How to Fill Out a W-4 Form: Optimize Your Tax Withholding for 2025

Introduction: Understanding the Importance of Your W-4

The 2025 landscape of tax withholding continues to evolve, making it more crucial than ever to understand how to properly fill out your Form W-4, also known as the Employee’s Withholding Certificate. This document plays a pivotal role in determining the amount of federal income tax withheld from your paycheck, directly impacting your take-home pay and potential tax refund or liability at the end of the year.

The W-4 form underwent significant changes in recent years, particularly following the Tax Cuts and Jobs Act (TCJA) of 2017. These modifications were designed to improve the accuracy of withholding and simplify the process for employees. However, they also require a more nuanced understanding of your tax situation and financial goals.

Why Proper W-4 Withholding Matters

Accurate completion of your W-4 is essential for several reasons:

- Balanced Cash Flow: It helps ensure you’re not having too much or too little tax withheld from each paycheck.

- Avoiding Penalties: Proper withholding can help you avoid underpayment penalties from the IRS.

- Financial Planning: It allows for better budgeting and financial planning throughout the year.

- Minimizing Large Refunds: While a big tax refund might seem appealing, it essentially means you’ve given the government an interest-free loan.

According to the IRS, in 2023, the average tax refund was $3,167. While this may seem like a windfall, it represents over $260 per month that could have been in your pocket throughout the year.

Recent Changes to the W-4 Form

The most significant change in recent years has been the elimination of withholding allowances. Instead, the form now focuses on specific dollar amounts for income tax credits, non-wage income, itemized and other deductions, and total annual taxable wages.

“The new design reduces the form’s complexity and increases the transparency and accuracy of the withholding system.” – IRS Commissioner Chuck Rettig

For a detailed overview of these changes, you can visit the official IRS page on Form W-4.

As we delve deeper into each section of the W-4 form, remember that your personal financial situation is unique. While this guide provides comprehensive information, consulting with a tax professional for personalized advice is always recommended, especially if you have a complex tax situation.

In the following sections, we’ll break down each step of the W-4 form, providing you with the knowledge to optimize your tax withholding for the 2025 tax year and beyond.

II. Understanding W-4 Withholding Basics

What is Tax Withholding and Why Does It Matter?

Tax withholding is a fundamental concept in the U.S. tax system, serving as the backbone of the “pay-as-you-go” approach to income taxation. It’s crucial to understand this process to effectively manage your finances and comply with tax laws.

Definition of Tax Withholding

Tax withholding refers to the amount of money that your employer deducts from your paycheck and sends directly to the Internal Revenue Service (IRS) on your behalf. This process applies to federal income taxes, as well as Social Security and Medicare taxes (collectively known as FICA taxes).

The amount withheld is based on the information you provide on your W-4 form, which includes details about your filing status, number of dependents, and other factors that influence your tax liability.

How Withholding Affects Your Paycheck and Tax Liability

The amount withheld from your paycheck directly impacts two key aspects of your financial life:

- Your Take-Home Pay: The more tax withheld, the lower your net pay will be each pay period.

- Your Year-End Tax Situation: Proper withholding helps ensure that you’re paying enough taxes throughout the year to cover your tax liability.

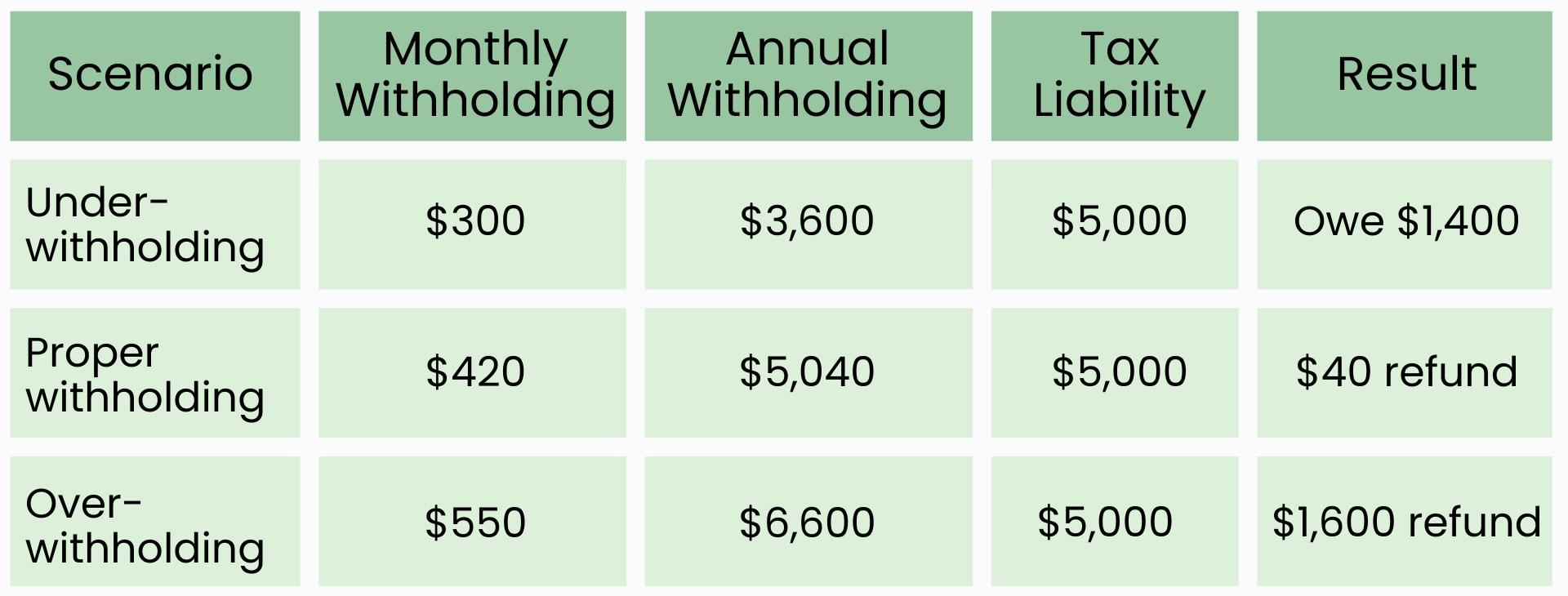

Consider this example:

As you can see, the amount withheld significantly affects your financial outcome at tax time.

Consequences of Incorrect Withholding

Incorrect withholding can lead to several issues:

- Owing a Large Sum: If you under-withhold, you may face a substantial tax bill when filing your return.

- Penalties: Severe under-withholding can result in an underpayment penalty from the IRS.

- Financial Strain: A large tax bill can cause financial stress if you haven’t budgeted for it.

- Opportunity Cost: Over-withholding means you’re giving the government an interest-free loan, potentially missing out on investment or debt repayment opportunities.

According to the Government Accountability Office, about 21% of taxpayers are under-withheld, while about 73% are over-withheld. Only about 6% have the correct amount withheld.

The Role of Taxable Income

Understanding taxable income is crucial for accurate withholding. Taxable income includes:

- Wages and salaries

- Bonuses and commissions

- Self-employment income

- Investment income (dividends, interest, capital gains)

- Rental income

- Certain types of Social Security benefits

However, not all income is taxable. For instance, certain employee benefits, like health insurance premiums paid by your employer, are generally not included in your taxable income.

“The key to proper withholding is to give your employer the most accurate information possible on your W-4.” – Janet Holtzblatt, Senior Fellow at the Urban-Brookings Tax Policy Center

By understanding these basics of tax withholding, you’re better equipped to make informed decisions when filling out your W-4 form. In the next section, we’ll explore the recent changes to the W-4 form and how they affect your withholding calculations.

III. The New Form W-4: What’s Changed?

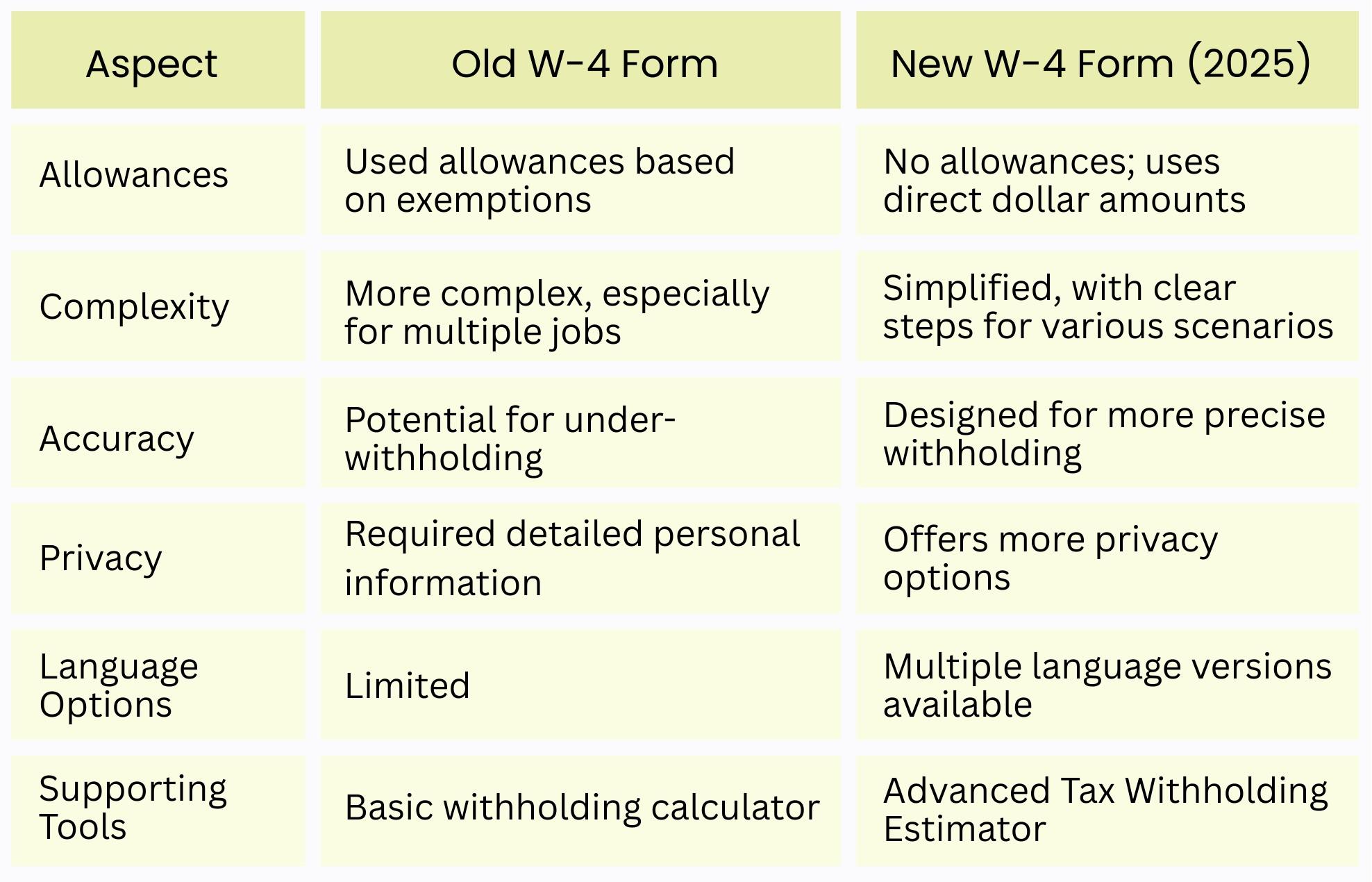

Key Differences in the 2025 W-4 Form

As we approach 2025, it’s crucial to understand the evolution of the W-4 form and how recent changes impact your tax withholding. The most significant overhaul occurred in 2020, with subsequent minor adjustments to improve accuracy and user-friendliness.

A. Removal of Allowances

One of the most notable changes in recent years has been the elimination of withholding allowances. Previously, employees would claim a certain number of “allowances” based on personal exemptions, which would then determine their withholding amount.

Why the change? The removal of allowances was primarily due to the Tax Cuts and Jobs Act (TCJA) of 2017, which eliminated personal exemptions. This change aimed to simplify the withholding process and improve accuracy.

Impact on taxpayers:

- More straightforward calculations

- Reduced risk of under-withholding due to misunderstanding allowances

- Greater transparency in how withholding is determined

B. Simplified Steps for Filling Out the Form

The new W-4 form has been redesigned to be more intuitive and easier to complete. It now consists of five clear steps:

- Enter Personal Information

- Multiple Jobs or Spouse Works

- Claim Dependents

- Other Adjustments

- Sign and Date

This structure guides employees through the process more logically, helping to ensure all relevant information is captured accurately.

Key benefits of the simplified structure:

- Reduced confusion for employees

- Easier identification of areas that may affect withholding

- More accurate withholding calculations

C. Addition of Language Options and Tax Withholding Estimator Tool

To further improve accessibility and accuracy, the IRS has made two significant enhancements:

- Multiple Language Options: The W-4 form is now available in several languages, including Spanish, Chinese, Korean, Vietnamese, and Russian. This change helps ensure that non-native English speakers can accurately complete their forms.”Providing form W-4 in multiple languages helps taxpayers who are more comfortable in a language other than English to better understand their tax obligations.” – IRS Commissioner Chuck Rettig

- Enhanced Tax Withholding Estimator Tool: The IRS has continually improved its Tax Withholding Estimator tool. This online calculator helps employees more accurately determine their withholding by considering various factors, including:

- Multiple jobs

- Spousal income

- Self-employment income

- Tax credits and deductions

Benefits of these enhancements:

- Increased accessibility for a diverse workforce

- More accurate withholding calculations

- Reduced likelihood of surprises at tax time

Comparative Analysis: Old vs. New W-4 Form

These changes reflect the IRS’s ongoing efforts to simplify the tax withholding process while improving accuracy. By understanding these updates, you can more effectively use the W-4 form to manage your tax withholding throughout the year.

These changes reflect the IRS’s ongoing efforts to simplify the tax withholding process while improving accuracy. By understanding these updates, you can more effectively use the W-4 form to manage your tax withholding throughout the year.

In the next section, we’ll provide a detailed, step-by-step guide on how to fill out each section of the new W-4 form, ensuring you can optimize your withholding for your specific financial situation.

IV. Step-by-Step Guide to Fill Out a W-4

How to Complete Each Section of Your W-4 Form

Filling out your W-4 form accurately is crucial for ensuring the right amount of tax is withheld from your paycheck. Let’s break down each step of the 2025 W-4 form to help you navigate this important document with confidence.

A. Step 1: Enter Personal Information

This initial step is straightforward but essential. You’ll need to provide:

- Full Name and Address: Ensure this matches the information on file with the Social Security Administration.

- Social Security Number: Double-check for accuracy to avoid processing delays.

- Filing Status: Choose from Single or Married filing separately, Married filing jointly (or Qualifying widow(er)), or Head of household.

Important Note: Your filing status on the W-4 should generally match what you plan to use when filing your tax return. However, in some cases, you might choose a different status for withholding purposes. For instance, if you’re married but want more tax withheld, you might select “Single” for higher withholding rates.

“Selecting the correct filing status is crucial as it affects your standard deduction and tax brackets.” – Mark Steber, Chief Tax Information Officer at Jackson Hewitt

B. Step 2: Multiple Jobs or Spouse Works

This section is critical if you have more than one job or if you’re married filing jointly and your spouse also works. There are three options:

- Use the IRS’s Tax Withholding Estimator: This online tool provides the most accurate withholding calculation. Access it at IRS Tax Withholding Estimator.

- Use the Multiple Jobs Worksheet: This worksheet is provided with the W-4 form and helps calculate additional withholding needed.

- Check the box if there are only two jobs total: This is the simplest option if you and your spouse each have one job with similar pay.

Pro Tip: If you choose option 2 or 3, complete Step 2 on only one W-4 form, typically the one for the highest paying job. Leave it blank on other W-4 forms.

C. Step 3: Claim Dependents

This step allows you to claim tax credits for dependents. As of 2025, the credits are:

- $2,000 for each qualifying child under 17

- $500 for other dependents

To calculate:

- Multiply the number of qualifying children under 17 by $2,000

- Multiply the number of other dependents by $500

- Add these amounts

D. Step 4: Other Adjustments

This optional step allows for further customization of your withholding:

- 4(a) Other Income: Enter estimated annual non-wage income not subject to withholding (e.g., dividends, interest).

- 4(b) Deductions: If you plan to claim deductions other than the standard deduction, use the Deductions Worksheet on page 3 of Form W-4.

- 4(c) Extra Withholding: Specify any additional amount you want withheld from each paycheck.

Tip: Use 4(c) if you had a large tax bill last year or if you’re transitioning from a W-2 job to self-employment and want to cover estimated taxes.

E. Step 5: Sign and Date

Don’t forget this crucial final step! Your W-4 is not valid without your signature and the date.

Additional Considerations

- Accuracy is Key: Providing accurate information helps avoid surprises at tax time.

- Regular Updates: Review and update your W-4 annually or when you experience significant life changes (marriage, new child, new job, etc.).

- Privacy Concerns: If you’re concerned about providing financial information to your employer, you can use the Tax Withholding Estimator and enter the resulting amount directly in Step 4(c).

By following these steps carefully, you can ensure that your W-4 accurately reflects your tax situation, leading to more precise withholding throughout the year.

V. Special Considerations for W-4 Withholding

Unique Situations That Affect Your W-4 Withholding

While the basic steps for filling out a W-4 apply to most employees, certain situations require special attention. Understanding these can help you optimize your withholding for your specific circumstances.

A. Multiple Jobs or Working Spouses

Having multiple jobs or a working spouse can significantly impact your tax withholding. If not accounted for properly, you might end up under-withholding, leading to a surprise tax bill.

Strategies for accurate withholding:

- Use the IRS Tax Withholding Estimator for the most precise calculation.

- Complete the Multiple Jobs Worksheet provided with Form W-4.

- For two jobs with similar pay, simply check the box in Step 2(c) on each W-4.

“When you have multiple jobs, it’s crucial to consider the tax brackets. Your total income might push you into a higher bracket than each individual job would suggest.” – Alison Flores, Principal Tax Research Analyst at H&R Block

B. Self-Employment Income

If you have self-employment income in addition to your W-2 job, you’ll need to account for this on your W-4.

Key points:

- Enter estimated self-employment income in Step 4(a).

- Consider making estimated tax payments quarterly to avoid penalties.

- Use Form 1040-ES to calculate estimated taxes.

C. New Job Considerations

Starting a new job is an ideal time to reassess your W-4 withholding.

Tips for new job W-4 completion:

- Review your previous year’s tax return for guidance.

- Consider any changes in your financial situation since your last job.

- Use the first few months to assess if your withholding is accurate, and adjust if necessary.

D. Seasonal or Part-Time Work

Seasonal and part-time workers face unique challenges in tax withholding.

Considerations:

- Your annual income may be lower than a full-time equivalent, potentially putting you in a lower tax bracket.

- If this is your only job, you might qualify for certain tax credits based on lower income.

- If you have other jobs during the year, consider the total annual income when determining withholding.

E. Part-Year Employment

If you work for only part of the year, your withholding should be adjusted accordingly.

Strategies:

- Use the Part-Year Method: This allows for more accurate withholding based on your actual work period.

- Communicate your employment duration to your employer for proper withholding calculation.

Here’s a comparison of withholding methods for part-year employment:

Case Study: The Impact of Multiple Jobs on Withholding

Case Study: The Impact of Multiple Jobs on Withholding

Consider Sarah, who has two jobs:

- Job A: $50,000 annual salary

- Job B: $30,000 annual salary

If Sarah fills out her W-4 for each job as if it were her only job, she might under-withhold by several thousand dollars. Here’s why:

- Each job’s withholding is calculated as if it’s the only income, placing her in a lower tax bracket.

- The combined income of $80,000 pushes her into a higher tax bracket.

- Standard deductions are essentially counted twice, further reducing withholding.

Solution: Sarah should use the IRS Tax Withholding Estimator or the Multiple Jobs Worksheet to accurately calculate her withholding across both jobs. She might also choose to have additional amounts withheld from one or both jobs to cover the shortfall.

By understanding these special considerations and applying the appropriate strategies, you can ensure your W-4 withholding accurately reflects your unique financial situation, helping you avoid surprises at tax time and maintain a stable cash flow throughout the year.

VI. How to Adjust Your W-4 Form

Strategies for Optimizing Your W-4 Withholding

Adjusting your W-4 form is a crucial step in managing your tax liability and cash flow throughout the year. Whether you’re aiming for a smaller refund, trying to avoid owing taxes, or adapting to life changes, knowing how to adjust your W-4 is essential.

A. Scenarios for Wanting Less or More Tax Withheld

There are various reasons why you might want to adjust your withholding:

- Aiming for a Smaller Refund:

- If you typically receive a large refund, you might prefer to have less tax withheld to increase your take-home pay.

- This allows you to use your money throughout the year instead of giving an interest-free loan to the government.

- Avoiding a Tax Bill:

- If you’ve owed taxes in previous years, you may want to increase your withholding to avoid a similar situation.

- This is especially important if you’ve incurred penalties for underpayment in the past.

- Life Changes:

- Marriage, divorce, birth of a child, or changes in income can all necessitate adjustments to your W-4.

B. Balancing Between Higher Take-Home Pay and Tax Refunds

Finding the right balance is key to optimizing your withholding:

Pros of Higher Take-Home Pay:

- More money available for immediate needs or investments

- Opportunity to pay down debt faster

- Control over your money throughout the year

Pros of Larger Tax Refund:

- Forced savings mechanism

- Potential for a lump sum to make large purchases or investments

- Psychological benefit of receiving a large check

“The goal should be to break even at tax time. This means you’ve paid the right amount throughout the year without giving an interest-free loan to the government or owing a large sum.” – Kathy Pickering, Chief Tax Officer at H&R Block

C. Adjustments Based on Personal Financial Situations or Extra Income

To make precise adjustments:

- Use the IRS Tax Withholding Estimator:

- This tool provides tailored recommendations based on your specific situation.

- Access it at IRS Tax Withholding Estimator

- Consider All Income Sources:

- Include income from investments, rental properties, or side gigs in your calculations.

- Account for Deductions and Credits:

- Estimate your itemized deductions if you plan to itemize.

- Factor in credits like the Child Tax Credit or Education credits.

- Adjust for Multiple Jobs or Working Spouses:

- Use the Multiple Jobs Worksheet or the Two-Earners/Multiple Jobs Worksheet.

- Fine-Tune with Extra Withholding:

- Use line 4(c) of Form W-4 to specify an additional amount to be withheld from each paycheck.

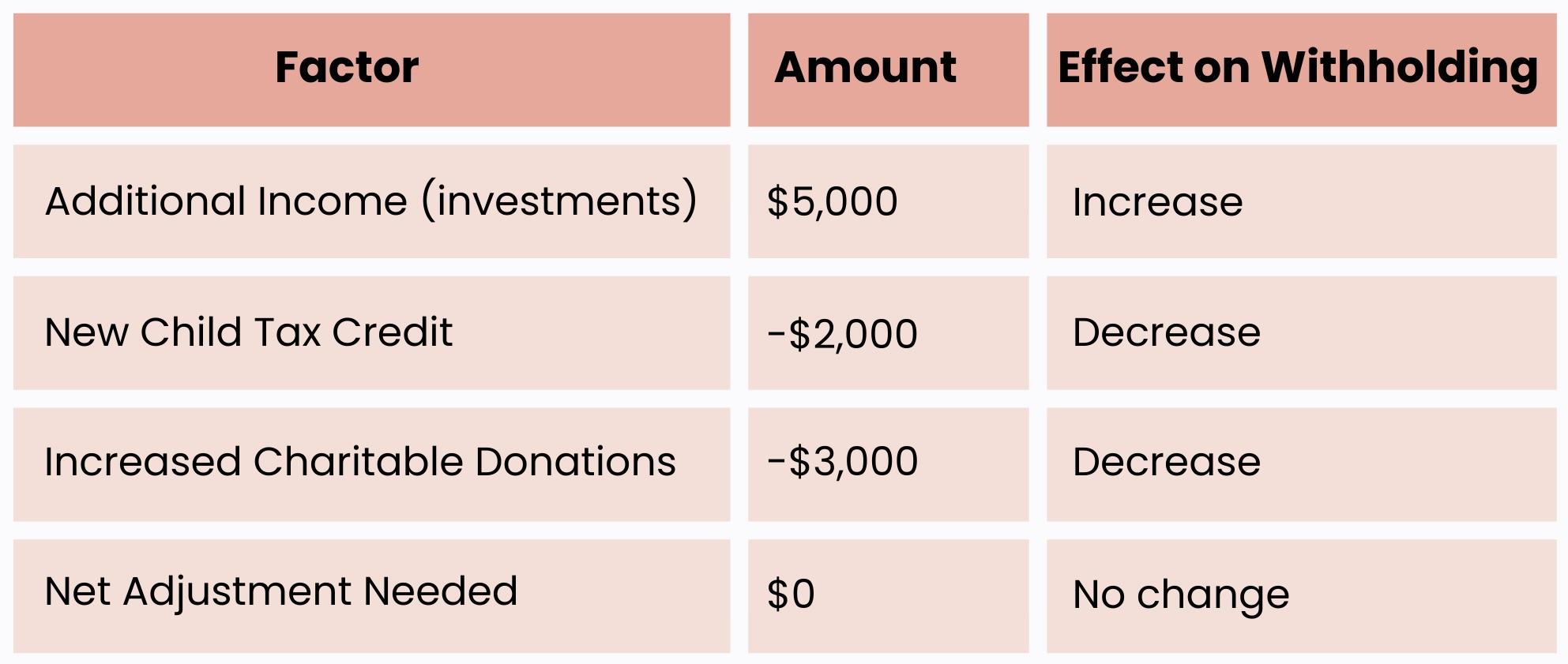

Example Adjustment Calculation:

In this example, the additional income is offset by new credits and deductions, resulting in no net change needed to withholding.

Tips for Effective W-4 Adjustments:

- Review Quarterly: Assess your withholding every few months to ensure it’s on track.

- Use Paycheck Checkups: Compare your actual withholding to your estimated tax liability periodically.

- Consider Future Changes: Anticipate known future changes (e.g., a planned job change or major life event) and adjust proactively.

- Keep Records: Maintain a record of your W-4 changes and the reasons for them to inform future adjustments.

- Consult a Professional: For complex situations, consider consulting a tax professional for personalized advice.

Remember, the goal is to have your withholding match your tax liability as closely as possible. This approach helps you avoid both large refunds and unexpected tax bills, giving you more control over your finances throughout the year.

VII. When and How to Update Your W-4

Keeping Your W-4 Current

Regularly updating your W-4 is crucial for maintaining accurate tax withholding. Life changes and financial shifts can significantly impact your tax situation, making it essential to revisit your W-4 periodically.

A. Process for Updating the W-4 with Life Changes

Updating your W-4 is a straightforward process:

- Obtain a New Form: Get a new W-4 form from your employer’s HR department or download it from the IRS website.

- Fill Out the Form: Complete the form with your updated information, following the step-by-step guide outlined earlier.

- Submit to Your Employer: Give the completed form to your employer’s payroll or HR department.

- Verify Changes: Check your next few paychecks to ensure the changes have been implemented correctly.

Important: You can submit a new W-4 at any time during the year. Changes typically take effect within one to two pay periods.

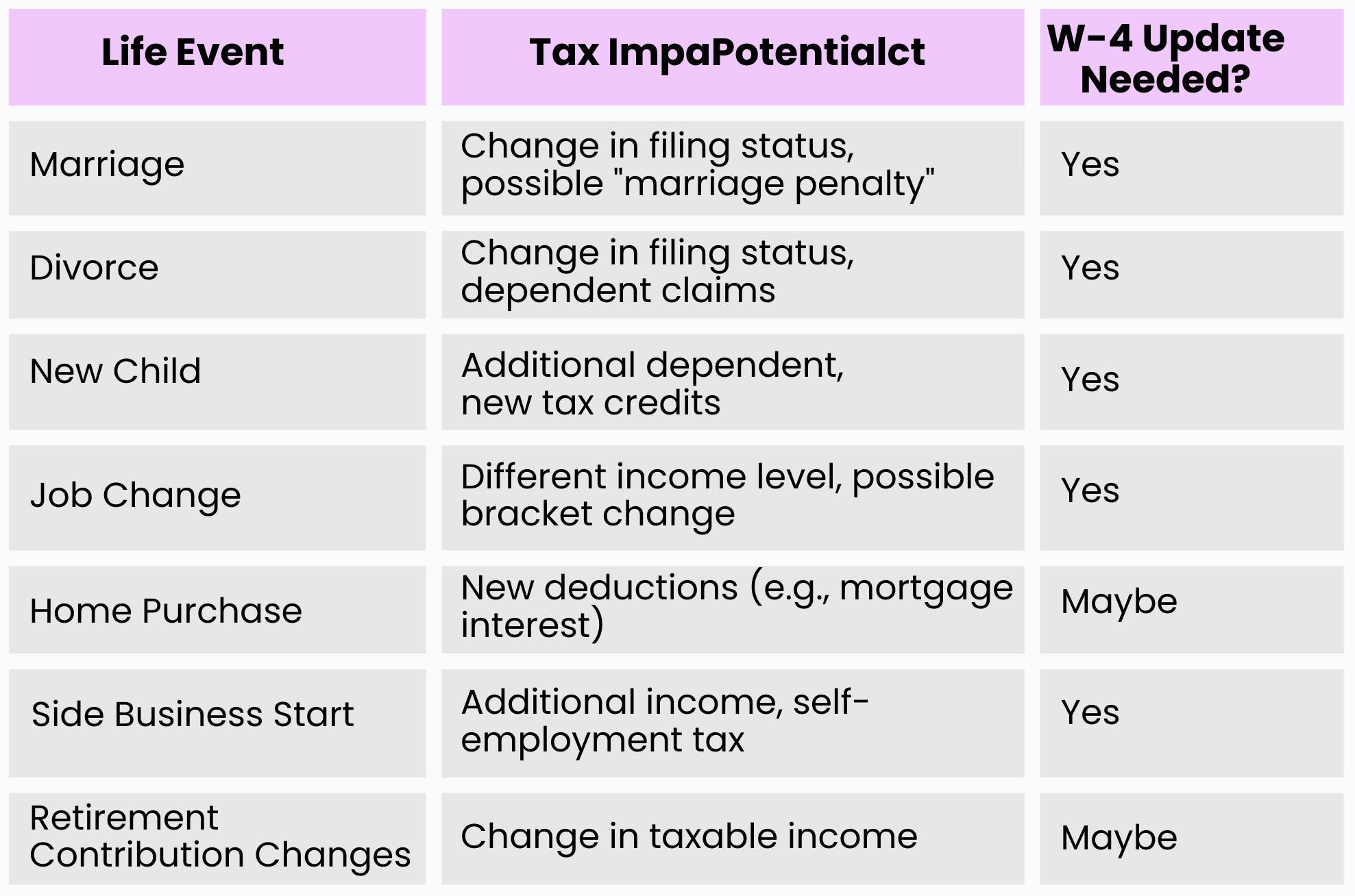

B. Common Life Events Prompting Updates

Several life events can significantly affect your tax situation, necessitating a W-4 update:

- Marriage or Divorce:

- Marriage can change your filing status and potentially put you in a different tax bracket.

- Divorce may affect your filing status and dependent claims.

- Birth or Adoption of a Child:

- New dependents can qualify you for additional tax credits and deductions.

- Job Change or Additional Job:

- A new job or second job can change your total annual income, potentially affecting your tax bracket.

- Significant Income Changes:

- Substantial salary increases, bonuses, or investment income can impact your tax liability.

- Home Purchase:

- Homeownership can introduce new deductions, like mortgage interest.

- Starting a Side Business:

- Self-employment income requires different tax considerations and possibly estimated tax payments.

- Retirement Contributions Changes:

- Adjusting your 401(k) or IRA contributions can affect your taxable income.

- Changes in Itemized Deductions:

- Major changes in charitable giving, medical expenses, or other itemized deductions can impact your tax situation.

Here’s a quick reference guide for when to update your W-4:

“Your W-4 should be a living document, evolving with your life circumstances to ensure your tax withholding remains accurate.” – Cindy Hockenberry, Director of Tax Research and Government Relations at the National Association of Tax Professionals

Case Study: Impact of Life Changes on W-4

Consider the case of John and Sarah:

- Initially: Both single, each earning $50,000 per year.

- Life Change: They get married and Sarah receives a promotion to $75,000.

Before Marriage (Each):

- Filing Status: Single

- Taxable Income: $37,450 (after standard deduction)

- Tax Bracket: 22%

- Estimated Tax: $4,865

After Marriage (Joint):

- Filing Status: Married Filing Jointly

- Combined Taxable Income: $100,900 (after standard deduction)

- Tax Bracket: 22% (but more income in this bracket)

- Estimated Tax: $15,032

Without updating their W-4 forms, John and Sarah might find themselves under-withholding by several thousand dollars. By submitting new W-4 forms reflecting their married status and Sarah’s higher income, they can adjust their withholding to avoid a large tax bill at year-end.

Tips for Effective W-4 Updates:

- Set Annual Reminders: Mark your calendar to review your W-4 at least once a year, even if no major life changes occur.

- Use Digital Tools: Leverage the IRS Tax Withholding Estimator or tax software to help calculate necessary adjustments.

- Communicate with Your Spouse: If married, ensure you’re coordinating W-4 adjustments, especially if both are employed.

- Keep Documentation: Maintain records of life events and corresponding W-4 changes for future reference.

- Consider Future Events: If you know of upcoming changes (e.g., planned retirement), adjust your W-4 proactively.

- Seek Professional Advice: For complex situations or significant life changes, consult a tax professional for personalized guidance.

By staying proactive with your W-4 updates, you can ensure your tax withholding remains accurate throughout the year, avoiding surprises at tax time and maintaining better control over your finances.

VIII. Common W-4 Withholding Mistakes to Avoid

Errors That Can Impact Your Tax Liability

Even with the simplified W-4 form, it’s still possible to make mistakes that can lead to incorrect withholding. Being aware of these common errors can help you avoid potential tax issues and financial stress.

A. Claiming Too Many or Too Few Allowances (Old Form)

While the new W-4 form no longer uses allowances, it’s worth mentioning this common mistake for those who may still be using older versions of the form or for historical context.

Impact of Incorrect Allowances:

- Too Many Allowances: Results in under-withholding, potentially leading to a tax bill and penalties.

- Too Few Allowances: Leads to over-withholding, resulting in a larger refund but less take-home pay throughout the year.

B. Forgetting to Update Your W-4 After Life Changes

This is perhaps the most common and impactful mistake people make with their W-4 forms.

Consequences of Not Updating:

- Inaccurate withholding that doesn’t reflect your current tax situation

- Potential for large tax bills or unnecessarily large refunds

- Missed opportunities for tax credits or deductions

Key Life Changes Often Overlooked:

- Marriage or divorce

- Birth or adoption of a child

- Child turning 17 (affects Child Tax Credit)

- Starting a second job or side business

- Spouse starting or stopping work

- Significant changes in income or deductions

“Your W-4 should be reviewed annually and updated whenever you experience a major life event. Think of it as a financial health check-up.” – Lisa Greene-Lewis, CPA and TurboTax Expert

C. Misunderstanding the Impact of Deductions and Credits

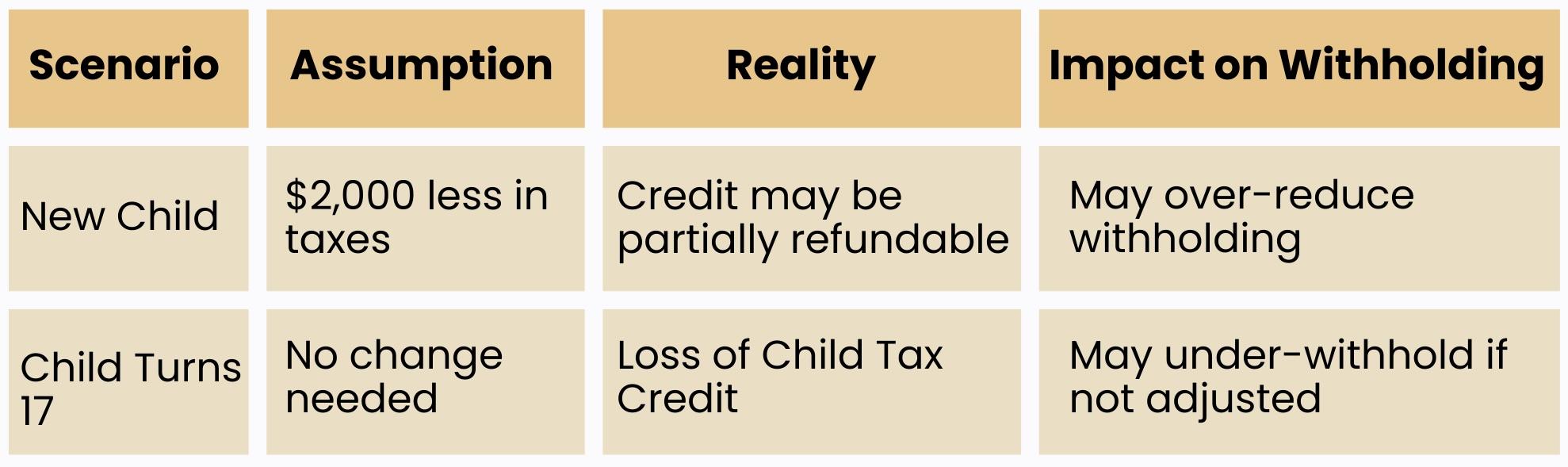

Many taxpayers don’t fully grasp how deductions and credits affect their tax liability and, consequently, their required withholding.

Common Misunderstandings:

- Confusing deductions with credits

- Overestimating the impact of itemized deductions

- Not accounting for phase-outs of certain credits and deductions based on income

Example: Child Tax Credit Misunderstanding D. Other Common Mistakes

D. Other Common Mistakes

- Not Considering All Income Sources:

- Failing to account for investment income, rental properties, or side gigs can lead to under-withholding.

- Incorrect Filing Status:

- Choosing the wrong filing status on your W-4 can significantly impact your withholding calculations.

- Assuming W-4 is Set-and-Forget:

- Many people fill out a W-4 when starting a job and never revisit it, leading to years of inaccurate withholding.

- Not Coordinating W-4s with a Spouse:

- For married couples, failing to coordinate W-4 strategies can result in incorrect overall household withholding.

- Misusing the “Exempt” Status:

- Claiming exempt status when you don’t qualify can lead to severe under-withholding and potential penalties.

- Ignoring State Withholding Requirements:

- While the W-4 is for federal taxes, many states have their own withholding forms that need attention.

Strategies to Avoid These Mistakes

- Annual W-4 Review: Set a reminder to review your W-4 at the beginning of each year or after any significant life event.

- Use the IRS Withholding Estimator: Regularly use this tool to ensure your withholding aligns with your tax liability. Access it at IRS Tax Withholding Estimator.

- Educate Yourself on Tax Basics: Understanding fundamental tax concepts can help you make more informed W-4 decisions.

- Consult a Professional: For complex situations, consider speaking with a tax professional for personalized advice.

- Keep Records of Life Changes: Maintain a log of significant life events and financial changes to prompt W-4 updates.

- Double-Check Your Math: When filling out worksheets or calculating adjustments, double-check your numbers to avoid simple arithmetic errors.

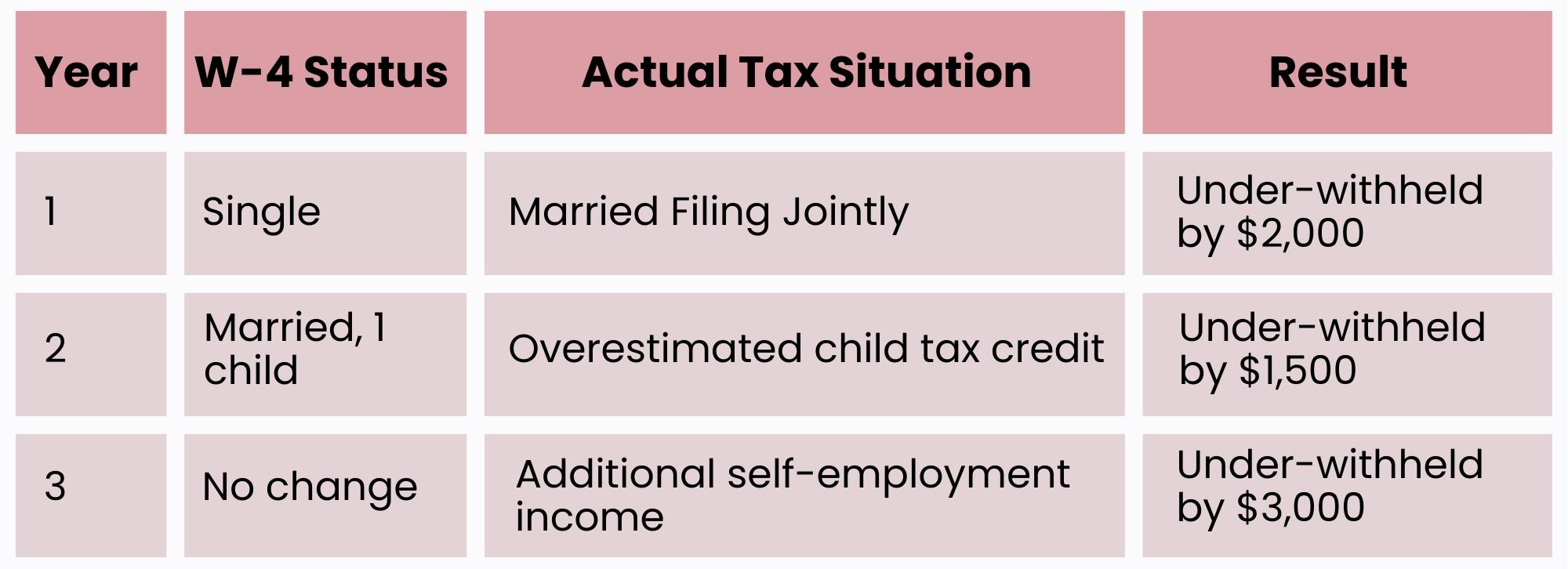

Case Study: The Cumulative Effect of W-4 Mistakes

Consider the case of Alex:

- Initial Situation: Single, no dependents, $60,000 salary

- Year 1: Gets married, spouse earns $50,000 (No W-4 update)

- Year 2: Has a child (Updates W-4 but overestimates tax credit impact)

- Year 3: Starts a side business earning $10,000 (Forgets to adjust W-4)

By Year 3, Alex faces a significant tax bill due to cumulative W-4 mistakes, potentially including underpayment penalties.

“The W-4 is not just a form; it’s a critical financial planning tool. Treating it with the attention it deserves can save you from significant tax headaches.” – Alison Flores, Principal Tax Research Analyst at H&R Block

By being aware of these common mistakes and taking proactive steps to avoid them, you can ensure that your W-4 withholding accurately reflects your tax situation. This approach helps you maintain better control over your finances throughout the year and avoid surprises when tax season arrives.

IX. W-4 Withholding for Different Tax Situations

Tailoring Your W-4 to Your Specific Circumstances

Understanding how to adjust your W-4 for various life situations is crucial for accurate tax withholding. Let’s explore how different tax situations affect W-4 completion and withholding strategies.

A. Single Filers

Single filers often have the most straightforward W-4 completion process, but there are still important considerations:

Key Points for Single Filers:

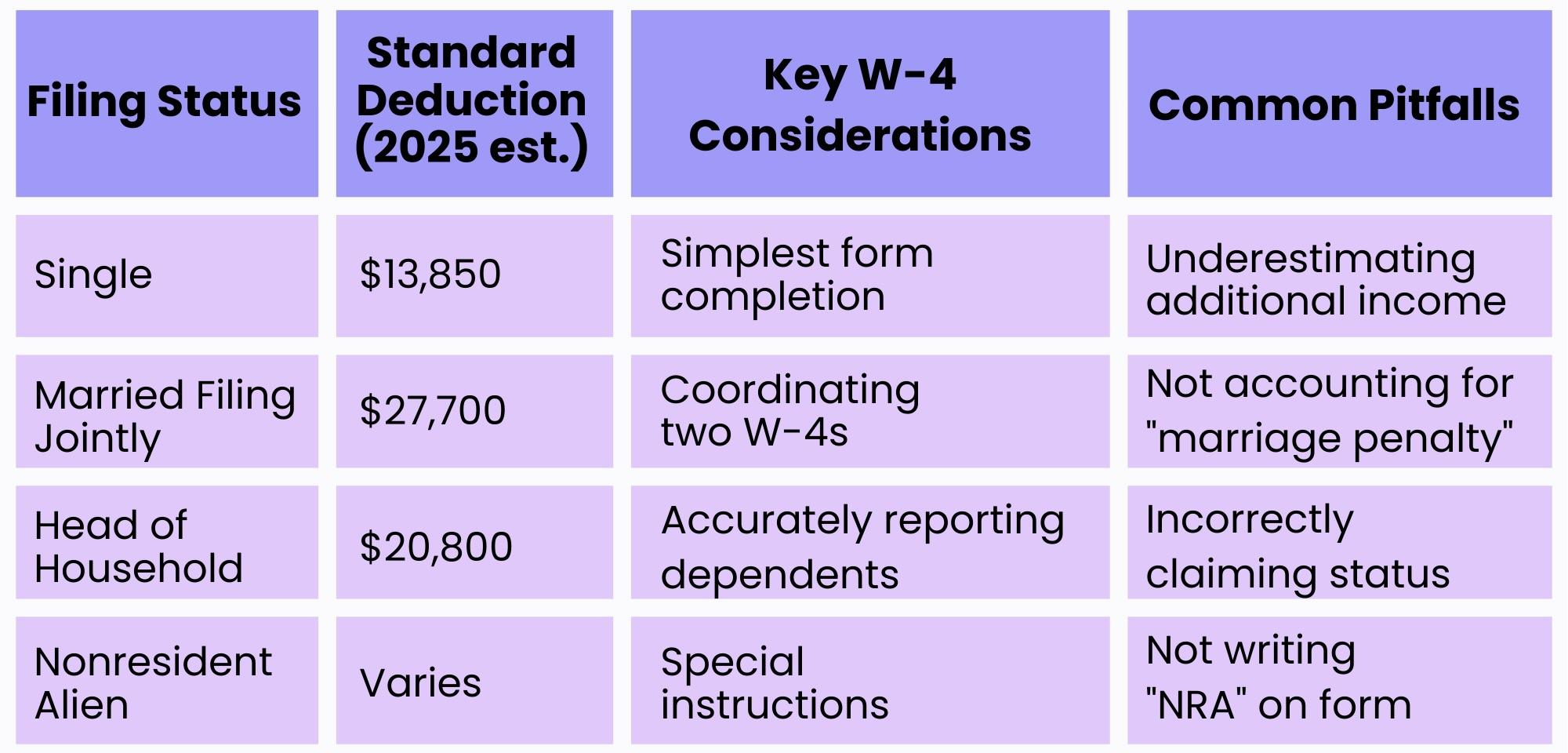

- Standard Deduction: As of 2025, the standard deduction for single filers is projected to be around $13,850 (adjusted for inflation).

- Tax Brackets: Be aware of your income in relation to tax brackets to avoid under-withholding.

- Additional Income: If you have income from sources other than your primary job, consider additional withholding.

Strategy Tip: If you’re a single filer with one job and no dependents, you can often achieve accurate withholding by simply filling out Steps 1 and 5 of the W-4.

B. Married Couples

Married couples have several options and considerations when it comes to W-4 withholding:

Filing Options:

- Married Filing Jointly: Often provides tax benefits but requires coordination of both spouses’ W-4s.

- Married Filing Separately: May be beneficial in certain situations but typically results in a higher tax liability.

Key Considerations:

- Combined income may push you into a higher tax bracket.

- If both spouses work, consider the “Two Earners/Multiple Jobs Worksheet” or use the IRS Tax Withholding Estimator.

- Decide whether to split additional withholding between both W-4s or adjust one spouse’s form.

Example Scenario: | Spouse | Income | W-4 Strategy | |——–|——–|————–| | Spouse A | $70,000 | Complete all steps, including 2(c) for two jobs | | Spouse B | $50,000 | Complete only Steps 1 and 5 |

This strategy ensures the higher-earning spouse’s W-4 accounts for the combined income, while avoiding over-withholding on the lower-earning spouse’s paycheck.

C. Head of Household

The Head of Household filing status is for unmarried individuals who pay more than half the cost of keeping up a home for themselves and a qualifying person.

Key Points for Head of Household Filers:

- Higher Standard Deduction: Head of Household filers receive a larger standard deduction than single filers.

- Different Tax Brackets: Tax rates are generally lower compared to single filers at the same income level.

- Dependents: Accurately reporting dependents is crucial for this filing status.

W-4 Strategy:

- Ensure you qualify for this status before selecting it on your W-4.

- Use the IRS Withholding Estimator to account for the specific tax benefits of this status.

- Consider adjustments in Step 3 for dependents and Step 4 for any additional withholding needed.

D. Nonresident Aliens

Nonresident aliens have specific W-4 requirements that differ from U.S. citizens and resident aliens:

Special W-4 Instructions for Nonresident Aliens:

- Single Filing Status: Must select “Single” regardless of actual marital status.

- One Allowance: On older forms, limited to claiming only one allowance (not applicable to new W-4).

- No Claim of Exempt: Cannot claim exempt status on Form W-4.

- Additional Withholding: Must write “Nonresident Alien” or “NRA” on Form W-4 above the dotted line on Step 4(c).

Tax Treaty Considerations:

- Some nonresident aliens may be eligible for tax treaty benefits, which can affect withholding.

- Consult IRS Publication 901 for information on U.S. tax treaties.

“Nonresident aliens should pay special attention to their W-4 forms, as incorrect withholding can lead to significant tax issues.” – Donna Kepley, President of the Arctic International LLC, a tax consulting firm specializing in international tax issues.

Comparative Analysis of W-4 Strategies for Different Tax Situations Case Studies

Case Studies

- Single Filer with Side Gig Sarah, a single filer earning $60,000 from her main job, also earns $10,000 from freelance work.W-4 Strategy:

- Complete W-4 normally for main job

- Use Step 4(a) to report additional $10,000 income

- Consider additional withholding in Step 4(c) to cover self-employment tax

- Married Couple with Significant Income Disparity John earns $150,000, while his wife Lisa earns $40,000.W-4 Strategy:

- John completes W-4 using “Married Filing Jointly” status

- Uses Two Earners/Multiple Jobs Worksheet

- Adds extra withholding in Step 4(c)

- Lisa completes W-4 with only basic information

- Head of Household with Multiple Children Michael, a single parent with three children, earns $80,000.W-4 Strategy:

- Selects “Head of Household” status

- Reports three dependents in Step 3

- Uses IRS Withholding Estimator to ensure accurate withholding considering child tax credits

- Nonresident Alien Graduate Student Yuki, a graduate student from Japan, receives a $25,000 stipend.W-4 Strategy:

- Selects “Single” filing status

- Writes “Nonresident Alien” above Step 4(c)

- Does not claim exempt status

- Consults tax treaty between U.S. and Japan for potential benefits

Tips for Accurate W-4 Completion Across All Situations

- Use the IRS Withholding Estimator: This tool is invaluable for complex situations and can help fine-tune your withholding.

- Review Annually: Tax laws and personal situations change. An annual W-4 review ensures continued accuracy.

- Consider All Income Sources: Don’t forget to account for investment income, rental properties, or side businesses.

- Understand Credits and Deductions: Familiarize yourself with the credits and deductions you’re eligible for, as they significantly impact your tax liability.

- Seek Professional Help: For complex situations, especially involving international tax issues, consulting a tax professional can be a wise investment.

- Plan for Life Changes: Anticipate upcoming life changes (marriage, children, job changes) and adjust your W-4 proactively.

- Balance Withholding Goals: Decide whether you prefer larger paychecks throughout the year or a potential refund at tax time, and adjust accordingly.

“The key to mastering your W-4 is understanding that it’s not just about compliance – it’s a powerful tool for financial planning and cash flow management.” – Janice Hayman, CPA and tax strategist

By tailoring your W-4 completion strategy to your specific tax situation, you can ensure more accurate withholding throughout the year. This approach not only helps avoid surprises at tax time but also allows for better financial planning and cash flow management. Remember, your W-4 is not a static document; it should evolve with your life circumstances to continually reflect your current tax situation.

X. The Impact of Recent Tax Laws on W-4 Withholding

How Tax Reforms Affect Your Withholding Decisions

Tax laws are continually evolving, and these changes can have significant impacts on how you should approach your W-4 withholding. Understanding recent tax reforms is crucial for making informed decisions about your withholding strategy.

A. Changes from the Tax Cuts and Jobs Act (TCJA) of 2017

Although the TCJA was enacted several years ago, its effects continue to influence W-4 withholding strategies. Here are some key changes that still impact withholding decisions:

- Standard Deduction Increase: The TCJA nearly doubled the standard deduction, affecting many taxpayers’ decisions to itemize.| Filing Status | 2017 Standard Deduction | 2025 Standard Deduction (Estimated) | |—————|————————-|————————————-| | Single | $6,350 | $13,850 | | Married Filing Jointly | $12,700 | $27,700 | | Head of Household | $9,350 | $20,800 |

Impact on W-4: Many taxpayers who previously itemized now take the standard deduction, potentially requiring less withholding.

- Personal Exemptions Eliminated: The TCJA eliminated personal exemptions, which were previously used to determine withholding allowances.Impact on W-4: This change led to the redesign of Form W-4, removing the concept of allowances entirely.

- Child Tax Credit Expansion: The Child Tax Credit was increased and made available to more taxpayers.Impact on W-4: Parents may need to adjust their withholding to account for this larger credit.

- Changes to Itemized Deductions: Several itemized deductions were limited or eliminated, such as the cap on state and local tax deductions.Impact on W-4: Taxpayers who previously itemized may need to reassess their withholding strategy.

“The TCJA fundamentally changed the way many Americans approach their taxes, making it more important than ever to regularly review and update your W-4.” – Mark Steber, Chief Tax Information Officer at Jackson Hewitt

B. Recent Updates to Tax Brackets and Standard Deductions

Tax brackets and standard deductions are adjusted annually for inflation. Here’s how these changes might affect your W-4 for the 2025 tax year:

- Inflation Adjustments to Tax Brackets: Tax brackets are expanded each year to account for inflation, potentially putting you in a different bracket.Example of Projected 2025 Tax Brackets (Married Filing Jointly): | Tax Rate | Taxable Income Range | |———-|———————-| | 10% | $0 – $22,000 | | 12% | $22,001 – $89,450 | | 22% | $89,451 – $190,750 | | 24% | $190,751 – $364,200 | | 32% | $364,201 – $462,500 | | 35% | $462,501 – $693,750 | | 37% | $693,751 or more |

Impact on W-4: As brackets expand, some taxpayers may find themselves in a lower bracket, potentially requiring less withholding.

- Standard Deduction Increases: The standard deduction typically increases each year due to inflation adjustments.Impact on W-4: Higher standard deductions may reduce taxable income, potentially allowing for less withholding.

- Retirement Contribution Limits: Contribution limits for 401(k)s and IRAs often increase, affecting taxable income.2025 Projected Contribution Limits:

- 401(k): $23,000 (up from $22,500 in 2023)

- IRA: $7,000 (up from $6,500 in 2023)

- Impact on W-4: Increased contribution limits can lower taxable income, potentially requiring withholding adjustments.

C. Potential Future Tax Law Changes

As we look towards 2025 and beyond, it’s important to be aware of potential tax law changes that could affect W-4 withholding strategies:

- Expiration of TCJA Provisions: Many individual tax provisions of the TCJA are set to expire after 2025, potentially reverting to pre-2018 levels.Potential Changes:

- Lower standard deductions

- Return of personal exemptions

- Changes to tax brackets

- Impact on W-4: If these changes occur, most taxpayers will need to significantly adjust their withholding strategies.

- Proposed Tax Reforms: Various tax reform proposals are continually being discussed in Congress. While it’s uncertain which will become law, some potential changes include:

- Adjustments to capital gains tax rates

- Changes to estate tax exemptions

- Modifications to retirement account rules

- Impact on W-4: Any major tax law changes would likely necessitate a review and update of W-4 forms.

“Staying informed about potential tax law changes is crucial. Even proposed changes can give you insight into how you might need to adjust your withholding strategy in the future.” – Luscious Lim, CPA and tax policy analyst

Strategies for Adapting to Tax Law Changes

- Regular W-4 Reviews: Set a reminder to review your W-4 annually, especially after major tax law changes are enacted.

- Use the IRS Withholding Estimator: This tool is updated to reflect current tax laws and can help you adjust your withholding accurately.

- Stay Informed: Keep abreast of tax law changes through reputable sources such as the IRS website or professional tax associations.

- Consult a Tax Professional: For complex situations or significant law changes, consider seeking advice from a tax professional.

- Plan for Multiple Scenarios: When major tax changes are on the horizon, consider planning for multiple scenarios to be prepared for various outcomes.

Case Study: Impact of Tax Law Changes on W-4 Strategy

Let’s consider the case of the Johnson family:

- Married couple with two children

- Combined income of $120,000

- Previously itemized deductions

Pre-TCJA Strategy:

- Claimed 4 allowances (2 for themselves, 2 for children)

- Additional withholding to account for itemized deductions

Post-TCJA Strategy:

- No allowances (new W-4 form)

- Take standard deduction due to increased amount

- Adjust for expanded Child Tax Credit

Potential 2026 Strategy (if TCJA provisions expire):

- May need to return to itemizing deductions

- Potentially increase withholding due to lower standard deduction

- Reassess strategy based on any changes to Child Tax Credit

This case study illustrates how tax law changes can significantly impact W-4 withholding strategies, necessitating regular reviews and adjustments.

Key Takeaways for Adapting to Tax Law Changes:

- Be Proactive: Don’t wait for tax season to consider the impact of law changes on your withholding.

- Understand Your Tax Situation: Know how specific changes in tax law relate to your personal financial circumstances.

- Use Available Tools: Leverage resources like the IRS Withholding Estimator to help navigate changes.

- Consider Long-Term Impacts: When adjusting your W-4, think about both immediate and future tax years, especially with scheduled law changes.

- Balance Withholding Goals: As laws change, reassess whether your priority is larger paychecks or avoiding a tax bill at year-end.

By staying informed about tax law changes and regularly reviewing your W-4, you can ensure that your withholding remains accurate and aligned with your financial goals, even as the tax landscape evolves.

XI. Tools and Resources for W-4 Withholding

Helpful Aids for Accurate W-4 Completion

Navigating the complexities of tax withholding can be challenging, but numerous tools and resources are available to help you optimize your W-4 withholding. Utilizing these resources can lead to more accurate withholding and better financial planning throughout the year.

A. IRS Withholding Calculator

The IRS Withholding Estimator is one of the most valuable tools for determining the right amount of tax withholding.

Key Features:

- Considers multiple income sources

- Accounts for tax credits and deductions

- Provides specific recommendations for W-4 adjustments

How to Use:

- Gather your most recent pay stubs and tax return

- Visit the IRS Tax Withholding Estimator

- Answer the questions about your tax situation

- Review the results and recommendations

Benefits:

- Helps avoid over or under-withholding

- Updated regularly to reflect current tax laws

- Provides a tailored withholding strategy

“The IRS Withholding Estimator is like having a personal tax assistant. It takes the guesswork out of W-4 completion.” – Alison Flores, Principal Tax Research Analyst at H&R Block

B. Paycheck Checkup Tool

While not a separate tool from the IRS Withholding Estimator, the concept of a “Paycheck Checkup” is promoted by the IRS to encourage regular review of withholding.

When to Do a Paycheck Checkup:

- After tax law changes

- When you experience a major life event (marriage, child, job change)

- If you had a large tax bill or refund the previous year

Steps for a Paycheck Checkup:

- Review your current withholding on recent pay stubs

- Gather information about other income sources and potential deductions

- Use the IRS Withholding Estimator

- Adjust your W-4 based on the results

Tip: Set a calendar reminder to do a paycheck checkup at least once a year, ideally in early spring after filing your taxes.

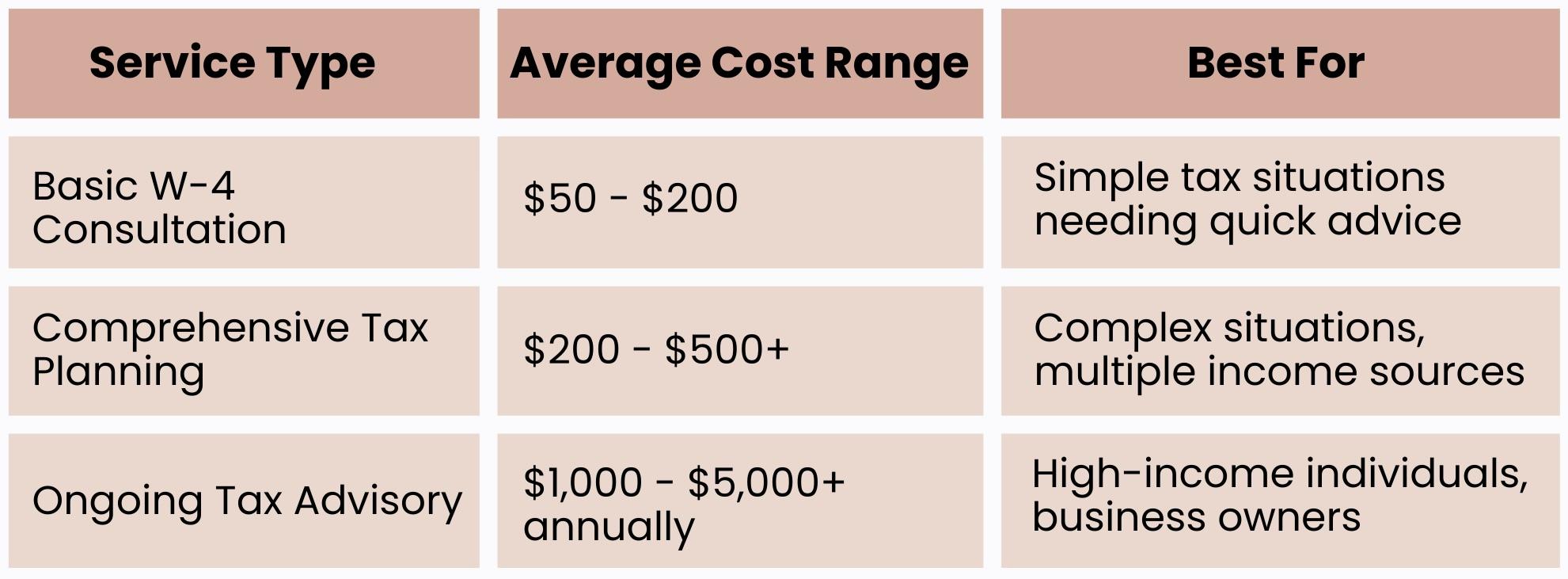

C. Professional Tax Advice Options

For more complex tax situations or for those who prefer personalized guidance, professional tax advice can be invaluable.

Types of Tax Professionals:

- Certified Public Accountants (CPAs): Offer comprehensive tax and financial planning services.

- Enrolled Agents (EAs): Specialize in tax issues and are licensed by the IRS.

- Tax Attorneys: Provide expert advice on complex tax matters and legal issues.

When to Consider Professional Help:

- If you have multiple income sources or complex investments

- When starting a business or becoming self-employed

- If you’ve experienced significant life changes affecting your taxes

- When dealing with international tax issues

Cost Comparison of Tax Professional Services:

“While online tools are great for many taxpayers, some situations benefit greatly from professional insight. A good tax professional can often save you more than their fee.” – Janice Hayman, CPA and tax strategist

D. Additional Resources

- IRS Publications:

- Online Tax Education:

- Websites like Khan Academy offer free courses on tax basics.

- Tax Software with W-4 Guidance: Many tax preparation software packages offer W-4 guidance as part of their services. Examples include:

- TurboTax’s W-4 Withholding Calculator

- H&R Block’s W-4 Planning Tool

- TaxAct’s Withholding Optimizer

These tools often provide year-round access and can be particularly useful if you’re already using the software for tax preparation.

- Employer Resources: Many HR departments offer guidance on W-4 completion. Some larger companies even provide access to tax professionals during benefits enrollment periods.

- Financial Planning Apps: Apps like Mint or Personal Capital can help you track your income and taxes throughout the year, providing insights that can inform your W-4 decisions.

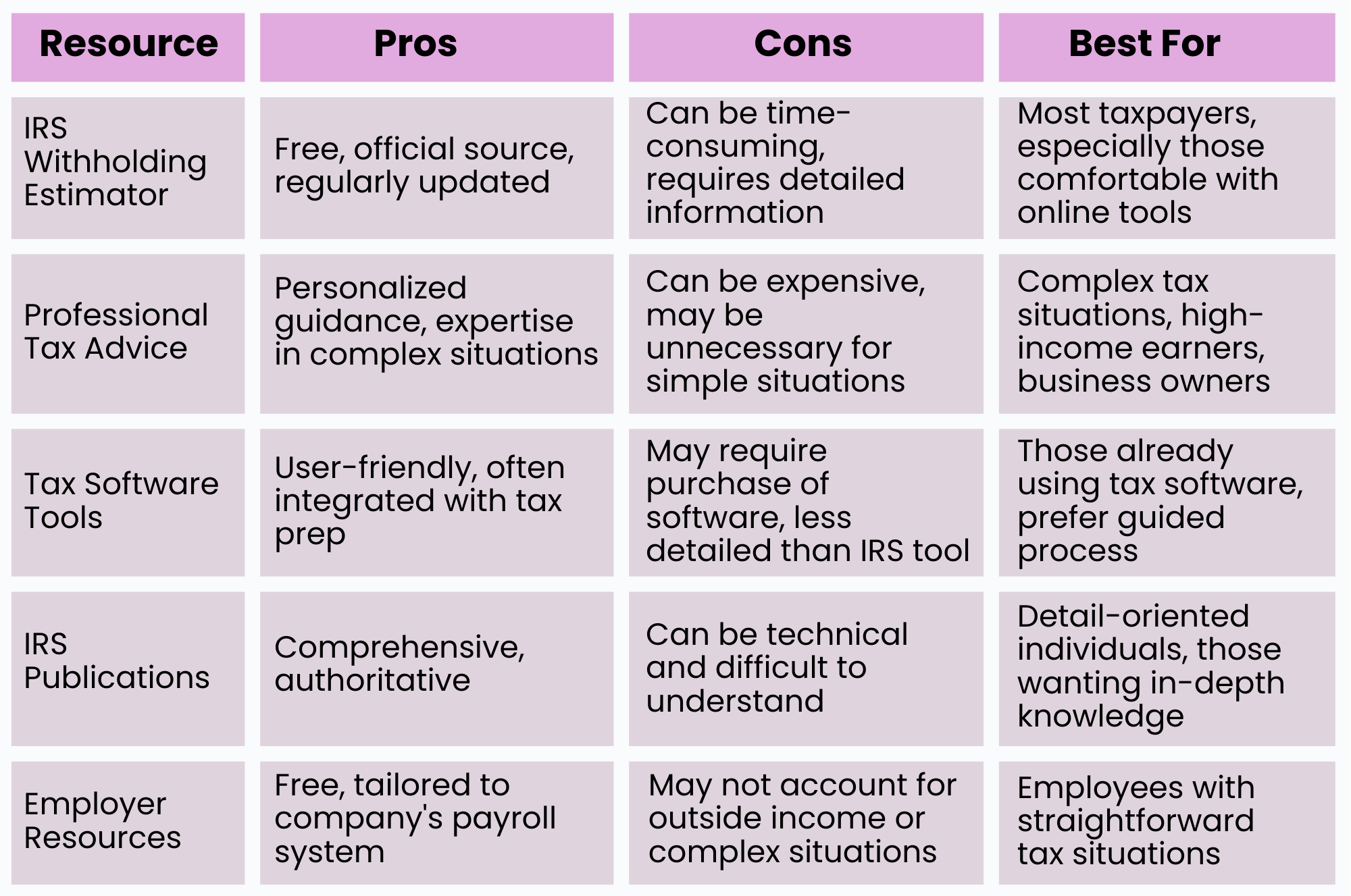

E. Comparative Analysis of W-4 Tools and Resources Case Study: Utilizing Multiple Resources for Optimal W-4 Completion

Case Study: Utilizing Multiple Resources for Optimal W-4 Completion

Meet Sarah, a software engineer with a side consulting business:

- Initial Assessment: Sarah starts with the IRS Withholding Estimator to get a baseline for her withholding needs.

- Professional Consultation: Given her side business, Sarah consults a CPA for advice on handling self-employment income and potential deductions.

- Ongoing Monitoring: She uses a financial planning app to track her income and estimated taxes throughout the year.

- Regular Reviews: Sarah sets a reminder to do a “paycheck checkup” quarterly, adjusting her W-4 as needed.

By combining these resources, Sarah ensures her withholding is accurate for both her employment and self-employment income, avoiding surprises at tax time.

Tips for Maximizing W-4 Resources:

- Cross-Reference Results: If using multiple tools, compare the outcomes to ensure consistency.

- Keep Records: Document the resources you use and the decisions you make about your W-4 for future reference.

- Update Regularly: Tax laws and personal situations change, so make use of these resources at least annually.

- Understand Your Needs: Choose resources that align with your tax complexity and comfort level with financial matters.

- Combine Approaches: Often, a combination of digital tools and professional advice yields the best results.

“The best approach to W-4 withholding is an informed one. Utilize available resources, but also take the time to understand the basics of how your taxes work.” – Mark Steber, Chief Tax Information Officer at Jackson Hewitt

By leveraging these tools and resources, you can approach your W-4 withholding with confidence, ensuring that your tax strategy aligns with your overall financial goals. Remember, the right combination of resources can vary based on your individual situation, so don’t hesitate to explore different options to find what works best for you.

XII. Conclusion

Mastering Your W-4: Key Takeaways for Optimal Tax Withholding

As we’ve explored throughout this comprehensive guide, understanding and properly completing your W-4 form is crucial for managing your tax liability and optimizing your financial health. Let’s recap the key points and provide some final thoughts on effective W-4 management.

A. Recap of Key Points About W-4 Withholding

- Purpose of the W-4: The W-4 form is your primary tool for controlling federal income tax withholding from your paycheck. It directly impacts your take-home pay and your tax situation at year-end.

- Recent Changes: The elimination of allowances and the redesign of the W-4 form have simplified the process but require a new approach to withholding calculations.

- Accuracy is Crucial: Proper completion of your W-4 helps avoid under-withholding (which can lead to penalties) and over-withholding (which amounts to an interest-free loan to the government).

- Life Changes Necessitate Updates: Major life events such as marriage, divorce, birth of a child, or job changes should trigger a review of your W-4.

- Multiple Income Sources: If you have multiple jobs or a working spouse, special consideration is needed to ensure adequate withholding across all income sources.

- Tax Law Impacts: Changes in tax laws, such as the TCJA and potential future reforms, can significantly affect optimal withholding strategies.

B. Importance of Regular W-4 Reviews and Updates

Treating your W-4 as a “set it and forget it” document can lead to significant tax issues. Regular reviews are essential for several reasons:

- Changing Personal Circumstances: Your financial and personal situation can change year to year, affecting your tax liability.

- Evolving Tax Laws: Tax regulations are subject to change, and these changes can impact your optimal withholding strategy.

- Income Fluctuations: Changes in salary, bonuses, or additional income sources may necessitate W-4 adjustments.

- Financial Goal Alignment: Your withholding strategy should align with your broader financial goals, which may change over time.

Recommended Review Schedule:

- Annually, preferably after filing your tax return

- After any major life event

- When tax laws change

- Quarterly for those with variable income or complex tax situations

“A proactive approach to W-4 management can save you from financial stress and help you make the most of your income throughout the year.” – Alison Flores, Principal Tax Research Analyst at H&R Block

C. Encouragement to Take Action on Optimizing Withholding

Now that you have a comprehensive understanding of W-4 withholding, it’s time to take action:

- Assess Your Current Situation: Review your most recent pay stub and last year’s tax return to understand your current withholding status.

- Utilize Available Tools: Take advantage of the IRS Withholding Estimator or other tools discussed to calculate your optimal withholding.

- Make Informed Adjustments: Based on your assessment and calculations, complete a new W-4 form if necessary.

- Consult Professionals if Needed: For complex situations, don’t hesitate to seek advice from a tax professional.

- Set Future Reminders: Mark your calendar for regular W-4 reviews to ensure ongoing accuracy.

Final Thoughts: The Power of Proactive W-4 Management

Mastering your W-4 withholding is more than just a tax compliance exercise; it’s a powerful financial planning tool. By taking control of your withholding, you can:

- Improve your monthly cash flow

- Avoid tax-time surprises

- Align your tax strategy with your overall financial goals

- Gain peace of mind knowing you’re on top of your tax obligations

Remember, your W-4 is not just a form – it’s a key component of your financial wellbeing. By applying the knowledge and strategies outlined in this guide, you’re taking an important step towards financial empowerment and stability.

“The W-4 form may seem like a small detail in your financial life, but its impact is significant. Mastering it puts you in control of your tax situation and enhances your overall financial health.” – Janet Holtzblatt, Senior Fellow at the Urban-Brookings Tax Policy Center

Actionable Steps to Take Now:

- Review Your Current W-4: Pull out your most recent W-4 and compare it to your current situation.

- Gather Necessary Information: Collect recent pay stubs, last year’s tax return, and information about any additional income sources.

- Use the IRS Withholding Estimator: Take the time to go through the estimator for a personalized withholding recommendation.

- Make Adjustments: If the estimator suggests changes, fill out a new W-4 form.

- Submit to Your Employer: Provide your updated W-4 to your employer’s HR or payroll department.

- Monitor the Changes: Over the next few pay periods, observe how the adjustments affect your take-home pay.

- Plan for Next Review: Set a reminder for your next W-4 check-up, whether it’s in a few months or next year.

By taking these steps, you’re not just optimizing your tax withholding; you’re taking a proactive stance in your overall financial management.

The Broader Impact of Effective W-4 Management

Understanding and optimizing your W-4 withholding has benefits that extend beyond just your tax situation:

- Improved Budgeting: Accurate withholding allows for more precise monthly budgeting.

- Enhanced Savings Opportunities: If you’ve been over-withholding, adjusting your W-4 could free up money for savings or investments.

- Reduced Financial Stress: Knowing you’re on track with your tax obligations can alleviate anxiety about potential tax bills.

- Better Financial Decision Making: A clear understanding of your true take-home pay enables more informed financial choices throughout the year.

A Call to Financial Empowerment

As we conclude this comprehensive guide on W-4 withholding, remember that your engagement with this topic is a significant step towards greater financial literacy and empowerment. By understanding and actively managing your W-4, you’re not just complying with tax requirements; you’re taking control of an important aspect of your financial life.

Whether you’re a new employee filling out your first W-4, someone experiencing major life changes, or simply looking to optimize your tax strategy, the knowledge and tools provided in this guide equip you to make informed decisions about your tax withholding.

“Financial empowerment starts with understanding the tools at your disposal. The W-4 is one of the most powerful yet often overlooked tools in personal finance.” – Luscious Lim, CPA and tax policy analyst

As you move forward, approach your W-4 not as a burdensome tax form, but as a valuable instrument in your financial toolkit. With the right approach, your W-4 can work for you, helping to align your tax withholding with your broader financial goals and contributing to your overall financial wellbeing.

Remember, in the world of personal finance, knowledge truly is power. By mastering your W-4, you’re taking a significant step towards mastering your financial future.