional.

- Stay Updated: Regularly check the IRS website for the latest tax information and changes.

- Plan Ahead: Use your understanding of tax requirements to make informed financial decisions throughout the year.

- Keep Records: Maintain organized records of income, expenses, and tax-related documents to simplify the filing process.

Case Study: Emily, a freelance writer, used to struggle with her taxes each year. For the 2025 tax year, she decided to stay informed about tax changes and keep meticulous records. By April 2026, she was well-prepared to file her return, confident in her compliance and even discovering new deductions she hadn’t known about previously.

Remember, while this guide provides a comprehensive overview of tax filing requirements for 2025, tax situations can be highly individual. When in doubt, it’s always best to consult with a qualified tax professional or contact the IRS directly for guidance specific to your situation.

By staying informed and proactive about your tax obligations, you can ensure compliance, minimize stress, and potentially optimize your financial outcomes in the complex world of taxation.

FAQs

Frequently Asked Questions About Filing Tax Returns

To further assist you with your tax filing decisions for the 2025 tax year, here are answers to some commonly asked questions:

A. What if I missed the filing deadline?

If you’ve missed the April 15, 2026 deadline for filing your 2025 tax return, here’s what you should do:

- File as soon as possible: The longer you wait, the more penalties and interest may accrue.

- Consider an extension: If you missed the deadline, you can still file Form 4868 to request an automatic extension until October 15, 2026. However, this is only an extension to file, not to pay.

- Pay any taxes owed: Even if you file late, pay as much as you can of any taxes owed to minimize penalties and interest.

- Request a payment plan: If you can’t pay in full, consider requesting an installment agreement with the IRS.

Important: If you’re owed a refund, there’s generally no penalty for filing late. However, you must file within three years of the original deadline to claim your refund.

B. Can I file tax returns for previous years?

Yes, you can file tax returns for previous years. Here’s what you need to know:

- Time limit for refunds: You have three years from the original filing deadline to file a return and claim a refund.

- Use the correct forms: You must use the forms and instructions for the specific tax year you’re filing for. These can be found on the IRS Prior Year Forms page.

- Paper filing required: Generally, you can’t e-file prior year returns and must submit them by mail.

- Penalties may apply: If you owed taxes and are filing late, penalties and interest may have accrued.

Pro Tip: If you’re filing old returns to claim a refund, start with the most recent year first, as it’s more likely to still be within the refund statute of limitations.

C. Do I need to file if I only received unemployment benefits?

For the 2025 tax year, unemployment benefits are generally considered taxable income. Whether you need to file depends on your total income, including unemployment benefits:

- Calculate total income: Add your unemployment compensation to any other income you received.

- Compare to filing threshold: If your total income exceeds the filing threshold for your filing status, you need to file a return.

- Consider tax withholding: If you had taxes withheld from your unemployment benefits, you may want to file to receive a refund, even if you’re below the filing threshold.

Note: Some states may have different rules regarding the taxation of unemployment benefits. Check with your state’s tax agency for specific guidance.

D. How does cryptocurrency affect my filing requirement?

As of 2025, the IRS treats cryptocurrency as property for tax purposes. Here’s how it might affect your filing requirement:

- Receiving cryptocurrency as income: If you received cryptocurrency as payment for goods or services, it’s treated as taxable income.

- Capital gains: If you sold or exchanged cryptocurrency, you may have capital gains or losses to report.

- Mining: Income from mining cryptocurrency is generally considered self-employment income.

- Reporting threshold: Cryptocurrency transactions should be reported regardless of the amount, but they may affect your need to file if they push your total income above the filing threshold.

Important: The IRS has been increasing its focus on cryptocurrency transactions. Be sure to keep detailed records of all your crypto activities.

E. What if my income is below the filing threshold but taxes were withheld from my paycheck?

If your income is below the filing threshold but taxes were withheld from your paycheck, you should consider filing a return:

- Potential refund: You may be entitled to a refund of the taxes withheld.

- Credits: You might be eligible for refundable credits like the Earned Income Tax Credit, even if you don’t owe taxes.

- Record keeping: Filing creates an official record of your income, which can be useful for various financial purposes.

Example: Sarah earned $5,000 in 2025, which is below the filing threshold. However, $500 was withheld for federal taxes. By filing a return, Sarah can claim a refund of the $500 withheld.

Expert Insight: According to the Taxpayer Advocate Service, “Many low-income taxpayers miss out on refunds simply because they don’t file a return. We always encourage filing if there’s a possibility of a refund.”

F. How do life changes affect my filing requirement?

Major life events can significantly impact your tax situation and filing requirements. Here are some common scenarios:

- Marriage or Divorce:

- Changes your filing status options

- May affect your income threshold for filing

- Could impact eligibility for certain credits and deductions

- Having a Child:

- May qualify you for additional credits (e.g., Child Tax Credit)

- Could change your filing status to Head of Household if you’re single

- Buying a Home:

- Introduces potential deductions (e.g., mortgage interest, property taxes)

- May make itemizing deductions more beneficial than taking the standard deduction

- Starting a Business:

- Introduces self-employment tax considerations

- May require quarterly estimated tax payments

- Retirement:

- Changes in income sources (e.g., pensions, Social Security)

- May affect your tax bracket and filing requirements

Pro Tip: After any major life change, it’s wise to reassess your tax situation and consider consulting a tax professional.

G. What if I live and work in different states?

If you live in one state but work in another, your tax filing can become more complex:

- Resident State Return: You’ll typically need to file a resident return in your home state, reporting all income.

- Nonresident State Return: You may need to file a nonresident return in the state where you work.

- Credits for Taxes Paid: Many states offer a credit for taxes paid to other states to avoid double taxation.

- Reciprocal Agreements: Some neighboring states have agreements that simplify taxes for cross-border workers.

Example: John lives in New Jersey but works in New York. He’ll need to file a resident return in New Jersey reporting all income, and a nonresident return in New York for his New York-sourced income. New Jersey will likely offer a credit for taxes paid to New York.

H. How does working remotely affect my state tax filing?

With the increase in remote work, state tax filing has become more complex for many:

- “Convenience of the Employer” Rule: Some states may tax you based on your employer’s location, even if you work remotely from another state.

- Establishing Domicile: If you’ve been working remotely from a different state, you may need to consider whether you’ve established domicile there.

- Multiple State Filings: You might need to file part-year resident returns in multiple states if you’ve moved during the year.

- Home Office Deductions: Remote work may qualify you for home office deductions if you’re self-employed.

Important: State tax laws regarding remote work are evolving. Check with a tax professional or state tax authorities for the most current guidance.

I. What if I’m a student with a part-time job?

As a student with a part-time job, your filing requirement depends on several factors:

- Income Level: If your income exceeds the standard deduction for your filing status, you’ll likely need to file.

- Dependency Status: If you can be claimed as a dependent, you have lower income thresholds for filing.

- Scholarships and Grants: Some portions of scholarships and grants may be taxable.

- Education Credits: Filing may allow you to claim education-related tax credits, even if you’re not required to file based on income.

Table: 2025 Estimated Filing Thresholds for Dependents (Earned Income Only)

| Filing Status | Threshold |

|---|---|

| Single | $12,950 |

| Married Filing Separately | $5 |

Note: These thresholds are lower if you have both earned and unearned income.

Remember, tax situations can be complex and individual. While these FAQs cover many common scenarios, it’s always best to consult with a tax professional or the IRS directly if you’re unsure about your specific tax filing requirements.

J. How does foreign income affect my filing requirement?

If you’re a U.S. citizen or resident alien, you must report your worldwide income, which can affect your filing requirement:

- Foreign Earned Income Exclusion: You may be able to exclude up to a certain amount of foreign earned income ($112,000 estimated for 2025).

- Foreign Tax Credit: You might be eligible for a credit for taxes paid to foreign countries.

- FBAR Filing: If you have foreign bank accounts exceeding $10,000 at any time during the year, you must file a Foreign Bank Account Report (FBAR).

- Treaty Considerations: Tax treaties between the U.S. and other countries may affect your tax obligations.

Important: The IRS International Taxpayers page provides detailed guidance for those with foreign income.

K. What if I receive Social Security benefits?

The taxability of Social Security benefits depends on your total income:

- Income Thresholds: Up to 85% of your benefits may be taxable if your combined income (adjusted gross income + nontaxable interest + half of your Social Security benefits) exceeds certain thresholds.

- Filing Requirement: Even if your Social Security is your only income, you may need to file if you’re married filing separately and lived with your spouse at any time during the year.

- State Taxation: Some states tax Social Security benefits differently than the federal government.

Table: Estimated Taxability of Social Security Benefits (2025)

| Filing Status | 0% Taxable | Up to 50% Taxable | Up to 85% Taxable |

|---|---|---|---|

| Single | < $25,000 | $25,000 – $34,000 | > $34,000 |

| Married Filing Jointly | < $32,000 | $32,000 – $44,000 | > $44,000 |

L. How do gambling winnings and losses affect my taxes?

Gambling winnings are taxable income and may affect your filing requirement:

- Reporting Winnings: Casinos and other gambling establishments may issue a Form W-2G for certain winnings.

- Threshold for Reporting: You must report all gambling winnings as income, regardless of the amount.

- Deducting Losses: You can deduct gambling losses if you itemize deductions, but only up to the amount of your winnings.

- Record Keeping: Keep detailed records of both winnings and losses.

Pro Tip: Even if you’re not issued a W-2G, you’re still required to report all gambling winnings on your tax return.

M. What if I’m retired but still working part-time?

Many retirees continue to work part-time, which can affect their tax situation:

- Social Security Benefits: Additional income may make a larger portion of your Social Security benefits taxable.

- Required Minimum Distributions (RMDs): If you’re over 72, you must take RMDs from traditional IRAs and 401(k)s, which count as taxable income.

- Earned Income Credit: You may still qualify for the Earned Income Credit, depending on your income and age.

- Medicare Premiums: Higher income can lead to increased Medicare Part B and Part D premiums.

Case Study: Tom, 68, receives $20,000 in Social Security benefits and earns $15,000 from a part-time job. His combined income makes 50% of his Social Security benefits taxable, and he needs to file a return due to his total income exceeding the filing threshold for his age and filing status.

N. How does owning a rental property affect my filing requirement?

Owning a rental property can significantly impact your tax situation:

- Rental Income: All rental income must be reported on your tax return, potentially increasing your total income above the filing threshold.

- Deductible Expenses: You can deduct various expenses related to your rental property, including mortgage interest, property taxes, repairs, and depreciation.

- Passive Activity Rules: Rental activities are generally considered passive, which may limit your ability to deduct losses against other income.

- Schedule E: Rental income and expenses are typically reported on Schedule E of your tax return.

- Net Investment Income Tax: High-income taxpayers may be subject to an additional 3.8% tax on net investment income, which can include rental income.

Important: The IRS provides detailed guidance on rental property taxation in Publication 527.

O. What if I have income from a hobby?

The IRS distinguishes between hobbies and businesses, which can affect your tax obligations:

- Hobby Income: All income from hobbies must be reported, even if it’s just a few dollars.

- Deductions: As of 2025, hobby expenses are not deductible against hobby income.

- Filing Requirement: Hobby income contributes to your gross income and may require you to file if it pushes you over the filing threshold.

- Hobby vs. Business: If your activity is deemed a business rather than a hobby, different tax rules apply, including the ability to deduct expenses.

Pro Tip: Keep detailed records of all income and expenses related to your hobby, even if you can’t deduct the expenses. This information can be crucial if the IRS questions whether your activity is a hobby or a business.

P. How does bankruptcy affect my tax filing requirement?

Filing for bankruptcy doesn’t eliminate your obligation to file tax returns:

- Continuing Obligation: You must continue to file your personal tax returns even during bankruptcy proceedings.

- Trustee Filings: In Chapter 7 or 11 bankruptcies, the bankruptcy trustee may be required to file separate returns for the bankruptcy estate.

- Discharged Debts: Cancelled debts in bankruptcy may be excluded from your taxable income, but you may need to file Form 982 to report this.

- Prior Year Returns: The bankruptcy court may require you to file any delinquent tax returns for previous years.

Important: Consult with a tax professional experienced in bankruptcy cases to ensure you meet all tax obligations during and after bankruptcy proceedings.

Q. What if I receive alimony or child support?

The tax treatment of alimony and child support payments changed significantly with the Tax Cuts and Jobs Act:

- Alimony:

- For divorce agreements executed after December 31, 2018: Alimony is not taxable income for the recipient and not deductible for the payer.

- For agreements executed before January 1, 2019: Alimony is taxable income for the recipient and deductible for the payer unless the agreement specifies otherwise.

- Child Support: Child support payments are never taxable to the recipient or deductible by the payer.

- Filing Requirement: While child support doesn’t affect your taxable income, alimony (for pre-2019 agreements) could increase your gross income and potentially require you to file.

Case Study: Sarah receives $24,000 in alimony in 2025 under a divorce agreement from 2017. This alimony is taxable income and requires Sarah to file a tax return, even if she has no other income.

R. How does inheriting money or property affect my taxes?

Inheriting money or property can have various tax implications:

- Income Tax: Most inheritances are not subject to income tax. However, certain inherited assets can generate taxable income (e.g., traditional IRA distributions, interest from inherited savings bonds).

- Estate Tax: As of 2025, federal estate tax only applies to very large estates (over $12.92 million, adjusted for inflation). However, some states have lower thresholds for estate or inheritance taxes.

- Capital Gains: If you sell inherited property, you may owe capital gains tax. The basis is usually stepped up to the fair market value at the date of the decedent’s death.

- Filing Requirement: While receiving an inheritance generally doesn’t create a filing requirement, income generated from inherited assets might.

Important: The tax implications of inheritances can be complex. Consult with a tax professional or estate planning attorney for guidance specific to your situation.

S. What if I have cryptocurrency transactions?

As cryptocurrency becomes more mainstream, the IRS has increased its focus on ensuring proper reporting:

- Taxable Events: The following cryptocurrency transactions are generally taxable:

- Selling cryptocurrency for fiat currency (e.g., USD)

- Trading one cryptocurrency for another

- Using cryptocurrency to purchase goods or services

- Receiving cryptocurrency as payment for goods or services

- Capital Gains/Losses: The IRS treats cryptocurrency as property, so selling or exchanging it can result in capital gains or losses.

- Income Reporting: If you receive cryptocurrency as payment for goods or services, it’s treated as ordinary income based on the fair market value at the time of receipt.

- Mining: Income from mining cryptocurrency is generally considered self-employment income.

- Form 1040 Question: As of 2025, Form 1040 includes a question about cryptocurrency transactions, which must be answered accurately.

Important: Keep detailed records of all cryptocurrency transactions, including dates, amounts, and fair market values. The IRS Virtual Currency page provides updated guidance on cryptocurrency taxation.

T. How does caring for an elderly parent affect my taxes?

Caring for an elderly parent can have several tax implications:

- Dependency Exemption: You may be able to claim your parent as a dependent if you provide more than half of their support and their gross income is below a certain threshold.

- Filing Status: If you’re unmarried and can claim your parent as a dependent, you might qualify for Head of Household filing status, which has more favorable tax rates.

- Medical Expenses: If you pay medical expenses for a qualifying parent, these can be included in your itemized deductions.

- Dependent Care Credit: In some cases, you may be eligible for the Child and Dependent Care Credit if you pay for care for your parent while you work.

- Caregiver Payments: If you receive payments from your parent or a government program for providing care, this may be taxable income.

Pro Tip: Keep detailed records of all expenses related to your parent’s care, as these may be deductible or qualify you for credits.

U. What if I’m a member of the clergy?

Clergy members have unique tax considerations:

- Dual Tax Status: Ministers are typically considered employees for income tax purposes but self-employed for Social Security and Medicare taxes.

- Housing Allowance: A minister’s housing allowance may be excludable from income taxes but is subject to self-employment tax.

- Self-Employment Tax: Ministers must pay self-employment tax on their ministerial earnings, unless they have opted out of Social Security.

- Form 4361: Ministers can opt out of paying self-employment tax on their ministerial earnings by filing Form 4361, but strict conditions apply.

- Estimated Tax Payments: Since taxes are often not withheld from a minister’s pay, quarterly estimated tax payments may be necessary.

Important: The tax rules for clergy can be complex. The IRS provides specific guidance in Publication 517.

V. How does having a health savings account (HSA) affect my taxes?

Health Savings Accounts offer several tax advantages:

- Contributions: Contributions to an HSA are tax-deductible, even if you don’t itemize deductions.

- Employer Contributions: If your employer contributes to your HSA, these contributions are generally not taxable income.

- Earnings: Interest or investment earnings in your HSA grow tax-free.

- Distributions: Withdrawals for qualified medical expenses are tax-free.

- Reporting: You must report HSA contributions and distributions on Form 8889 with your tax return.

Pro Tip: Keep receipts for all medical expenses paid from your HSA, as you may need to prove these were qualified expenses if audited.

W. What if I have canceled debt?

Canceled debt is generally considered taxable income, but there are exceptions:

- Form 1099-C: You’ll typically receive this form if a debt of $600 or more is canceled.

- Exceptions: Certain canceled debts may be excludable from income, such as:

- Debts discharged in bankruptcy

- Qualified principal residence indebtedness

- Insolvency (when your total debts exceed the fair market value of your total assets)

- Form 982: If you qualify for an exclusion, you generally need to file Form 982 to report the exclusion and any reduction of tax attributes.

- Impact on Filing Requirement: Canceled debt that’s considered taxable income may push your total income above the filing threshold, requiring you to file a return.

- State Taxes: Some states may treat canceled debt differently than the federal government for tax purposes.

Important: The rules surrounding canceled debt can be complex. The IRS provides detailed information in Publication 4681.

X. How does participating in the gig economy affect my taxes?

With the rise of the gig economy, many taxpayers have questions about how this work affects their taxes:

- Self-Employment: Most gig workers are considered self-employed for tax purposes.

- Form 1099-K or 1099-NEC: You may receive these forms reporting your income, but you’re required to report all income even if you don’t receive a form.

- Quarterly Estimated Taxes: Since taxes aren’t typically withheld from gig economy earnings, you may need to make quarterly estimated tax payments.

- Self-Employment Tax: You’re responsible for paying self-employment tax (Social Security and Medicare taxes) on your net earnings.

- Deductions: You can deduct ordinary and necessary business expenses related to your gig work.

- Home Office Deduction: If you use part of your home exclusively for your gig work, you may qualify for the home office deduction.

Pro Tip: Keep detailed records of all income and expenses related to your gig work. The IRS Gig Economy Tax Center provides resources specifically for gig workers.

Y. What if I have income from a trust or estate?

Income from a trust or estate can affect your tax situation in several ways:

- Schedule K-1: You’ll typically receive this form reporting your share of income, deductions, and credits from the trust or estate.

- Types of Income: Trust or estate income can include various types of income (e.g., interest, dividends, capital gains) which may be taxed differently.

- Filing Requirement: Income from a trust or estate is included in your gross income and may require you to file a return if it pushes you over the filing threshold.

- Complex Trusts: Some trusts have complex distribution rules that can affect how and when income is taxed to beneficiaries.

- State Taxes: Trust and estate income may be subject to state taxes, which can vary depending on the trust’s location and your residency.

Important: The taxation of trust and estate income can be complex. Consider consulting with a tax professional experienced in this area.

Z. How does having a side business affect my taxes?

Many people have side businesses in addition to their regular jobs, which can significantly impact their tax situation:

- Schedule C: Income and expenses from your side business are typically reported on Schedule C of your personal tax return.

- Self-Employment Tax: If your net earnings from self-employment exceed $400, you’ll owe self-employment tax.

- Estimated Tax Payments: You may need to make quarterly estimated tax payments on your side business income.

- Home Office Deduction: If you use part of your home exclusively for your side business, you may qualify for this deduction.

- Business Expenses: Keep track of all business-related expenses, as these can be deducted to reduce your taxable income.

- Hobby vs. Business: The IRS has specific criteria to determine if your activity is a business or a hobby, which affects your ability to deduct expenses.

Case Study: Jane works full-time as a teacher and runs an online tutoring business on the side. In 2025, she earns $5,000 from tutoring. This income pushes her over the threshold for self-employment tax, requires her to report the income on Schedule C, and may necessitate quarterly estimated tax payments.

Remember, tax laws can be complex and are subject to change. While this FAQ covers many common scenarios, it’s always best to consult with a qualified tax professional or the IRS for guidance specific to your individual situation. Here are a few more frequently asked questions to round out our comprehensive guide:

AA. How does receiving a large gift affect my taxes?

Receiving a large gift generally doesn’t create a tax liability for the recipient:

- Gift Tax: The person giving the gift (the donor) is typically responsible for any gift tax, not the recipient.

- Annual Exclusion: As of 2025, gifts up to $15,000 per recipient (adjusted for inflation) are excluded from gift tax.

- Lifetime Exemption: Even gifts above the annual exclusion can be covered by the donor’s lifetime gift and estate tax exemption.

- Income from Gifts: While the gift itself isn’t taxable, any income generated from the gifted asset (e.g., interest from a gifted savings account) is taxable to the recipient.

- Filing Requirement: Receiving a gift doesn’t typically create a filing requirement for the recipient.

Important: The IRS Gift Tax page provides detailed information on gift tax rules and exclusions.

BB. What if I have foreign financial accounts?

If you have financial interests in or signature authority over foreign financial accounts, you may have additional filing requirements:

- FBAR: You must file a Foreign Bank and Financial Accounts Report (FBAR) if the aggregate value of your foreign accounts exceeds $10,000 at any time during the calendar year.

- Form 8938: You may need to file Form 8938, Statement of Specified Foreign Financial Assets, if the total value of your foreign financial assets exceeds certain thresholds.

- Income Reporting: Any income earned from foreign accounts must be reported on your U.S. tax return.

- FATCA: The Foreign Account Tax Compliance Act (FATCA) requires certain U.S. taxpayers holding foreign financial assets to report those assets to the IRS.

Pro Tip: The penalties for failing to report foreign accounts can be severe. If you have foreign financial interests, consider consulting with a tax professional experienced in international tax matters.

CC. How does owning cryptocurrency mining equipment affect my taxes?

Cryptocurrency mining can have significant tax implications:

- Income Recognition: The fair market value of cryptocurrency you mine is taxable as ordinary income in the year you receive it.

- Self-Employment Tax: If your mining activity rises to the level of a trade or business, you may owe self-employment tax on your mining income.

- Equipment Depreciation: You may be able to depreciate the cost of your mining equipment over time.

- Electricity Costs: The cost of electricity used for mining may be deductible as a business expense.

- Sale of Mined Cryptocurrency: When you sell cryptocurrency that you mined, you’ll need to calculate capital gains or losses based on the difference between your basis (the amount you included in income when mined) and the sale price.

Important: Keep detailed records of all mining activity, including equipment costs, electricity usage, and the fair market value of mined cryptocurrency on the day you receive it.

DD. What if I receive income from crowdfunding or online fundraising?

The tax treatment of crowdfunding and online fundraising income can vary:

- Gifts: If the funds are received as gifts with no expectation of goods or services in return, they’re generally not taxable to the recipient.

- Business Income: If the crowdfunding campaign is for a business venture, the funds received are likely taxable as business income.

- Form 1099-K: You may receive a Form 1099-K from the crowdfunding platform if you receive more than $20,000 and have more than 200 transactions in a year.

- Charitable Donations: If you’re raising funds for a qualified charity, donors may be able to deduct their contributions, but you should not include the donations in your income.

- Medical Expenses: Funds raised for medical expenses may be excludable from income under certain circumstances.

Pro Tip: The tax implications of crowdfunding can be complex. Consider consulting with a tax professional to ensure proper reporting.

EE. How does participating in a clinical trial affect my taxes?

Participating in a clinical trial can have tax implications:

- Compensation: Any payments you receive for participating in a clinical trial are generally considered taxable income.

- Form 1099-MISC: You may receive this form reporting the income if you were paid $600 or more.

- Expense Reimbursements: Reimbursements for out-of-pocket expenses related to the trial (like travel costs) are typically not taxable.

- Medical Care: The value of medical care received as part of the trial is generally not considered taxable income.

- Filing Requirement: Income from clinical trials is included in your gross income and may require you to file a return if it pushes you over the filing threshold.

Important: Keep detailed records of all payments received and expenses incurred related to the clinical trial.

FF. What if I receive a legal settlement or judgment?

The tax treatment of legal settlements or judgments can vary depending on the nature of the case:

- Physical Injury Settlements: Compensation for physical injuries or physical sickness is generally not taxable.

- Emotional Distress: Settlements for emotional distress are typically taxable unless they stem from a physical injury.

- Lost Wages: Settlements for lost wages are usually taxable as ordinary income.

- Punitive Damages: These are generally taxable regardless of the nature of the case.

- Attorney Fees: In many cases, you must report the full amount of the settlement as income, even if a portion went directly to your attorney.

- Form 1099-MISC: You may receive this form reporting the settlement amount.

Pro Tip: The tax implications of legal settlements can be complex. Consider consulting with a tax professional to ensure proper reporting.

GG. How does having a green card affect my tax obligations?

Green card holders (lawful permanent residents) generally have the same tax obligations as U.S. citizens:

- Worldwide Income: You must report your worldwide income on your U.S. tax return, regardless of where you live or where the income is earned.

- Filing Requirement: You’re subject to the same filing requirements as U.S. citizens based on your income, age, and filing status.

- FBAR and FATCA: You may need to report foreign financial accounts and assets.

- Tax Treaties: Some tax treaties between the U.S. and other countries may provide special provisions for green card holders.

- Social Security and Medicare: You’re generally required to pay into these systems if you work in the U.S.

Important: If you surrender your green card or it’s revoked, there may be special tax considerations, including potential exit tax.

HH. What if I receive income from intellectual property (patents, copyrights, etc.)?

Income from intellectual property can have unique tax implications:

- Royalties: Income from royalties is generally reported on Schedule E and is subject to ordinary income tax rates.

- Sale of Intellectual Property: If you sell your intellectual property, it may be treated as a capital gain, potentially qualifying for lower tax rates.

- Self-Created Works: Special rules may apply to copyrights, literary, musical, or artistic compositions created by your personal efforts.

- Amortization: In some cases, you may be able to amortize the cost of acquiring intellectual property over time.

- Foreign Income: If your intellectual property generates income from foreign sources, you may need to consider international tax implications.

Pro Tip: Keep detailed records of all income and expenses related to your intellectual property. The tax treatment can vary depending on how the intellectual property was acquired or created.

II. How does participating in a barter exchange affect my taxes?

Bartering, while not involving cash, still has tax implications:

- Fair Market Value: The fair market value of goods or services received through bartering is generally taxable income.

- Form 1099-B: If you participate in a barter exchange, you may receive this form reporting the value of goods or services you received.

- Business Income: If the bartering is related to your business, report it on Schedule C.

- Deductions: You may be able to deduct expenses related to the goods or services you provided in the barter transaction.

- Timing: You generally must report bartering income in the year you receive the goods or services, even if you provide your goods or services in a different year.

Important: The IRS Bartering Tax Center provides detailed information on the tax implications of bartering.

JJ. What if I have income from fantasy sports or online gambling?

With the rise of online gambling and fantasy sports, many taxpayers have questions about how this income is taxed:

- Reporting Winnings: All gambling winnings, including those from fantasy sports, are taxable income and must be reported on your tax return.

- Form W-2G: You may receive this form if your winnings exceed certain thresholds, but you’re required to report all winnings regardless.

- Deducting Losses: Gambling losses can be deducted, but only up to the amount of your winnings, and only if you itemize deductions on Schedule A.

- Professional Gamblers: If gambling is your profession, you may report income and expenses on Schedule C.

- State Taxes: State tax treatment of gambling income can vary, so check your state’s specific rules.

Pro Tip: Keep a detailed log of all your gambling activities, including winnings, losses, dates, and locations. This documentation is crucial if you’re ever audited.

KK. How does having a 529 college savings plan affect my taxes?

529 plans are tax-advantaged savings plans designed to encourage saving for education costs:

- Contributions: Contributions to 529 plans are not deductible on your federal tax return, but some states may offer tax deductions or credits.

- Earnings: Earnings in 529 plans grow tax-free.

- Distributions: Withdrawals for qualified education expenses are tax-free at the federal level and usually at the state level as well.

- Non-Qualified Distributions: Withdrawals for non-qualified expenses may be subject to income tax and a 10% penalty on the earnings portion.

- Gift Tax: Contributions to 529 plans are considered gifts for tax purposes, but special rules allow for larger upfront contributions.

Important: The definition of qualified education expenses has expanded in recent years. Check the IRS 529 Plans page for the most current information.

LL. What if I receive a state or local tax refund?

The taxability of state and local tax refunds can be complex:

- Form 1099-G: You’ll typically receive this form reporting your state or local tax refund.

- Federal Deduction: If you deducted state and local taxes on your previous year’s federal return, you might need to report part or all of the refund as income.

- Standard Deduction: If you took the standard deduction in the previous year, your state or local tax refund is generally not taxable.

- SALT Cap: The $10,000 cap on state and local tax deductions can affect how much of your refund is taxable.

- Worksheet: The IRS provides a worksheet in the Form 1040 instructions to help determine the taxable portion of your refund.

Pro Tip: Keep your previous year’s tax return handy when determining if your state or local tax refund is taxable.